Supply and Demand Conditions at Tesla

| ✅ Paper Type: Free Essay | ✅ Subject: Finance |

| ✅ Wordcount: 2473 words | ✅ Published: 23 Sep 2019 |

Supply and Demand Conditions

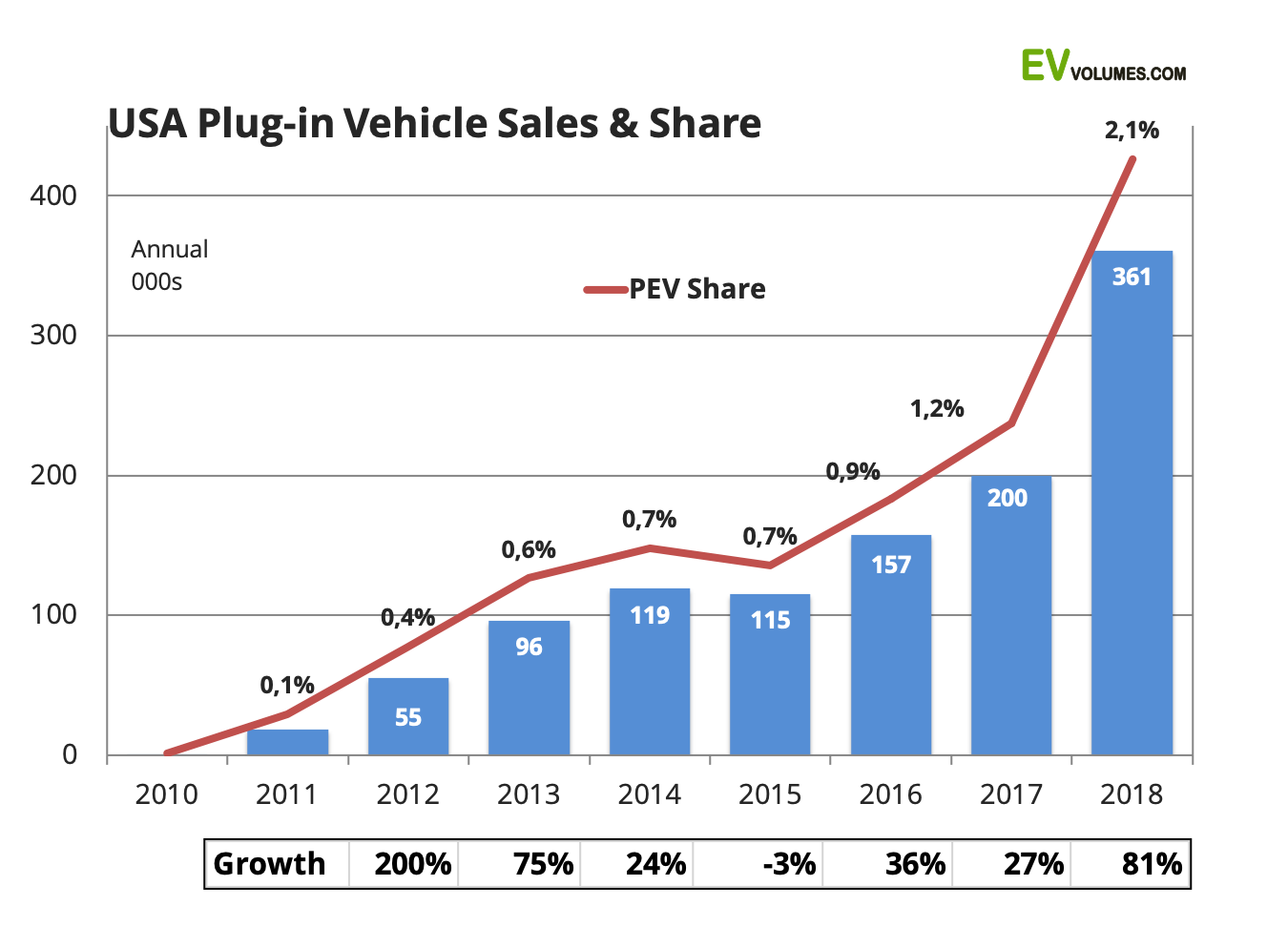

The EV sales in United States increased by a whopping 81% in 2018, compared to 2017. It also saw the highest growth rate since 2013. This growth rate is similar to the growth that was experienced between 2011 and 2013, when electric vehicles were first introduced in the United States. Some examples are the Prius plug-in, Chevy Volt and Tesla’s Model S. The EV sales saw moderate increases for the next four years and sales even declined temporarily. It picked up steam in 2018 and now the current wave is four times larger than the wave witnessed in 2011-2013 (“EV-Volumes – The Electric Vehicle World Sales Database,” n.d.).

This strong performance in 2018 really came down to one new entry, Tesla’s Model-3. Last year, 139,782 units of the Model 3 were sold. The Toyota Prius Prime was second with 27,595 units being sold. The Chevy Bolt, sold just 18,019 units for the year. Unsurprisingly, Tesla’s market share was more than 50 percent of the total plug-in vehicle sales in 2018 (“US Electric Vehicle Sales Increased by 81% in 2018,” 2019).

Tesla had a stellar 2018 and the introduction of Model-3 has been a game changer for the industry. Tesla has forced the auto industry to rapidly innovate and change. Large, established auto makers now are making fully electric and hybrid electric cars. The monthly sales volumes during the second half of 2018 were comparable to household names like Camry, Corolla, Civic and Accord, all gas-driven cars. In the end, the consumers will be the ultimate winner, due to start-of-the-art technology electric cars available at competitive prices, as the companies battle each other to gain a bigger share of the market.

Determinants of Market Demand

The determinants are Income, Price of related goods, Tastes, Population and demographics and Expected future prices.

Income – When the income increases, the demand for a normal good increase and when income decreases, the demand for that product falls (“Hubbard/O’Brien: Economics, 5e,” n.d.). Tesla sells cars that come under the categories of normal good and luxury good. Demand for luxury goods follow the same trend as normal goods. While the Model S and Model X are targeted towards the wealthier population, Tesla hopes to start producing standard Model 3 cars with a base price of $35,000, during the latter part of this year, as part of their plan to mass-market a car in the price range of consumers who cannot afford the luxury models.

Price of Related Goods – Price sensitivity or a very high elasticity of demand is a significant contributor to the slow growth of the EV market. It’s a major sticking point for vast majority of the population. When Georgia’s state legislature removed the state’s EV tax credit in 2015, EV sales in the state saw a big decline from 17% of the US total in 2014 to just 2% in 2016 (Michael J. Coren, 2018).

Expected Future Prices – Though prices are still high, many luxury car makers are working feverishly to build EV vehicles to compete with Tesla, which will bring down prices in the future. The current Model 3 being sold is available at $50,000, so that the company can start being profitable before it starts work on the standard $35,000 model, sometime this year. Companies like Hyundai will sell a new EV car, called Kona, which will have a range of 258 miles on a single battery charge, for only $23,000 this year (Michael J. Coren, 2018). Tesla will have to start producing and then ramp up its production of the $35,000 Model 3 cars sooner than later, to stay competitive and remain the market leader in the EV space.

Tastes – Tesla, like Apple does with iphone, has a huge fan following for its cars. People want electric vehicles, primarily due to two main reasons, gasoline cost and reduce greenhouse gas emissions (Kristina Zucchi, CFA, 2015). Whenever the gas prices remain high for long periods of time, people start looking at alternatives and seriously consider buying energy efficient cars. Also, consumers who are eco-friendly, will look into purchasing pure electric or hybrid automobiles. Tesla, in addition to the above two factors, has been successful into tapping in the luxury segment, which no company has sought to exploit before. Also, the Tesla brand is recognized and respected globally and people desire to be a part of the company, by buying their cars (Kristina Zucchi, CFA, 2015).

Population and demographics – A study conducted by Edmunds.com in 2013 created the following profile of Tesla S owners, more men than women and they were on average, younger and wealthier than those purchasing competing luxury sedans. About 84% of the buyers were males, 77.3% had income over $100,000 and 50.6% were in the 45-60 age group (Kristina Zucchi, CFA, 2015). The base version of Model 3, available at $35,000, was designed to make an every-day car for consumers, who cannot afford to buy the higher end luxury cars.

Analysis of Information and Data

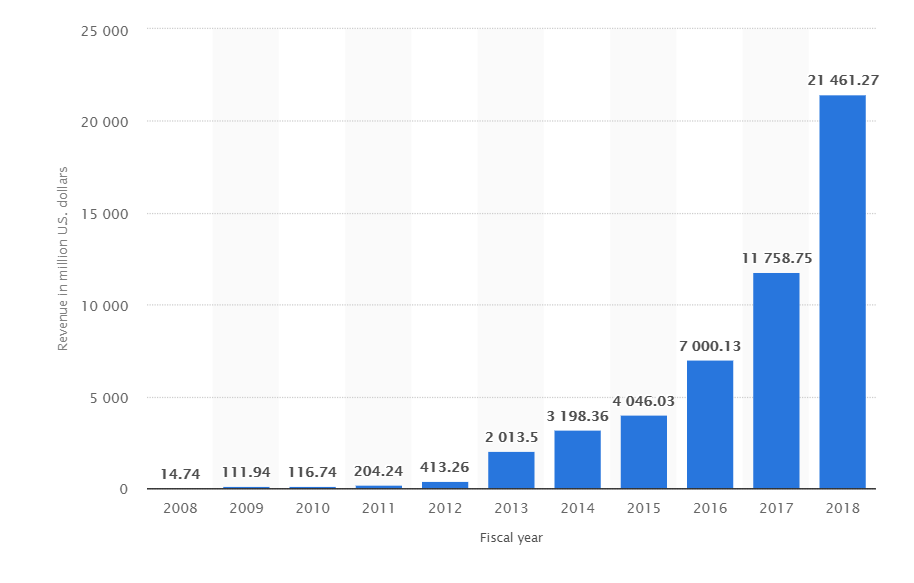

Tesla’s revenue from FY 2008 to FY 2018 in millions (US dollars)

The above graph shows Tesla’s worldwide revenue from fiscal year 2008 to fiscal year 2018. Their revenue grew to around $21.46 billion in 2018, from under $15 million in 2008 (“Tesla’s revenue 2008-2018 | Statistic,” n.d.).

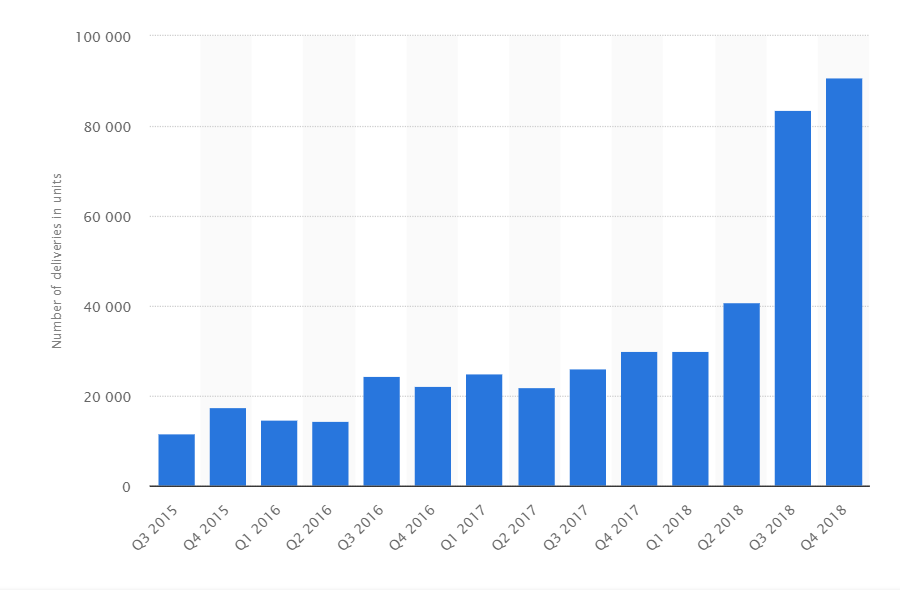

Tesla vehicles delivered worldwide (in units) from 3rd quarter 2015 to 4th quarter 2018

As the graph shows, Tesla delivered around 91,000 units during the last quarter of 2018. This is a big jump from 17,400 units delivered in the 4th quarter of 2015. The 91,000 units sold included 63,000 Model 3’s, with the rest comprising Model X and Model S sedans. With nearly 140,000 units of Model 3 sold during the full year in 2018, it was also the best-selling premium vehicle (including SUV’s) in the US. This was the first time in decades an American carmaker was able to secure the top spot (, n.d.). Model 3’s production rate progressively improved through Q4, and December 2018 recorded the highest monthly production volume ever.

Determinants of Supply

Prices of Inputs – Inputs are used in the production of a good or service. If the price of inputs Tesla uses in producing their vehicles increase, then the cost of production will increase too. This will lower the profitability of their vehicles at all prices thereby decreasing the supply of their cars in the market. Tesla faces some risks in this regard since they are dependent on external firms for the supply of lithium-ion cells required for their batteries. If the cost goes up or the availability of raw materials gets negatively impacted, it will reduce the number of cars available for sale in the market.

Technological changes – A positive technological change will allow Tesla to increase the production of vehicles with the same amount of inputs. This will increase the profitability at all levels since the supply will be increased and costs will decrease. By the end of 2019, Tesla is expected to start producing Model 3 vehicles at their new Gigafactory in Shanghai, using a complete vehicle production line. This will reduce by more than half their capital spend per unit of capacity, compared to the Model 3 line in Fremont, California (, n.d.).

Prices of Substitutes – Tesla produces and sells several models of cars catering to different income levels of consumers. If there is a more than anticipated increase in demand for the $35,000 Model 3 and consumers are willing to pay more than the asking price, the supply of other models will decrease, as the company will divert the inputs to produce more Model 3 cars to meet the demand.

Number of Firms – More firms in the EV market will lead to more EV’s available at a given price, since there will be an increase in supply. Similarly, there will be a decrease in supply when there are less firms in the market. Though several large and reputed auto manufactures are expected to come out with their electric cars to compete with Tesla by next year, Tesla’s unique position and status it enjoys in the car market, will give it a massive advantage over other branded vehicles. It will continue to dominate the market share in the EV space for the foreseeable future.

Change in expected future prices – If a firm thinks the price of its product will rise in the future, it might decrease the supply today and release it later when the price goes up, to take advantage of higher prices and profits (“Hubbard/O’Brien: Economics, 5e,” n.d.). As the production rate of Model 3 continues to ramp up, the cost per vehicle continues to decline. With the new Gigafactory schedule to start production at the end of this year, it will keep increasing the affordability of Model 3, while retaining a sustainable level of profitability for Tesla (, n.d.). With many competitors expected to release their EV’s as early as next year, the market will become crowded and Tesla will have to find new ways to decrease their production costs and remain profitable in the long run.

Price Elasticity of Demand

Tesla produces different models of cars aimed at different demographics. Though the market demographic it is targeting with the Model 3 is bigger, it’s more competitive than the demographic for Model S and Model X (2018 Annual reports). Moreover, additional electric vehicles are entering the market on a regular basis. The market for EV’s is a lot smaller than the market for gasoline vehicles and there are still misconceptions about the features, quality, performance and safety of the vehicles, mileage on a single battery charge (2018 Annual Reports). Though there is huge consumer interest and demand for Tesla sedans, the demand for Model 3 far outpaces the demand for Model S and Model X sedans. This is because the base Model 3 version is priced at $35,000 and the upgraded version is priced at $50,000, which is far less than the Model S, priced at $76,000 and Model X, which is priced at a whopping $82,000. More than 400,000 people have put down a deposit for the $35,000 Model 3 sedan (Song, 2018). This clearly demonstrates that the price elasticity of demand is high for Model 3 cars.

Price Elasticity of Demand determinants

Availability of Substitutes – A product will have a higher elastic demand if there are many substitutes available (“Hubbard/O’Brien: Economics, 5e,” n.d.). There are a variety of choices for the American consumer, from all electric models to hybrids, which run on gasoline like the Toyota Prius or plug-ins like the Hyundai Sonata.

Passage of time – As time passes, consumers will be able to change their buying habits more easily, so usually, elasticity will be higher in the long run, when compared to the short run (“Hubbard/O’Brien: Economics, 5e,” n.d.). As Tesla finally starts to produce and deliver the Model 3 in large quantities at affordable prices, consumers who could not afford the pricier luxury sedans, can start submitting their orders. It has taken more than 10 years to finally deliver on their promise of affordable electric vehicles.

Luxury or necessity – Tesla sedans are not a necessity like milk or bread. So, for luxuries, the price elasticity of demand is higher, since consumers can still go on about their daily lives with a cheaper gasoline car. Of course, Tesla is kind of an exception in this regard, due to the uniqueness of their products.

Definition of Market – If only the pure-electric vehicle segment is considered, there are only very few players, apart from Tesla. Examples are Nissan Leaf and Chevy Volt. But if you take expand the market definition to include hybrids, the list is longer with more established players in the market,

Share of Budget – Since a car will take a significant share of the budget, any price fluctuations will have a bigger impact in their decision making. Tesla’s vision to produce and deliver the base Model 3 at $35,000, which is within the reach of most consumers and the fact that the cost per mile will be negligible will play a significant part in their decision to buy this model.

Pricing Decisions through Elasticity of Demand

The demand for Tesla cars is relatively price elastic. This means that consumers are very sensitive to the price of the product. This also means when the price is decreased, there will be a higher increase in demand, relative to the price decrease. The additional consumers will more than compensate for the lost revenue and therefore the total revenue goes up. In other words, when the demand curve is elastic, there is an opposite relationship between price and total revenue (“Hubbard/O’Brien: Economics, 5e,” n.d.). “Any attempts to increase vehicle prices in response to increased material costs could result in cancellations of vehicle orders and reservations and therefore materially and adversely affect our brand, image, business, prospects and operating results.” (Annual Reports, 2016). Its vision is to decrease the cost of production at all costs, rather than increase the price of its products and lose potential customers. It is expected to start producing Model 3 vehicles at their new Gigafactory in Shanghai by the end of this year, which will cut the capital spend per unit by more than half. Also, by improving the current production rate of Model 3, by building all the critical parts under its own control, it has more control over costs and thereby keeping the prices stable. Tesla is also able to sell more cars than ever before in the luxury segment as well, though it had to increase prices of Model S and Model X sedans, to keep up with the increasing costs as it tries to mature in the EV production space.

References

- EV-Volumes – The Electric Vehicle World Sales Database. (n.d.). Retrieved from http://www.ev-volumes.com/country/usa/

- US Electric Vehicle Sales Increased by 81% in 2018. (2019, January 7). Retrieved from https://www.greentechmedia.com/articles/read/us-electric-vehicle-sales-increase-by-81-in-2018

- Michael J. Coren. (2018, December 21). A California program to put the masses in electric cars may cost $14 billion. Retrieved from https://qz.com/1499245/ev-price/

- Kristina Zucchi, CFA. (2015, February 17). What Drives Consumer Demand for Tesla? Retrieved from https://www.investopedia.com/articles/personal-finance/021715/what-drives-consumer-demand-tesla.asp

- Tesla’s revenue 2008-2018 | Statistic. (n.d.). Retrieved from https://www.statista.com/statistics/272120/revenue-of-tesla/

- Retrieved from http://ir.tesla.com/static-files/0b913415-467d-4c0d-be4c-9225c2cb0ae0

- Hubbard/O’Brien: Economics, 5e. (n.d.). Retrieved from http://media.pearsoncmg.com/ph/bp/bp_hubbard_econ_5/sectionvid/section0301.html

- Hubbard/O’Brien: Economics, 5e. (n.d.). Retrieved from http://media.pearsoncmg.com/ph/bp/bp_hubbard_econ_5/sectionvid/section0602.html

- Hubbard/O’Brien: Economics, 5e. (n.d.). Retrieved from http://media.pearsoncmg.com/ph/bp/bp_hubbard_econ_5/sectionvid/section0603.html

- Form 10-K. (2016, February 24). Retrieved November 03, 2017, from http://ir.tesla.com/secfiling.cfm?filingid=1564590-16-13195&cik=1318605

- Song, K. (2018, June 29). Elon Musk opens Tesla Model 3 sales to all, but auto experts give 3 reasons why you may want to wait. Retrieved from https://www.cnbc.com/2018/07/13/tesla-model-3-sales-car-experts-say-consumers-may-want-to-wait.html

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal