Factors Leading to the Sainburys and Asda Merge

| ✅ Paper Type: Free Essay | ✅ Subject: Finance |

| ✅ Wordcount: 2985 words | ✅ Published: 23 Sep 2019 |

Table of contents

3.0 The issues before and after the merger

4.12 Dividend Valuation Models

4.13 Income/Earnings Based Model

4.14 Discounted future cash flow.

4.2 Appropriateness of the valuation

4.3 Adjustments if Asda is a private company

Sainsbury’s & Asda

On 30th April 2018, J Sainsbury plc (“Sainsbury’s”) and Walmart Inc. announced the combination of Sainsbury’s and Asda Group Limited (“Asda”). Sainsbury’s predicted that the groups after combination would be UK’s leading groups in grocery retail. This report analyzes the grocery retail industry over the past 3-5 years and its trends towards consolidation. The factors which lead up to the merger and about subsequent business integration are also considered. Then the report calculates Asda’s value by four various models and assesses whether the transaction price is appropriate. At last, the report explains the regulatory regime about CMA and describes the current risk environment.

In the past few years, the brexit had fundamentally affected the development of UK grocery retail industry while inflation kept at a high level. The UK grocery market had fallen into decline for the first time in 2016 because the performance of all four major supermarkets worsened (Butler, 2016). The companies found they need to spend more money in buying products because of the devaluation of pound.

At the same time, food margins fell because of the increase in costs. It hit the discounters and supported the repositioning of their models (Dresser, 2017). In addition, imports cost more, but some inflation would just be another way for the market to get out of it. In 2017, the dairy products hit record lows while the price of butter had fallen to 82p in some cases. The market has adjusted and these lines are now picking up. So while there are currency weakness and broader inflation through brexit, in some cases, the grocery retail industry is swinging in the other direction (Dresser, 2017).

2018 was a challenging year with pressure mounting on retailers (Deloitte, 2018). Consumer confidence rose, but spending growth slowed. Inflation had fallen as expected, but so had wage growth, meaning consumers were not letting up. In the first three months of 2018, snow and freezing temperatures reached ridership at the shopping site, and supply chain disruptions also caused empty shelves. Improved weather in the second quarter, coupled with the World Cup and royal weddings, gave UK retail a necessary support. Supermarkets were benefited from increased sales of food and drinks as consumers grill and celebrated the start of summer. In the end of 2018, retail sales proved strong in 2018 due to strong performance in the food, beverage sector and continued growth in e-commerce which accounted for almost 20% of retail sales.

In conclusion, although the grocery retail industry faced some difficulties over the past years, the prospect has started improving. IGD (2018) predicted that UK grocery market will grow 14.8% by £28.2 billion by 2023. The market provides a positive environment for the merger between Sainsbury’s and Asda.

3.0 The issues before and after the merger

Because of Tesco-Booker deal, the market was coming to terms. The brexit also increased uncertainty. To combat Aldi, Lidl and emerging threats from Amazon, Sainsbury’s and Asda had decided on a super-merger plan with an investment of more than 12 billion pounds. Before the acquisition, Asda and Sainsbury’s held 15.6% and 15.8% of the grocery market share respectively while Tesco accounted for 27.6% (Wood, 2018). The UK competition regulator claimed that once the merger was successful, the giant company is about 31.4% and become the largest retailer in the UK.

On the company, Sainsbury’s has 605 stores, 807 convenience stores, 250,000 online order and 150,000 employees (Sainsbury’s, 2018). Asda has 584 stores, 400,000 online order and 160,000 employees. Mergers and acquisitions could bring many benefits to both supermarkets. ASDA will be used to compete with German low-priced supermarket brands Lidl and Aldi. Sainsbury’s price reduction will weaken the market competitiveness of high-end food retailers such as M&S and Waitrose. Also, Sainsbury’s hopes to put pressure on Amazon through online payments of up to 500,000 times a week from two supermarkets. However, although Sainsbury’s claims that resource consolidation will not lead to the closure of any supermarket or store, hundreds of supermarkets may be closed or sold in the next few years because there is no need to set up two competitors in the overlapping area and Sainsbury’s needs to meet CMA’s requirement to get the approval form it. In addition, the potential unemployment should also be considered because of stores’ closure.

After the announcement of the acquisition, Sainsbury’s shares increased by 15% and reached their highest point in four years on 30th April on Monday, spiking by more than 20% to 327.1p in early trading while the shares of its major competitors Tesco and Morrisons reduced. It showed the market held the optimistic attitude to the merger (Leyland & Quinn, 2018).

This is the following purchase of department store chain brand by Sainsbury’s after it acquired Argos in 2016. In the future, there is a further £75m will come from integrating Argos outlets into Asda stores, and the rest from savings will be used on utilities and other operational costs (Leyland & Quinn, 2018).

4.0 Valuation

The asset based valuations assume the Asda’s value when it breaks up.

Its assets are adjusted by their various attributes.

We assume that all of Asda’s liabilities need to be paid.

Based on these assumptions, Asda’s value after adjustment is £6104.3 million

(Please see Appendix I)

4.12 Dividend Valuation Models

Dividend valuation models could not be applied in this case because Asda simplified its group structure in 2016. It made Asda only kept 4 ordinary shares to decrease its share capital to £1. This makes the calculation which is based on dividend per share become meaningless. (Please see Appendix II)

4.13 Income/Earnings Based Models

Asda’s earnings and the similar listed company Tesco’s P/E ration are used to calculate Asda’s value. After that, the valuation is adjusted because Asda is an unquoted company.

Asda’s value is £8,059.8 million in the Income/Earnings Based Models.

(Please see Appendix III)

4.14 Discounted future cash flow

The shareholders earnings are calculated by subtracting the capital expenditure from the depreciation and amortization. The shareholders earnings in this case are £712m.

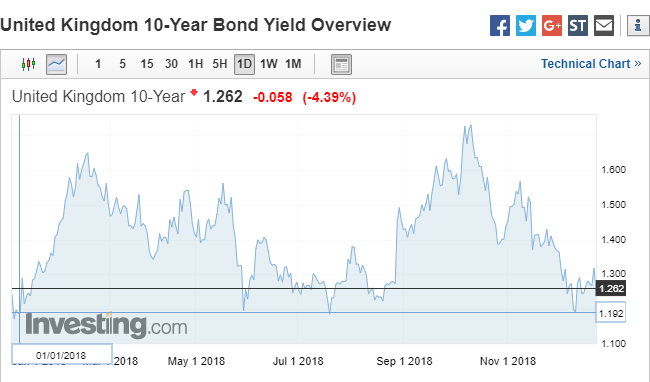

We assume UK Ten-year Treasury yields as UK risk-free interest rate.

£712m/1.192%=£59,731.544m

Asda’s value is £59,731.544 million in the discounted future cash flow.

(Please see Appendix IV)

4.2 Appropriateness of the valuation

|

Sainsbury’s paid |

£7.3 billion |

|

Asset Based Valuations |

£6.1043 billion |

|

Income/Earnings Based Models |

£8.0598 billion |

|

Discounted future cash flow |

£59.731544 billion |

Asset Based Valuations is lower than Sainsbury’s paid because its percent of assets’ adjustment is very high.

Income/Earnings Based Models is higher than Sainsbury’s paid because its similar listed company’s P/E ratio was relatively high and Asda’s earning also kept at the high level.

Discounted future cash flow is much higher than Sainsbury’s paid because UK risk-free interest rate kept at a very low level.

4.3 Adjustments if Asda is a private company

Sainsbury’s is a public limited company (PLC) and Asda is a group limited company. If Asda is a private company, we need to add a discount on the valuation. Koeplin, Sarin and Shapiro (2000) concluded that the practitioners attribute the discount mainly because of the relative illiquidity of private companies, so they apply empirical studies designed to measure illiquidity discounts to value private companies. In this case, we set a 30 percent discount of adjustment for Asda because of its liquidity, industry and potential risks after the merge.

The competition and Markets Authority (CMA) is the main competition authority in the UK market (National Audit Office, 2016). It is an independent non-ministerial department which works for promoting competition for the benefit of consumers (CMA, 2018).

Its main responsibilities are investigating mergers, managing market studies and investigations about competition and consumer problems, enforcing the legislation to protect consumers, encourage sector regulators to use their competition powers and considering appeals and regulatory references (CMA, 2018).

In this case, CMA had finished Phase 1 in September and started Phase 2.

In the first phase, CMA assessed detailedly how the merger between Sainsbury’s and Asda would affect competition for UK consumers (CMA, 2018). The investigation considered whether the merger would lead to reduce choice, cause higher prices or worse quality services and products. In addition, CMA also assessed whether the merged company would squeeze suppliers by its increased buyer power and whether this could have potential effects for consumers.

In the second phase, CMA is further investigating the issues in Phase 1 (CMA, 2018). At the same time, it is also investigating some other issues it raised like fuel, groceries and other general merchandise. Furthermore, some emerging retailers’ potential impact of competition is also included. CMA needs to consider whether the supermarkets could make their commercial decisions more easily and reduce vigorous competition after the merger. In this phase, CMA needs to gather evidence to analyze, scrutinise both Sainsbury’s and Asda’s internal information and seeks the opinions of rival retailers and suppliers.

The investigations are still under way and the statutory deadline is 5th March 2019 (CMA, 2018). According to some early cases like the merger between Tesco and bookers, the merger between Sainsbury’s and Asda might be approved soon. CMA might ask Sainsbury’s and Asda to take some actions to keep the market competition. For example, it might ask them to sell some stores to keep the balance with other retailers. The consequence will still be positive as long as Sainsbury’s and Asda make some remedies to meet CMA’s requirements.

In the previous situation, Sainsbury’s and Asda faced the pressure from other competitors. Sainsbury’s claimed that two stores would have 10% discount for their products, this decision exists business risks that affecting product sales and costs. After they set a lower price, they would have more opportunities to against the competitors in the inexpensive product market. However, the result of the price reduction would apparently increase the demand for these products. That means the producers need to raise their yield of products but earn less profit. In addition, the unemployment risks also exist. Some stores might be closed because Sainsbury’s and Asda have many overlapping regions.

Once Sainsbury’s and Asda merge successfully, they should also focus on protecting the environment because their merge will increase the demand and bring more stress and pollution to the limited resources. Fortunately, Simms (1992, p. 36) pointed out that “The impression is that Asda has been active on environmental issues for some time” and Sainsbury’s also makes effort in “green activity and promotion appear intelligent and coordinated”. It shows they could keep the balance between production and environmental protection. Yang (2007, p. 89) had summarized there are three types of risk during the process of enterprise merge. They are “merge fail, the loss of competitive advantage and the management of enterprise out of control”. In this case, the merger is still under way and the prospect is positive. The price reduction will make two companies maintain their competitive advantage. However, they might face operational risks. These two companies might have some difficulties in the process of resources integration. As a family business which lasts for 150 years, Sainsbury’s has enough experience to manage the company. Furthermore, Asda also has a mature logistics service and cutting-edge technology center. It is obvious that both companies could manage the operational risks under the control.

In conclusion, their merger is an optimistic decision in the current environment. However, the environment of the market changes constantly and is difficult to predict. Sainsbury’s and Asda should focus on making good use of two companies’ flexibility to avoid and control the current risks.

The merger of Sainsbury’s and Asda is to get rid of the economic inflation brought about by Brexit and to combat the sales pressures brought by online e-commerce platforms like Amazon and low-cost supermarkets like Lidi. In a short time, it will stimulate their company’s share price, and it can complement each other in commodities or other aspects. The merger will have a deep influence on the UK supermarket retail industry.

- ASDA Group Limited. (2010). Reports and Financial Statements 31 December 2009. Leeds: ASDA Group Limited.

- ASDA Group Limited. (2017). Reports and Financial Statements 31 December 2016. Leeds: ASDA Group Limited.

- ASDA Group Limited. (2018). Reports and Financial Statements 31 December 2017. Leeds: ASDA Group Limited.

- CMA. (2018). About us. Retrieved from https://www.gov.uk/government/organisations/competition-and-markets-authority/about

- CMA. (2018). Administrative timetable. Retrieved from https://assets.publishing.service.gov.uk/media/5c1228e540f0b60bc4029c59/full_administrative_timetable.pdf

- CMA. (2018). CMA launches Sainsbury’s / Asda merger investigation. Retrieved from https://www.gov.uk/government/news/cma-launches-sainsburys-asda-merger-investigation

- CMA. (2018). CMA sets out scope of Sainsbury’s / Asda merger investigation. Retrieved from https://www.gov.uk/government/news/cma-sets-out-scope-of-sainsburys-asda-merger-investigation

- CMA. (2018). J Sainsbury PLC / Asda Group Ltd merger inquiry. Retrieved from https://www.gov.uk/cma-cases/j-sainsbury-plc-asda-group-ltd-merger-inquiry

- CMA. (2018). Sainsbury’s / Asda merger referred for in-depth investigation. Retrieved from https://www.gov.uk/government/news/sainsburys-asda-merger-referred-for-in-depth-investigation

- Deloitte. (2018). Retail Trends 2018. Retrieved from https://www2.deloitte.com/uk/en/pages/consumer-business/articles/retail-trends.html#

- Dresser, S. (2017). Food Retail / Consumer Trends for 2017. Retrieved from https://www.groceryinsight.com/blog/2017/01/retail-trends-2017/

- IGD. (2018). UK food and grocery market to grow 14.8% by £28.2bn by 2023. Retrieved from https://www.igd.com/about-us/media/press-releases/press-release/t/uk-food-and-grocery-market-to-grow-148-by-282bn-by-2023/i/19052.

- J Sainsbury plc. (2018). Proposed combination of J Sainsbury plc and Asda Group Limited. Retrieved from https://www.about.sainsburys.co.uk/~/media/Files/S/Sainsburys/documents/reports-and-presentations/2018/combination-of-j-sainsbury-and-asada-group-ltd.PDF

- J Sainsbury plc. (2018). Groceries. Retrieved from https://www.about.sainsburys.co.uk/great-products-and-services/groceries

- Koeplin, J., Sarin, A., & Shapiro, A. C. (2000). The private company discount. Journal of Applied Corporate Finance, 12(4), 94-101.

- Leyland, A., & Quinn, I. (2018). Sainsbury’s Asda £51bn combination play: what we know and what it means. Retrieved from https://www.thegrocer.co.uk/home/topics/sainsburys-asda-merger/sainsburys-and-asda-mega-merger-what-we-know-and-what-it-means/566476.article

- Butler, S. (2016). UK’s major supermarkets decline for first time this year. Retrieved from https://www.theguardian.com/business/2016/jun/28/aldi-lidl-asda-supermarket-sector

- Simms, C. (1992). Green issues and strategic management in the grocery retail sector. International journal of retail & distribution management, 20(1), 32-42.

- Tesco PLC. (2018). Annual Report and Financial Statements 2017. Welwyn Garden City: Tesco PLC

- Wood, Z. (2018). Sainsbury’s and Asda in shock talks over £10bn merger deal. Retrieved from https://www.theguardian.com/business/2018/apr/28/sainsburys-and-asda-in-shock-talks-over-10bn-merger-deal

- Yang, C. (2007). Study on the risk decision for enterprise merge and acquisition based on AHP [J]. Journal of Central University of Finance & Economics, 2007(8), 88-92.

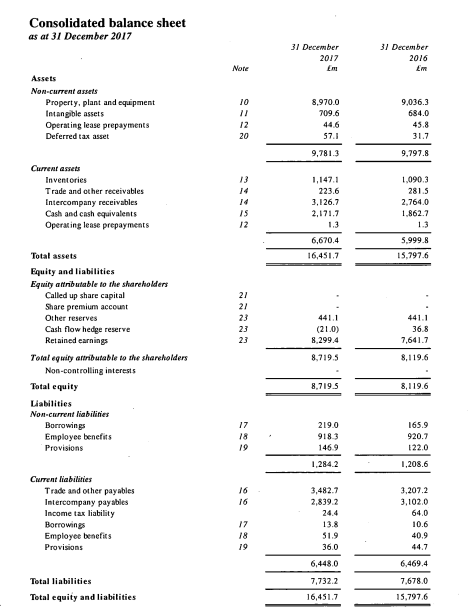

Appendix I

Asda’s balance sheet in 2017

|

Non-current assets: |

Book value(£m) |

Adjustment rate |

Value after adjustment(£m) |

|

Property, plants and equipment |

8,970.0 |

80% |

7176.0 |

|

Intangible assets |

709.6 |

80% |

567.7 |

|

Opertaing lease preparements |

44.6 |

100% |

44.6 |

|

Deferred tax assets |

57.1 |

100% |

57.1 |

|

Total Non-current assets |

9781.3 |

7845.4 |

|

|

Current assets: |

|||

|

Inventories |

1,147.1 |

70% |

802.9 |

|

Trade and other receivables |

223.6 |

90% |

201.2 |

|

Intercompany receivables |

3,126.7 |

90% |

2814.0 |

|

Cash and cash equivalents |

2,171.7 |

100% |

2,171.7 |

|

Operating lease Prepayments |

1.3 |

100% |

1.3 |

|

Total current assets |

6,670.4 |

5991.1 |

|

|

Total aseets |

16,451.7 |

13,836.5 |

|

|

Liabilities |

(7,732.2) |

100% |

(7,732.2) |

|

Value (assets – libilities) |

8719.5 |

6104.3 |

The asset based valuations assume the Asda’s value when it breaks up.

Most of Asda’s property, plants and equipment are freehold properties which could relatively hold the value, so we assume its adjustment rate is 80%.

Although the intangible assets are uncertain, most of Asda’s intangible assets are its goodwill. We assume its adjustment rate is 80% because Asda is one of the biggest market retailers in UK.

Asda’s inventories are very complicated. Some of them could hold the value, but some of them will lose their value quickly. For this reason, we assume its adjustment rate is 70%.

Considered Asda’s market share in UK, we assumed it has a high percent of possibility to receive the fund. We assume intercompany receivables, trade and other receivables are 90%.

We assume that all of Asda’s liabilities need to be paid.

Based on these assumptions, Asda’s value after adjustment is £6104.3 million

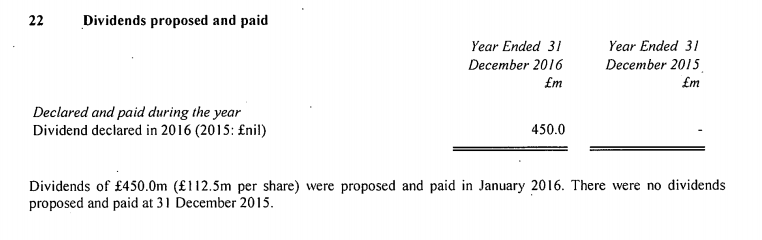

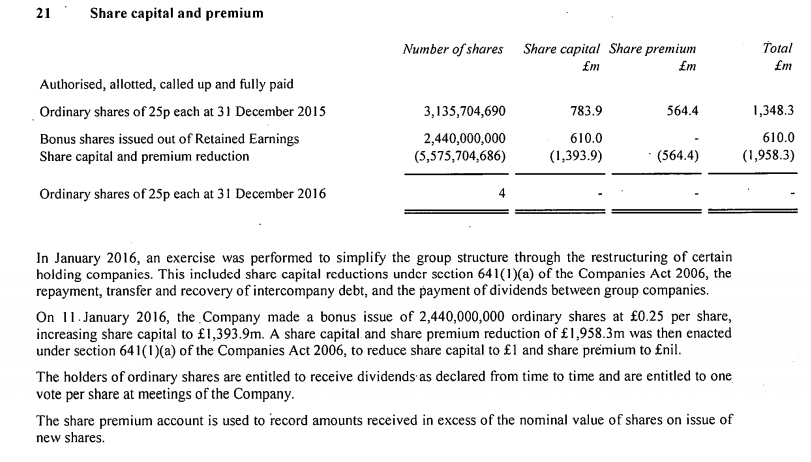

Asda’s dividends proposed and paid in 2016

Asda’s share in 2016

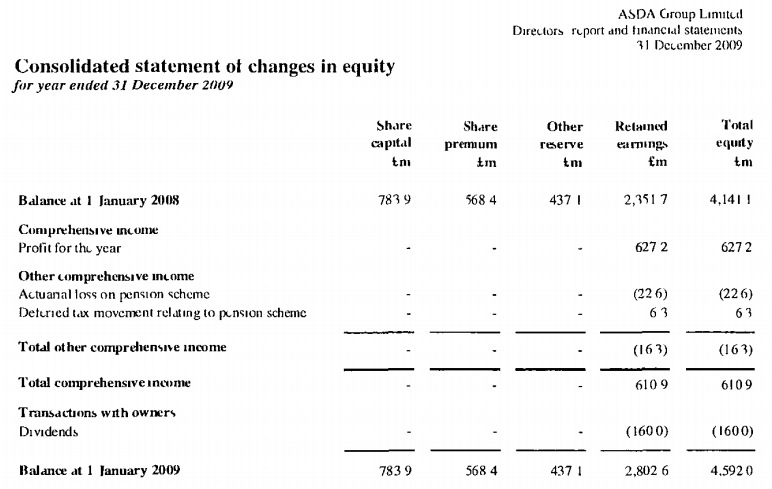

Asda’s dividend propsed and paid in 2009

Asda’s share in 2009

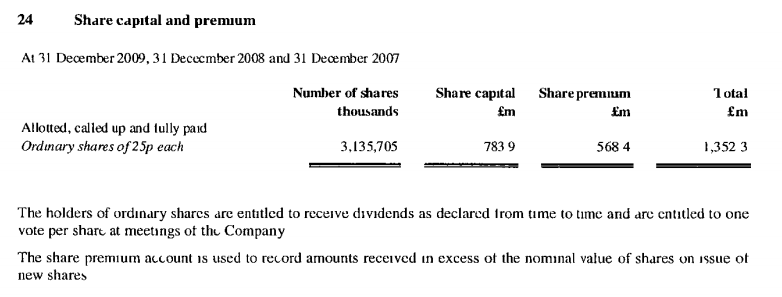

The last time Asda paid dividends was in 2016. It paid £450 million. However, “an exercise was performed to simplify the group structure through the restructuring of certain holding companies” (ASDA, 2016, p.53) in January. The share price reductions were included “under section 641(1)(a)” (ASDA, 2016, p.53). For this reason, it reduced its ordinary share and bonus share that it decreased its share capital to £1 and share premium to £nil. In 2016, the dividend per share was £112.5 million per share (£450m/4=£112.5m).

The time before last time Asda paid dividends was in 2009. It paid £160 million. In that time, there were 3,135,705,000 ordinary shares. In 2009, the dividend per share was 5.1p per share (£160m/3,135.705m=£0.051).

Po = D0(1+g)/(r-g)

If we use the data to calculate, the “g is” 20.62.

(112,500,000/0.051)^(1/7) -1=2062%

The “g” which is calculated by Asda’s dividend per share of 2016 and 2009 does not make sense because of its special situation in 2016, so dividend valuation models could not be applied in this case.

Appendix III

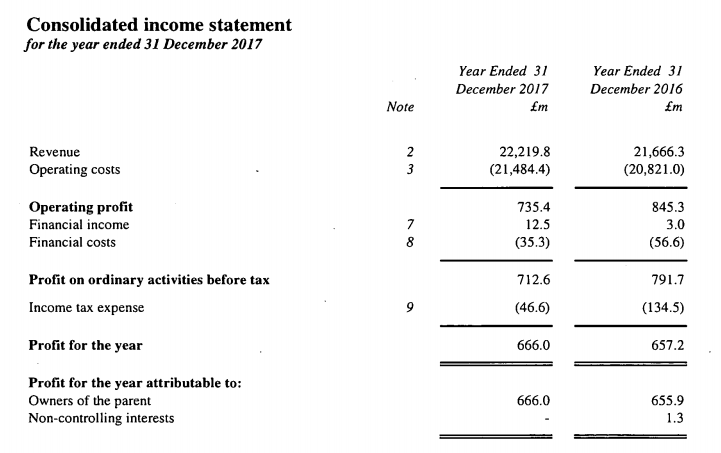

Asda’s income statement in 2017

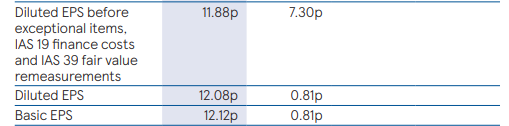

Tesco’s EPS in 2017 annual report

Tesco’s share price on 23th February (There was no share price on 24th Februry)

Asda has earnings of £666,000,000

A similar listed company Tesco has a P/E ratio of 17.290

205.4p/11.88p=17.290

P=E * P/E= £666,000,000 * 17.290 = £11,514,000,000

The quoted company (Tesco) is safer and less risky, so Asda’s price needs to be reduced because it is an unquoted company.

£11,514,000,000 – (£11,514,000,000 * 30%) = £8,059,800,000

Asda’s value is £8,059.8 million in the Income/Earnings Based Models.

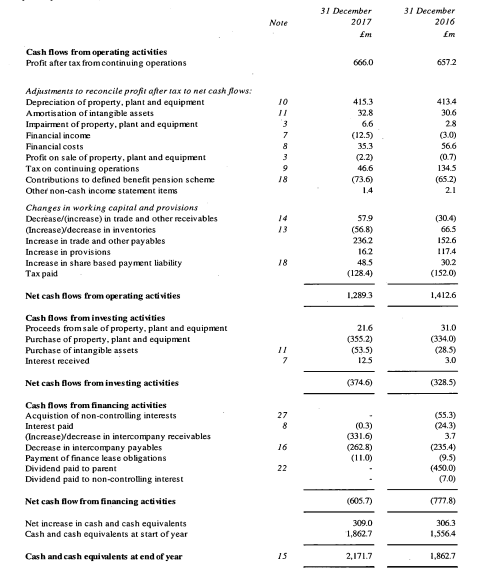

Asda’s cash flow in 2017

UK Ten-year Treasury yields

|

Profit after tax |

£666.0 million |

|

Depreciation and amortization: |

|

|

Depreciation of property, plant and equipment |

£415.3 million |

|

Amortisation of intangible assets |

£32.8 million |

|

Impairment of property, plant and equipment |

£6.6 million |

|

£1120.7 million |

|

|

Capital expenditure: |

|

|

Purchase of property, plant and equipment |

(£355.2 million) |

|

Purchase of intangible assets |

(£53.5 million) |

|

Shareholders earnings |

£712 million |

We assume UK Ten-year Treasury yields as UK risk-free interest rate.

£712m/1.192%=£59,731.544m

Asda’s value is £59,731.544 million in the discounted future cash flow.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal