Marketing Analysis of Hybrid Car

| ✅ Paper Type: Free Essay | ✅ Subject: Marketing |

| ✅ Wordcount: 3549 words | ✅ Published: 23 Sep 2019 |

1 Background and introduction

The objective of this study is to conduct a critical analysis of an individual product as part of the marketing course at the University of Sheffield. This analysis is focused on a full hybrid car, the IS300h, from car manufacturer Lexus. The marketing analysis is based on the country Belgium and is covered by four different elements. First, the consumer behaviour of a typical customer. Secondly, the marketing mix analysis. Thirdly, the STP analysis and finally a recommendation to improve the marketing mix strategy.

Lexus, the luxurious subsidiary of the Japanese Toyota Motor Corporation, was founded in 1989 and debuted in Europe in 1990 (Lexus, 2018a). The company launched their first hybrid car in 2005 and has since sold more than 1 million hybrid cars worldwide (Lexus, 2014). The IS, on the other hand, was first launched in 1999 and originally sold by Toyota. In 2005 the second generation, of the model, became a part of the Lexus line. The IS300h is currently in its third generation in which the car got a facelift (Lexus, 2017).

Consumer Behaviour analysis

Today the automotive industry is undergoing many changes. Globally, there is a shift in the industry towards hybrid cars, electrified vehicles and a shared economy of vehicles in the future (Gao et al., 2016). We can say that the changing interest of consumers and stricter emissions regulations are drivers for these shifts.

Today the automotive industry is undergoing many changes. Globally, there is a shift in the industry towards hybrid cars, electrified vehicles and a shared economy of vehicles in the future (Gao et al., 2016). We can say that the changing interest of consumers and stricter emissions regulations are drivers for these shifts.

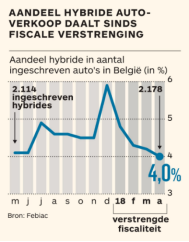

In Belgium, consumers are increasingly becoming mindful of their ecological footprint. A study by the Flemish Department of Environment shows that 44% are considering buying an environmentally-friendly car for their next purchase (Vlaanderen, 2017; Belga, 2018). Experts consider the hybrid car as the ideal transition technology as long as a fully electric car has a relatively higher purchase price (Vanacker, 2018). A specialized car blog, that based its findings on official government figures, indicated that this trend was clearly visible in sales figures. These figures doubled in 2017 compared to 2016 (E-gear, 2018). On the contrary, in the first quarter of 2018, the share of hybrids declined due to the stricter tax deductibility measure for so-called “fake hybrids”(Graph 1). The self-loading hybrids of Toyota/Lexus have not been affected by this measure. In fact, Lexus’ market-share even rose (Vanacker, 2018).

Graph 1 Selling figure Hybrid cars since stricter regulations (Vanacker, 2018)

The main characteristics influencing consumer behaviour when purchasing the IS300h are social class, family, age and life-cycle stage, belief and attitude and lifestyle (Kotler, 2016). This means that a typical consumer is likely to belong, according to the social classes, to the group of middle class or upper middle class (Kotler, 2016; Neil, 2017). This consumer is concerned about a sustainable environment and also influenced by his lifestyle and the age and life-cycle stage. In this case, it could be said that an average consumer lives a sportive lifestyle and is rather in a later stage of life, more specifically 30+, in which the family situation could influence the purchase.

If the purchase of the IS300h would be classified in the matrix of different types of purchasing behaviour (Assael, 1998), it could be categorised as complex buying behaviour. A car is an expensive and infrequently purchase which makes consumer involvement very high. Besides that, the differences between car brands are significant which leads to a learning process for the consumer (Kotler, 2016).

Summarizing, with these findings, combined with the favourable tax regime for companies, let us assume that the majority of consumers are self-employed and SMEs or wealthier consumers looking for a more environment-friendly premium car. Furthermore, consumer involvement and the differences between brands are significant that consumers display complex purchasing behaviour.

Marketing mix analysis

The marketing mix is commonly known as product, place, price and promotion (Kotler, 2016). In this analysis, these four elements will be covered to conduct an analysis of the marketing mix of the IS300h.

1.1 Product analysis

The IS300h is available in Belgium in only one petrol engine configuration equipped with an electric motor and Lexus’ hybrid technology. There are six versions in which the standard features in each version differs and are fixed. Also, optional features are limited in each version. In terms of customisation, they offer nine colours and one type of rim in every package (Lexus, 2018b).

According to Kotler (2016), a product is a combination of goods and service. This means that not only the product delivers value to the customer but also that the associated service is vital in order to make a product complete. Therefore, the IS300h comes with a highly comprehensive warranty as standard and is composed of four packages (Lexus, 2018b). Besides that, the brand has also been selected in Europe as the most reliable car brand of 2018 by an NPO for the protection of consumer rights (Nieuwsblad, 2018). This is, therefore, a reflection of the brand’s high quality.

1.2 Pricing analysis

Since Lexus is the luxurious subsidiary brand of Toyota, prices go to a higher end. According to the Marketing Manager of Lexus Belgium, Lexus strives to be competent by ensuring their cars are priced 5-10% lower compared to their direct competitors (Peeters, 2018). This is, therefore, a clear example of competition-based pricing (Kotler, 2016). The IS300h has a starting price of €37,890 including VAT and this goes up to €52,900 for the most extensive version. These prices include the extensive fixed options. Besides new cars, Lexus also offers approved pre-owned cars.

Lexus also offers financing facilities for both private and business users and for both new and pre-owned cars. The possibilities differ in each country. In Belgium, you can choose between a lease purchase, leasing or personal contract purchase. For companies, there is also the contract hire option available(Lexus, 2018b). Concerning discounts, Toyota decided in 2017 to increase the fleet discounts for companies. Lexus offers 10% discount on the “Business Edition” and 13% on all other versions (ToyotaBusinessPlus, 2017).

1.3 Promotion analysis

Internationally, the brand is much more active. Lexus uses product placement as a “mass media marketing strategy” in various films, like the recent Marvel film “Black Panther” (Kretchmer, 2004; Sylt, 2018). Additionally, celebrity endorsements and collaborations with athletes and artists are also used (Hobbs, 2016).

1.4 Place Analysis

Lexus has 9 branches in Belgium, mainly around larger cities, operated on a concession basis. There are 5 branches in the Flemish province, 2 in the Walloon Region and 2 in the Brussels province. In most cases, these branches are also linked to a larger Toyota dealer. Furthermore, Toyota/Lexus has 2 business centres in Belgium focusing on fleet contracts (De Paepe, 2018). The company has also a website with a configurator. However, it is only possible to compose a car.

In collaboration with Brussels airlines, Lexus also has a lounge at Brussels airport where travellers can relax and experience the brand (Lexus Europe newsroom, 2018). “Belgium is often called the gateway to Europe” (EY, 2013, p. 4). Therefore, Toyota also has a distribution centre for spare parts for both Toyota and Lexus in Diest (Belgium). From here all spare parts are delivered for Europe and is a pillar for Toyota’s European and global distribution network (Toyota Newsroom Europe, 2017).

1.5 conclusion

The approach restricting the choice of options makes customization more constrained compared to competing models like the BMW 3 series, Mercedes C-class and Jaguar XE (BMW, 2018; Jaguar, 2018; Mercedes-Benz, 2018). However, research has shown that people are more likely to commit a purchase when choices are limited since too many choices can be demotivating (Iyengar and Lepper, 2000).

Looking at the location, all concessionaires are located in the most densely populated cities with enormous economic activity (Fgov, 2017). Moreover, the business centres are in the middle of the “Blue Banana”, the largest concentration area of people and economy in Europe (Faludi, 2015). Therefore, the conclusion can be drawn that Lexus is strategically located in relation to its typical consumer.

Product placement is actively used as a promotion tool. This is, according to research, the most cost-effective way to reach a broad audience since it “gets a much longer lifetime than a commercial of 30 seconds”(Nagar, 2016). It can be concluded from this that their international approach can also reach and influence Belgian consumers. In the B2B market, Lexus is more dependent on personal selling. This method gives an advantage in the market for expensive and complex products (Brassington and Pettitt, 2013).

2 Segmentation, Targeting and Positioning Analysis

This section analyses the segmentation, targeting and positioning. This strategy, also known as the STP-strategy, helps to develop “a basic marketing strategy” (Tarantino, 2003, p. 54).

2.1 Segmentation Analysis

Segmentation enables the brand to recognize and group “all clusters of potential consumers” based on similar characteristics (Khan, 2013, p. 57).

The analysis shows that Lexus is using a mix of demographic, psychographic and behavioural variables to segment both the consumer and B2B-market (Kotler, 2016). However, slightly different variables are used to segment both markets (Brassington and Pettitt, 2013). For the consumer market, demographic segmentation is further divided into variables such as age, life cycle, occupation and income. The car is focused on singles and families aged 30 and over with a higher position in a company. For the companies in this segmentation, the market is divided, according to the marketing manager, by size. In this segment, Lexus focuses mainly on the self-employed and SMEs (Peeters, 2018).

In terms of psychographic and behavioural segmentation, the variables social class, lifestyle and usage rate are used. In these segments, Lexus is focusing, with the IS300h, on the middle and upper middle class with a sportier lifestyle. In addition, the car is for daily use for both urban and rural areas.

2.2  Targeting Analysis

Targeting Analysis

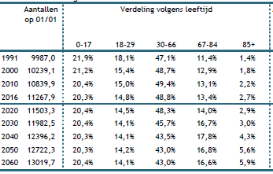

Evaluating the different segments, the age at which the IS300h is targeted represents about 48% of the total population, but Figure 1 shows a slightly declining trend towards 2060. Besides, the 30-39 age group would be the largest group of the total population by 2060 (FOD Economie, 2017).

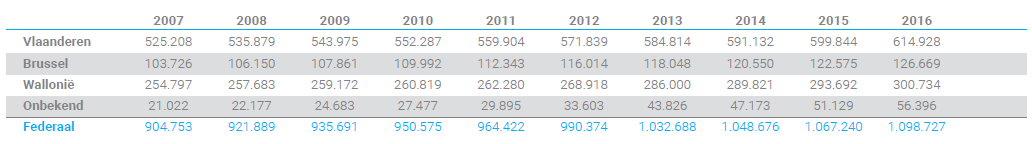

According to Peeters (2018), 75% of Lexus’ customer base consists of SMEs and the self-employed. Figure 2 shows that there was a sustained increase since 2007 in SMEs. By the end of 2016, the country counted nearly 1.1 million SMEs, of which 56% were located in Flanders (Thijs et al., 2017). The number of new company cars registered shows a correlated growth. In 2017 there was an increase of more than 3%, resulting in almost 300,000 new registered company cars (VRT, 2018). In SMEs, one third to half of the employees receives a company car, where job level is one of the most important criteria for the allocation of a car (Jobat, 2011).

Figure 1 Population Figures Belgium (FOD Economie,2017)

Figure 2 Development of SMEs in Belgium(Thijs et al,2017)

2.3 Positioning Analysis

Positioning “is the way a product is defined by customers on important attributes” and which perception consumers have relatively to competing products (Kotler, 2016, p. 238).

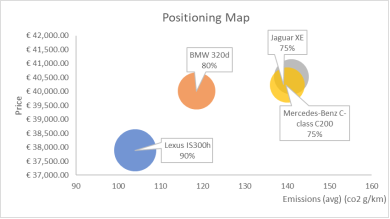

The IS300h is positioned as the “sports sedan that seamlessly combines the well-known luxury of Lexus with hybrid performance”(Lexus, 2018d). Dalrymple and parson (2000) proposed to produce a perceptual map with the main competing models to create an overview of the market situation. Also, positioning maps can reveal why certain products and brands perform better than others (D’Aveni, 2007). Graph 2 visualizes consumer perceptions of the IS300h and competitive models based on key purchasing dimensions. Multiple dimensions can be used to make a positioning map. In order to create the map for the IS300h the following three dimensions were used:

The IS300h is positioned as the “sports sedan that seamlessly combines the well-known luxury of Lexus with hybrid performance”(Lexus, 2018d). Dalrymple and parson (2000) proposed to produce a perceptual map with the main competing models to create an overview of the market situation. Also, positioning maps can reveal why certain products and brands perform better than others (D’Aveni, 2007). Graph 2 visualizes consumer perceptions of the IS300h and competitive models based on key purchasing dimensions. Multiple dimensions can be used to make a positioning map. In order to create the map for the IS300h the following three dimensions were used:

- Price (€)

- Emissions (g/km)

- Tax deductibility (%)

The position of each circle represents the brand’s position on price and emissions. The size of each circle represents the tax deductibility ratio.

2.4 Conclusion

Graph 2 Positioning Map IS300h

Graph 2 Positioning Map IS300h

In conclusion, Lexus mainly targets the B2B segment. This is clearly reflected in the depth of the product analysis through offering a “Business Edition” and an “Executive Line”.

Our analysis shows that this is a growing segment. Furthermore, a survey has shown that 90% of SMEs have fleets of 1 to 9 vehicles (Livis, 2017). These have a shorter service life and are usually replaced after four years (VRT, 2018). This is one of the main differences compared to the consumer market. In the consumer segment, Lexus focuses on an age at which, according to research, wages are rising the most and this can have a positive impact on purchasing capacity (Vanoost, 2016).

Considering the positioning map, Lexus has clearly a favourable position towards their main competitors with a lower average of emissions leading to a higher Tax benefit. This position can be linked to the price strategy in the price analysis of the marketing mix. This allows us to say the company is positioned on the value proposition of the same for less or even more for less (Kotler, 2016).

3 Recommendation

This recommendation will relate to the promotion aspect of the marketing mix. The brand could strengthen its position by being more actively present on social media platforms in Belgium. This could be beneficial for both the consumer and B2B-market.

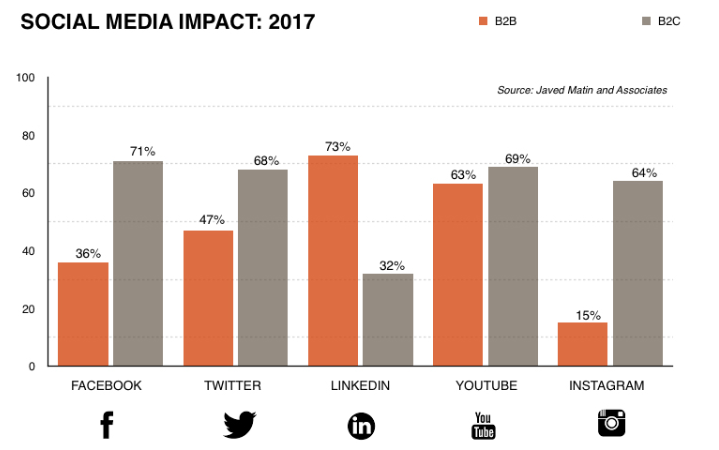

For the B2B-market, research has shown that 83% of executives use social media in their decision-making (Schimel, 2018). Moreover, 42% of the B2B-buyers share their experiences on social media (Post, 2016). According to a survey, LinkedIn has the highest impact for the B2B-market while YouTube has an enormous influence on generating lead and brand awareness (Grillo, 2017). Importantly, these B2B-clients become consumers after work (Bloovi, 2017). Who in this phase also can be influenced because personal experiences influence business expectations and ultimately the purchasing behaviour (Post, 2016). Therefore, social media marketing must also be on the point, in this case, for the consumer market.

Graph 3 shows that Facebook, Twitter, Instagram and YouTube has the most impact on the consumer market (Grillo, 2017). Consumers who become a fan of brand pages tend to stay loyal and generate positive word-of-mouth (de Vries et al., 2012). Thus, it can be said that social media is vital building brand loyalty and long-lasting relationships (Erdoğmuş and Çiçek, 2012). Interestingly, a study by Nielsen found that one in four new car buyers in the U.S. used Twitter to assist them in making a purchase-decision (Shaw, 2018).

Graph 3 Social Media Impact: 2017 (Grillo,2017)

Reference List

- Assael, H. (1998), Consumer Behavior and Marketing Action, 6th ed., South-Western College Pub, Cincinnati, Ohio.

- Belga. (2018), “Steeds meer Vlaamse consumenten bekommerd om hun ecologische voetafdruk”, Het Nieuwsblad, available at: https://www.nieuwsblad.be/cnt/dmf20180712_03610096 (accessed 19 November 2018).

- Bloovi. (2017), “De toekomst van B2B is vandaag: Het verloren potentieel van e-commerce tussen bedrijven”, Bloovi, 13 April, available at: http://www.bloovi.nl/nieuws/detail/de-toekomst-van-b2b-is-vandaag-het-verloren-potentieel-van-e-commerce-tussen-bedrijven (accessed 25 December 2018).

- BMW. (2018), “Configurator”, available at: https://configure.bmw.be/nl_BE/configure/G20/5V51/S01CB,S01SX,S0230,S0255,S02PA,S02VB,S02VC,S0465,S04GN,S0544,S0548,S05AQ,S05DA,S05DC,S06AE,S06AF,S06AK,S06U2,S07CG,S0851,S0886,S08AP,S08KB,S08R9,S08S3,S08TF,S0ZKS,S0ZLD,S0ZOR (accessed 27 November 2018).

- Brassington, F. and Pettitt, S. (2013), Essentials of Marketing, 3rd ed., Pearson, Harlow, England ; New York.

- D’Aveni, R.A. (2007), “Mapping Your Competitive Position”, Harvard Business Review, 1 November, No. November 2007, available at: https://hbr.org/2007/11/mapping-your-competitive-position (accessed 21 December 2018).

- Dalrymple, D.J. and Parsons, L.J. (2000), Basic Marketing Management, Wiley.

- De Paepe, P. (2018), “Stef Holemans en Nico Van Hauwermeiren (Toyota-Lexus): ‘Wij verkopen al 20 jaar succesvol alternatieve aandrijvingen’ – FLEET.be”, available at: https://www.fleet.be/stef-holemans-en-nico-van-hauwermeiren-toyota-lexus-wij-verkopen-al-20-jaar-succesvol-alternatieve-aandrijvingen/ (accessed 8 December 2018).

- de Vries, L., Gensler, S. and Leeflang, P.S.H. (2012), “Popularity of Brand Posts on Brand Fan Pages: An Investigation of the Effects of Social Media Marketing”, Journal of Interactive Marketing, Vol. 26 No. 2, pp. 83–91.

- E-gear. (2018), “Hybride verkoop is verdubbeld in 2017, elektro-auto verkoop stagneert”, Elektrische Auto Info | eGear.be, 10 January, available at: https://www.egear.be/aantal-elektrische-wagens-2017/ (accessed 19 November 2018).

- Erdoğmuş, İ.E. and Çiçek, M. (2012), “The Impact of Social Media Marketing on Brand Loyalty”, Procedia – Social and Behavioral Sciences, Vol. 58, pp. 1353–1360.

- EY. (2013), Gateway to Europe.

- Faludi, A. (2015), “The ‘Blue Banana’ revisited”, European Journal of Spatial Development, Vol. 1.

- Fgov. (2017), Kerncijfers-Statistisch Overzicht van Belgie 2017.

- FOD Economie. (2017), Demografische vooruitzichten 2016-2060 bevolking en huishoudens.

- Gao, P., Kaas, H.-W., Mohr, D. and Wee, D. (2016), “Disruptive trends that will transform the auto industry | McKinsey”, available at: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/disruptive-trends-that-will-transform-the-auto-industry (accessed 19 November 2018).

- Grillo, F. (2017), “‘Social Media: Considerations for B2C vs. B2B’ – Frank Grillo”, Social Media: Considerations for B2C vs. B2B”, available at: http://www.marketingjournal.org/social-media-considerations-for-b2c-vs-b2b-frank-grillo/ (accessed 25 December 2018).

- Hobbs, T. (2016), “Lexus: ‘Brands must truly collaborate with celebrities or it’s just an empty endorsement’”, Marketing Week, 22 February, available at: https://www.marketingweek.com/2016/02/22/lexus-brands-must-truly-collaborate-with-celebrities-or-its-just-an-empty-endorsement/ (accessed 12 December 2018).

- Iyengar, S.S. and Lepper, M.R. (2000), “When choice is demotivating: Can one desire too much of a good thing?”, Journal of Personality and Social Psychology, Vol. 79 No. 6, pp. 995–1006.

- Jaguar. (2018), “Dit is mijn Jaguar. Configureer die van u vandaag.”, Jaguar Configurator, available at: https://rules.config.jaguar.com/jdx/nl_be/xe_k19/3kqet/jdxmodel.html (accessed 27 November 2018).

- Jobat. (2011), “Wie krijgt een bedrijfswagen? – Jobat.be”, available at: https://www.jobat.be/nl/artikels/wie-krijgt-een-bedrijfswagen/ (accessed 28 December 2018).

- Khan, T. (2013), “STP strategy for New Product Launch-a Work in Progress”, p. 10.

- Kotler, P. (2016), Principles of Marketing, Sixteenth edition.; Global edition., Pearson, Harlow, Essex, England.

- Kretchmer, S.B. (2004), “Advertainment: The Evolution of Product Placement as a Mass Media Marketing Strategy”, Journal of Promotion Management, Vol. 10 No. 1–2, pp. 37–54.

- Lexus Europe newsroom. (2018), “THE LOUNGE BY LEXUS AT BRUSSELS AIRPORT”, THE LOUNGE BY LEXUS AT BRUSSELS AIRPORT, available at: https://newsroom.lexus.eu/2019-the-lounge-by-lexus-at-brussels-airport/ (accessed 8 December 2018).

- Lexus. (2014), “Lexus hybrid cars: an introduction”, Lexus, 3 July, available at: https://blog.lexus.co.uk/lexus-hybrid-cars-an-introduction/ (accessed 18 November 2018).

- Lexus. (2017), “NIEUWE LEXUS IS 300h”, available at: https://press.lexus.be/nieuwe-lexus-is-300h-95046 (accessed 18 November 2018).

- Lexus. (2018a), “Company Background”, available at: https://media.lexus.co.uk/wp-content/files_mf/1542969071181123MLexusintheUK.pdf.

- Lexus. (2018b), “Lexus Belgium | Garantie en bijstand”, available at: https://nl.lexus.be/lexus-services/garantie-en-bijstand/ (accessed 7 December 2018).

- Lexus. (2018c), “Lexus IS Modelreeks & Specs | Lexus België”, available at: https://nl.lexus.be/car-models/is/prices-and-specs/ (accessed 3 December 2018).

- Lexus. (2018d), “Lexus IS Sportsedan”, available at: https://nl.lexus.be/car-models/is/ (accessed 15 December 2018).

- Livis, G. (2017), “Europese KMO’s en hun wagenparkbeheer – FLEET.be”, available at: https://www.fleet.be/europese-kmos-en-hun-wagenparkbeheer/ (accessed 22 December 2018).

- Mercedes-Benz. (2018), “Mercedes-Benz C-Klasse Berline: uitrustingen”, available at: https://www.mercedes-benz.be/nl_BE/passengercars/mercedes-benz-cars/models/c-class/saloon/equipment.html (accessed 27 November 2018).

- Nagar, K. (2016), “Consumer Response to Brand Placement in Movies: Investigating the Brand-Event Fit”, Vikalpa, Vol. 41 No. 2, pp. 149–167.

- Neil, W. (2017), “2017 Lexus IS300h Luxury review | Autocar”, available at: https://www.autocar.co.uk/car-review/lexus/is/first-drives/2017-lexus-is300h-luxury (accessed 27 November 2018).

- Nieuwsblad. (2018), “OVERZICHT. Dit zijn de meest en minst betrouwbare auto’s volgens Belgische bestuurders”, Het Nieuwsblad, available at: https://www.nieuwsblad.be/cnt/dmf20180131_03331266 (accessed 8 December 2018).

- Peeters, J. (2018), “Marketingonderzoek – uw vragen via lexus.be”, 13 December, available at: https://mail.google.com/mail/u/0/#inbox/FMfcgxvzMBqKDDwkQRwPfwjrCcnmgxvf.

- Post, S. (2016), “De B2B wake up call: B2B-kopers vertonen consumentengedrag”, available at: https://www.ey-vodw.com/blog/de-b2b-wake-up-call-b2b-kopers-vertonen-consumentengedrag (accessed 25 December 2018).

- Schimel, E. (2018), “Strategic Social Media Is Essential For Driving B2B Sales”, Forbes, available at: https://www.forbes.com/sites/forbesagencycouncil/2018/03/22/strategic-social-media-is-essential-for-driving-b2b-sales/ (accessed 25 December 2018).

- Shaw, A. (2018), “How Social Media Can Move Your Business Forward”, Forbes, available at: https://www.forbes.com/sites/forbescommunicationscouncil/2018/05/11/how-social-media-can-move-your-business-forward/ (accessed 25 December 2018).

- Sylt, C. (2018), “The Marvellous Marketing Vehicle For The New Lexus”, Forbes, available at: https://www.forbes.com/sites/csylt/2018/02/26/the-marvellous-marketing-vehicle-for-the-new-lexus/ (accessed 12 December 2018).

- Tarantino, D. (2003), “Developing a Marketing Strategy”, Physician Executive, Vol. 29 No. 1, p. 54.

- Thijs, P., Roy, A.L., Bortier, J., UNIZO-Studiedienst, D., Ramakers, C. and UCM-Studiedienst, D. (2017), “Begeleidingscomité en databronnen”, p. 172.

- Toyota Newsroom Europe. (2017), “Toyota Parts Centre Europe celebrates its 25th anniversary”, Toyota Parts Centre Europe Celebrates Its 25th Anniversary, 20 October, available at: https://newsroom.toyota.eu/2017-toyota-parts-centre-europe-celebrates-its-25th-anniversary/ (accessed 8 December 2018).

- ToyotaBusinessPlus. (2017), “Nieuwe sterke fleetconditities 2017 | TOYOTA & LEXUS | Nouvelles conditions exceptionnelles en fleet 2017”, available at: https://fleet.toyota.be/nieuwe-sterke-fleetconditities-2017–toyota–lexus–nouvelles-conditions-exceptionnelles-en-fleet-2017 (accessed 8 December 2018).

- ToyotaBusinessPlus. (2018), “Correctie Fleet condities 2018”, available at: https://fleet.toyota.be/correctie-fleet-condities-2018 (accessed 12 December 2018).

- Vanacker, L. (2018), “Verkoop hybride auto’s sputtert”, De Tijd, 22 May, available at: https://www.tijd.be/ondernemen/auto/verkoop-hybride-auto-s-sputtert/10014281.html (accessed 19 November 2018).

- Vanoost, H. (2016), “Je loon stijgt het sterkst rond je 30ste”, hln.be, available at: https://www.hln.be/nieuws/je-loon-stijgt-het-sterkst-rond-je-30ste~a89c1625/ (accessed 22 December 2018).

- Vlaanderen. (2017), Vlaamse Consumenten En Hun Houding T.O.V. Milieu, available at: https://www.lne.be/milieuverantwoorde-consumptie.

- VRT. (2018), “Waarom het aantal bedrijfswagens blijft stijgen”, vrtnws.be, available at: https://www.vrt.be/vrtnws/nl/2018/01/09/meer-en-meer-nieuwe-bedrijfswagens/ (accessed 22 December 2018).

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal