Advantages and Disadvantages of Debt Relief

| ✅ Paper Type: Free Essay | ✅ Subject: Finance |

| ✅ Wordcount: 2904 words | ✅ Published: 04 Sep 2017 |

Please explore the economic implications of sovereign borrowing in a country of your choice. What are the pros and cons of conditionality and debt relief in that context?

Introduction

In this essay we will revise the theoretical framework of the advantages and disadvantages of both debt relief and conditionality in the context of sovereign borrowing in order to contrast it with the historical experience of Argentina. We will demonstrate, with a chronological view of the Argentinean debt that the first measures taken to resolve the problem of debt and service, in consonance with conditionality only worsen the situation that the country was facing. Following history, we will evaluate the beneficial results that came from a different set of plans arranged according to debt relief, reaching a point where the disadvantages where not suffered and the country could repay most of the obligations.

To do so, we will start with a review of the conditionality theoretical framework in order to understand the possibilities for this type of arrangement comprehended by the academics. In this we will analyse the possibility of a negative impact on indebted economies, coming from the short term benefit that would come from designating the loan resources to increase consumption rather than investment.

Secondly we will submit the academic theories on debt relief a similar review. In this case, it will be highlighted the contribution from Krugman (1988) that states how a relief may appear as a loss for the lenders, but in real terms facing the impossibility of payment, it would become a capital gain on terms of the initial landed amount

In concordance with the theory, we will review in the last part, the negative impact that conditionality had in Argentina, leading the country to pursue consumption instead of investment and therefore submersing into further loans that could not repay, nor recourses to build the capacity for future payments. For the country this culminated in a period of crisis. On the other hand, we will see how the debt relief plans that the country benefited from after said crisis, would cause a strong and steady rate of repayment that terminated in beneficial terms for both parties, Argentinean government and various creditors.

Conditionality

A conditional loan would be expected to bring a wide variety of economic and political benefits to the destined country. For example steady and balanced growth rate, exchange rate stability, and an increase in the exports (Guitián, 1995) and ultimately resolving debt crisis and debt overhangs (Fafchamps, 1995). On the political side, if we realize that most economically poor countries face such a reality because of bad politics, it becomes extremely important to focus on reforming the political issues that led to that position. The IMF and World Bank possess the capacity to analyse beyond the economic factor and consequences of loans and determine, under their opinion, what would be the best path to follow for the objectives set for the credit. Lastly, conditional loans are commonly granted to countries that need to escape a specific rough situation, which means that it would probably need flexible or soft terms to be able to repay. For that Institutions like the previously mentioned are better positioned to fill the demand without the debtor country being forced to accept unfavourable terms on a credit from another market actor (Sachs, 1988).

On the other hand, conditionality can lead to worse scenarios like leading the country into a vicious circle of conditionality (Fafchamps, 1995). We must understand that the conditionality of a loan, overlaps with a State’s sovereignty, the idea that said state does not recognize a superior rule than his own. So ultimately, conditionality is a self-limitation of a State to a set of rules and a path pre-set by an international organization which is followed only by the good faith. To mitigate this, the lender can set a series of consequences and sanctions that may be applied to those countries that do not comply with the previously stated conditions, but still the nature of this types of loan is not comparable to a domestic one, between two individuals and regulated by internal law (Sachs, 1988). Therefore, the threat to cut the possibility of future lending is not strong enough.

It is rational to think that, despite, a country that seeks to contract sovereign debt with an international organization, is concerned about their production and desires to increase it in order to boost the economy and assure the means to repay the loan. Yet mostly, the countries would be more politically benefited from increasing consumption than investment. In the short term, locating resources to investment could lead to a recession until industries are developed, risking the political stability and continuity of the current regime. Therefore, a government that was recently granted the capital requested, my turn its policies to expand consumption in an effort to gain power in the short term, but knowing that in the long, they will not be able to fulfil the services (Sachs, 1988).

Debt Relief

There is an enormous advantage, in theoretical terms, to debt relief. For a country that has a bigger of debt service than payment possibility, it is possible that the combination of a debt relief and an investment promoting policy will benefit both the creditor and the debtor. If we consider that the capacity of payment is dependent to the export capacity of a country, then an extra amount of money utilised to promote production and exports could boost the service in a certain time. Following this logic, if debtors are reduced part of the immediate debt service demanded to a quantity that leaves enough capital to execute the required movements to increase the exports then, in the future and as a result of debt relief, the total service capacity of the country is likely to increase in the future. Promoting as well the debtor production capacity and his possibilities on new loans (Krugman, 1988; Sachs, 1988).

On the other hand, after debt relief, there is a high possibility that a country accumulate a similar amount of debt as the relieved in order to restore the ratio of net worth to GDP from before the original loan. Despite the fact that high-debt countries might show symptoms of decreasing production, relief can encourage new debt acquisition that would be toxic in the future to a debtor that is reducing its assets and with them, the capacity to repay the new services (Easterly, 2002).

Another factor to take into account is the economic policies of the debtor country. Burnside and Dollar (2000) argue that aid only increases economic growth on countries with good policies, whether in those with bad ones, it creates little to no effect on growth. Debt relief are granted depending on the policies of a country that are considered to be improving to the best, but this favours the changes in policies and not quality of the policies. The criteria on the policies is measured by a contrast on their evolution. This provides a way to grant aid to countries with a bad set of policies that changed it for what is considered a good set, in order to get the aid. But without regarding the possibility that after granting it, the country will change back to increase their probabilities of future aid in the future by going back and forth on this motion (Burnside and Dollar, 2000).

Finally, we should consider that a vicious circle could be constructed from the debt relief of a country and the consequent possibility of a new loan. Even though it might be clear that lending is not stimulating or increasing in any way the country’s capacity to export and therefore to pay services, creditors are inclined to provide new loans on the risk that a default will be declared and all their services remain unpaid (Easterly, 2002).

The Argentinean case

History

The history of Argentinean debt dates back to the early XIX century, when the government of the city of Buenos Aires was granted a loan to finance the ongoing wars that would later determinate the political unity and territorial integrity of the country. After four years, the government declared a default that would last for another 29 years (Bruno, 2006).

Moving forward to more recent times, it is possible to separate the history of Argentinean debt into three parts (Damil, Frenkel and Rapetti, 2005). Between 1977 and 1983, during the coup governments, in which the amount of the total debt increased by three times and service went from representing a 40% of exports to a 90%. By the mid-1970s the total debt was not bigger than 8.000 millions of U.S. dollars and that quantity rose to 45.000 million in 1983 (Kulfas and Schorr, 2003). During this time, liquidity was prominent in the U.S. banks due to the increase on the price of oil from 3 to 12 dollars between 1972 and 1974. Recourses provided by the contraction of this debt where wasted on unproductive imports such as armament, instead of being used to finance production and increase the country’s capacity to export (Carro, 2006).

The second segment identified is from 1983 to 1990, characterised by the suspension of most public debt on the grounds of the illegality of those in power at the moment of receiving it. Democratic president Alfonsin, firmly stated that there was no reason to pay a debt from a de facto government that misused the financial resource in corrupt means. Alfonsin tried to renegotiate with de accreditors the debts and also tried to create an international union of Latin American Countries in debt to gain political power over the creditors. During this period, the amount owed rose a 44.8% (Carro, 2006).

The last part from the 1990 to the year 2001 again centred in financial aperture and accelerated indebtedness promoted by president Menem and his Chicago School thinking (Damil, Frenkel and Rapetti, 2005). The country underwent a series of structural changes. In 1993 the “Brady Plan” was implemented. It had two central ideas. First it was clear that the indebted economies would not be able to repay if certain degree of it was relieved. Second, it proposes the IMF and the World Bank grant new loans to this countries to increase their productive capacity and in this way, generate the income needed to pay the remaining debt (Godoy Ortiz, Aspiroz, Aulita, Mason, Semino, Fonrouge and Zille, 2004). This plan was supposed to be the definitive solution to the debt, but instead it created a window to increase it, and without the proper control mechanisms on the quality of the spending, it had the same result as the one contracted in the 70s. On 2001, Argentina defaulted again (Kulfas and Schorr, 2003).

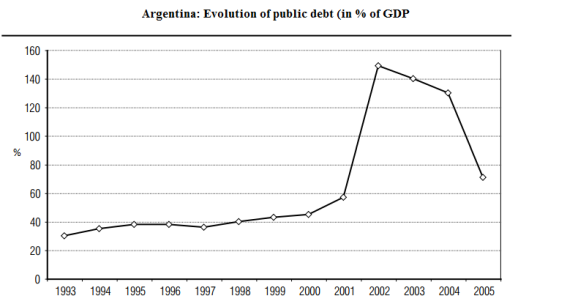

In the following graph we can see how the Argentinean public debt evolved from 1993 to 2004.

Source: Bleger. Del Sur hacia el Norte: Economía política del orden económico internacional. Emergente. In Deuda externa y soberanía: análisis y lecciones de la reciente reestructuración. 2007. CLACSO. Buenos Aires, Argentina.

Conditionality vs Debt Relief

Since 1990, the IMF scheduled more than 50 technical advisories missions. After the 2001 default, the organism started a study which concluded that the IMF had not had enough strength in the conditionality of previous agreements to enforce real change in the Argentinean economy and that led to such a disastrous conclusions (Bleger, 2007).

Argentina defaulted because it could not really afford the services that where expected from the different debts contracted. The country had entered the vicious circle of conditionality, living from the international loans and debts without fomenting the industry enough to produce the expected return that would provide means for service payment (Sachs, 1985). Living on the shadow of recent coups that acted mainly as solution to economic crises no government was ready to face the political cost of investing and shortening consumption with the consequence of facing a recession. There were few years in between the military coups of democratic governments that tried to impulse production, but came to a violent end due to the economic pressures and resulted again in a second series of coups. That context led to the incitation to consumption that would led Argentina towards a dead end path on debt.

At the start of his presidential term, Nestor Kirchner decided to seek a solution for the end the debt problem in Argentina. He divided the services into those who were to be payed fully, but negotiating a new schedule, and those to which a payment would be offered but with a considerable relieve. The first added up to a total of 62 billion U.S. dollars mainly composed by debts to international organizations and countries. The other part of the debt, was mainly to private investors and accumulated up to 82 billion plus interest from the default period (Carro, 2006). In 2003, an agreement was signed between Argentina and the IMF, under which for 3 years the services comprehended on such time would be subject to relief. After hard negotiations debt restructuration of the private sector was approved by a 76% of the total holders. In 2005 a new negotiation started with the IMF to try to set conditions for a new relief of future services on the remaining debt.

From this we can see how Argentina has undergone the processes of conditionality and debt relief, in a chronological order and we can sustain that conditionality has not been a solution to the Argentinean debt, but rather has made the problem worse and led to the biggest default in history from the Latin American Government. On the other hand, debt relief appears to help the country get rid of the international financial obligations and not promote further indebtedness. Nevertheless it is still important to point out that Argentina remained outside of the debt market until 2015 and therefore it was not possible to acquire further loans up until then

Conclusions

This essay has analysed the advantages and disadvantages of conditionality and debt relief in the particular case of Argentinean sovereign borrowing to find that the first option did not lead to an improvement of the situation of the South American countries’ debt situation. On the contrary, and following the research done on the matter, the impact of conditionality terms on the 90s increase the debt contracted by the government but did not reduce the ratio nor increased the capacity of the nation’s economy to produce the means to pay it.

A complete contrary result was obtained from the measures of relief granted to Argentina after the economic crash in the first years of this century. The management of debt during the Nestor Kirchner administration based on separation, restructuring, rescheduling and relief proved successful terminating on an acceptance of the 76% of the total debt under the new terms. Academics do warn about the possibility that debt relief measures may encourage to enter a vicious circle of acquiring more debt in hope of new reliefs. But as we can see, this was not the case for the South American country.

In conclusion, for the particular case of Argentina, the alternative of conditionality did not lead to success, but rather performed as a perfect example of the risks and disadvantages that may come from said measures. On the other hand, debt relief came as a solution for the historical problem of the country on the matter of debt allowing for a restructuring and a fruitful solution for all parts involved. Although the impossibility to take new loans until 2015 must be considered.

Bibliography

Barry, C. & Tomitova, L. (2006), “Fairness in Sovereign Debt”, Social Research, vol. 73, no. 2, pp. 649-694,736,0_3.

Bleger, L. (2007). “Del Sur hacia el Norte: Economía política del orden económico internacional”. In CLACSO Consejo Latinoamericano de Ciencias Sociales, Deuda externa y soberanía: análisis y lecciones de la reciente reestructuración. CLACSO. Buenos Aires, Argentina, pp. 171-182.

Boeri, C. (2003), “How to solve Argentina’s debt crisis: Will the IMF’s plan work?”, Chicago Journal of International Law, vol. 4, no. 1, pp. 245-255.

Bruno, E.A. (2006), “The Failure of Debt-Based Development: Lessons from Argentina”, CATO Journal, vol. 26, no. 2, pp. 357-365.

Burnside, C., & Dollar, D. (2000). “Aid, Policies, and Growth”. The American Economic Review, 90(4), 847-868.

Calomiris C. W., (2003), Lessons from Argentina and Brazil, Columbia University Academic Commons.

Carro, E. (2006). “Historia y evolución de la deuda argentina”. Estudios Carro. October. Córdoba, Argentina.

Cordella, T. & Dell’Ariccia, G. (2002), “Limits of conditionality in poverty reduction programs”, IMF Staff Papers, vol. 49, pp. 68-86.

Damill, M., Frenkel, R. & Rapetti, M. (2005), “Argentina’s debt: history, default and restructuring”, Desarrollo económico, vol. 45, no. 178, pp. 187-233.

Datz, G. (2012), “The Inextricable Link Between Sovereign Debt and Pensions in Argentina, 1993-2010”, Latin American Politics and Society, vol. 54, no. 1, pp. 101-126.

Easterly W. (2002), “How Did Heavily Indebted Poor Countries Become Heavily Indebted? Reviewing Two Decades of Debt Relief”, World Development, Volume 30, Issue 10, Pages 1677-1696.

Fafchamps, M. (1996), “Sovereign debt, structural adjustment, and conditionality”, Journal of Development Economics, vol. 50, no. 2, pp. 313-335.

Guitian, M. (1995), “Conditionality: Past, present, future”, International Monetary Fund.Staff Papers – International Monetary Fund, vol. 42, no. 4, pp. 792.

Godoy Ortiz, A., Aspiroz, V., Aulita, C., Mason, A., Semino, S., Fonrouge, M. and Zille, A. (2004). “Deuda Externa Argentina: Evolucion y Determinantes”, Investigaciones Rodolfo Walsh. October. Buenos Aires, Argentina.

Krugman, P.R. (1988), “Financing vs. Forgiving a Debt Overhang”, National Bureau of Economic Research, Inc, Cambridge.

Kulfas, M. y Schorr, M. (2003): “La deuda externa argentina. Diagnósticos y lineamientos propositivos para su reestructuración”, CIEPP/OSDE, 2003.

Sachs, J.D. (1985), “External debt and macroeconomic performance in Latin America and East Asia”, Brookings Papers on Economic Activity, , no. 2, pp. 523-573.

Sachs, J.D. (1988). “Conditionality, Debt relief and the Developing Country Debt Crisis”. National Bureau of Academic Research. July. no. 2644.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal