Investigation of Zircon’s Projects Using Hedging

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 2201 words | ✅ Published: 13 Sep 2017 |

Executive Summary:

Zircon is a multinational company working on Argentinian contracts through hedging, in order maximise cash flow and minimise risks. It considers the current and possible future economic markets, and any possible contracts that it may receive and create alternative strategies to ensure maximum profits can be achieved. It then analyses and evaluates the risks in order to minimise and manage it using various techniques.

Investigate the US Company Zircon’s Project using hedging, to establish whether the contracts will maximise cash flow, while considering the current and future economic impact.

To understand whether hedging will minimise financial and economic risks for Zircon and result in a profitable project.

Analyse and investigate the cash flow, currency conversions, uncertainties and risks using many methods, in order to make more informed financial decisions

Introduction

Zircon a Unites States (US) based multinational company, is considering a project that will sell the use of its technology for Argentinean firms.

Revenue of starting the project that is the Argentinean firm orders already received will generate within one year (that is end of year 1), it will make a total of $3,000,000 Argentinean pesos (ARS).

Zircon will also be providing the Argentinean government with technology, and within one year of starting the project (that is end of year 1) it will make a total of $5,000,000 Argentinean pesos (ARS)

Zircon will not know whether it will receive the government order until the end of the current year (that is end of year 1).

Zircon has the following information, which will help to decide whether the project is feasible:

- Today’s spot rate (that is time 0 or beginning of year 1) is US$0.14.

- One-year forward peso rate (that is the current forward price for exchange at the end of year 1) is US$0.12.

- One year from now Spot rate of the peso (that is end of year 1) will be US$0.13.

- Initial outlay (that is at time 0 or beginning of year 1) will be US$300,000. To cover development expenses, regardless of whether the Argentinean government purchases the technology or not.

Zircon will only pursue the project if it can satisfy its required rate of return of 18%.

It will be ignoring possible tax effects assuming cash inflows, if they materialise, within a year of occurring (that is end of year 1) from the initial investment in the project.

- Hedged Maximum expected revenue

5000,000ARG x 0.12 = $600,000

- The Net Present Value (NPV) if the government contract is awarded

NPV: $600,000/1.18 – $300,000= $208,475

- Hedged Maximum expected revenue

Revenue converted to $: 3000,000 ARG x 0.12= $360,000

The Net Present Value (NPV) if the Government contract is NOT Awarded

As such excess will be offset, and therefore it would be hedged more than required because of buying in the spot market in pesos at the time of the sale.

Amount paid to offset forward sales = 2,000,000ARG – $0.13 = $260,000

Proceeds from the excess forward sales = 2,000,000ARG – $0.12 = $240,000

Loss resulting from the excess forward sales = $240,000 – $260,000 = -$20,000

Dollar Cash flows = Dollar Revenue $360,000

– Loss resulting from

excess forward sales – $20,000

$340,000

NPV = $340,000/(1.18) – $300,000 = -$11,864

- Alternative Strategy – Minimum revenue is hedged. As such, any revenue due to the Government contract would not be hedged.

Revenue converted to $:

Hedged portion: 3,000,000ARG – $0.12 = $360,000

Unhedged portion: 2,000,000ARG – $0.13 = $260,000

Total $620,000

- Alternative Strategy – The Net Present Value (NPV) – Government contract is awarded.

NPV = $620,000/(1.18) – $300,000 = $225,423

- Alternative Strategy – Net Present Value (NPV) – Government contract is NOT awarded

Revenue converted to $:

3,000,000ARG – $0.12 = $360,000

NPV = $360,000/(1.18) – $300,000 = $5,085

- Uncertainty of the project’s future cash flow estimates from the perspective of the US parent, explained by the Financial Manager of Zircon

Zircon’s performance will be impacted due to its exposure to uncertain environmental and organizational risks. This is because of the project’s cash flow changes in a number of related variables

Uncertain changes in exchange rates and interest rates, as well as deviations from purchasing power parity exchange rates create input sourcing and product pricing arbitrage.

Zircon will be impacted by transaction exposure, which affects the exchange rate changes on transactions and projects that the company has already entered into. Exchange rate changes on expected future cash flows and discount rates will cause an operating exposure, and will ultimately impact on total value.

Hedging minimises the home currency outflows, while maximising the home currency inflows. Over-hedging Cash Flow and Exchange Rate Movement and Under-hedging Cash Flow and Exchange Rate Movement both generates profit, which means cash flow is achieved at maturity.

Funding liquidity risks can mean that liabilities cannot be met, when due, or can be met at an uneconomic price

Zircon may face complications causing political risks, whereby businesses and governments as a result alters the expected outcome and value by changing the probability of achieving the objectives of the business. It is therefore a strategic, financial, or personnel loss for the company because of macroeconomic and social policy (monetary, trade, investment, industrial, income, labour, and developmental) factors, or due to political unbalance (terrorism, riots etc.). This means, investors may face financial losses due to it, causing difficulties for the governments, as they are unable implement initiatives.

The ramification of such risks can be measured by analysing the likelihood of political events, which may complicate earning capacity through direct impacts or indirect impacts, resulting in reduced interest in the investment.

To ensure there is no uncertainty, capital budgeting for Zircon is necessary, which should take into account initial investments, price and consumer demands, costs, tax laws, remitted funds, exchange rates, and lastly required rate of returns. However, accurately forecasting the financial variables, used to estimate cash would be challenging.

- Risk evaluations of the proposal in deciding whether to proceed with this project explained by the Financial Manager of Zircon

Transaction exposures are manageable by hedging both downside and upside risk in order to eliminate the effects of exchange rate risk and reduce earnings variability, through the use of forward contracts.

Zircon will have economic exposure as the market value is influenced by unexpected exchange rate fluctuations. Such changes can severely affect the firm’s market share position with its competitors, future cash flows, and ultimately the firm’s value. It can also affect the present value of future cash flows. Economic Exposures cannot be hedged well due to limited data, and because it is costly and time consuming.

The risk is in changes in the expected value of a contract, between its signing and execution, as a result of unexpected changes in foreign exchange rates.

Transaction exposures can also be managed by adopting operational strategies, which help to offset existing foreign currency exposures.

The strategies include:

- Risk Shifting- By not having any exposure. As the company would invoice all transactions in the home currency, thus avoiding transaction exposure all together. However, this technique will mean someone must bear transaction exposure, and the bearer must do so at the lowest cost. Depending on whom bears the currency risk may also impact the final price set of the contract

- Currency risk sharing – Whereby two parties share the transaction risks. Thus, the agreed upon contract should be written in such a way that any change in the exchange rate date for the transaction will be split between them.

- Leading and Lagging – Helps reduce transaction gains and losses. When the foreign currency in an existing nominal contract is denominated and appreciates, it is likely to pay off the liabilities earlier while taking receivables later. On the other hand when a foreign currency in a nominal contract is denominated and depreciated, then receivables are taken earlier and liabilities are paid off later.

Pricing Policy should be used, as there will be periods in the future when the ARG may depreciate against the dollar or vice versa.

International Fisher Effect (IFE) Theory which recognizes the country’s nominal, that is quoted interest rate and inflation rate are related, can be used. This effect assumes that the nominal interest rate consists of two components, such as the expected inflation rate and real rate of interest. This is measured as the normal interest rate minus the expected inflation rate. If the real rate of interest in a country is constant over time, then the nominal rate of interest there must adjust to changes in the expected rate of inflation.

A two step process is required when using this theory. The first is by applying the fisher effect to estimate the expected inflation rate for each country. Second use the Purchasing Power Parity theory to estimate how the difference in expected inflation will affect the exchange rate.

There are limitations to the Fisher theory though can be subject to error. This is because the nominal interest and actual interest rate is not consistent.

Because the IFE relies on the PPP, it is subject to error, as it relies on inflation to forecast the future exchange rate.

Zircon must consider market share versus profit margin, with respect to the foreign currency price of foreign sales. This should be made by selecting the price that maximizes profits.

Diversifying operations helps to deal with the impact of exchange rate exposure on the cash flows, by getting the company to diversify activities, by offsetting exposures to the exchange rate, thus reducing exchange rate risk in a symmetric way. This creates a natural operating hedge that keeps the total dollar cash flows steady in the case of exchange rate movements.

Operational flexibility enables the firm to select favourable currency movements to maximise profit while minimising the impact of unfavourable currency movements. This in turn increases protection and adds an option value.

Use of regression analysis helps to assess the company’s economic exposure to currency movements, by analysing historical cash flows and exchange rate data’s.

Zircon faces contingent exposure when bidding or negotiating for foreign projects or contracts. This is due the company suddenly facing foreign transactional or economic exchange risk, while waiting on the outcome of the technology contract

Zircon may also face translation exposure whereby financial reporting is affected by exchange rate movements. As such the consolidated financial statements required for reporting purposes entails translating foreign assets and liabilities or the financial statements of foreign companies from foreign to domestic currency. While this may not affect cash flows, it could however impact on the reported earnings and as a result its stock price.

Zircon can manage such exposure by performing a balance sheet hedge. This is due to conflicting data on the balance sheet between net assets and net liabilities, mainly due to exchange rate differences. Therefore Zircon would need to obtain appropriate amounts of exposed assets or liabilities to balance it. Other derivatives such as foreign exchange may also be used to hedge against such exposure.

To predict future values, historical exchange rate data is used for technical forecasting. However the limitation with this is it is only good for short term periods.

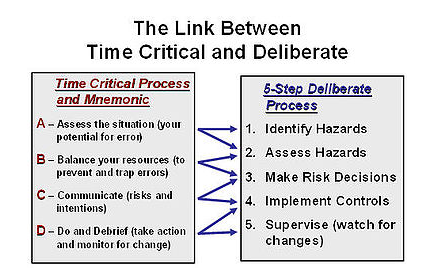

Operational Risk Management (ORM) is a process that moves in a continual cycle. It includes risk assessment, risk decision making, and implementation of risk controls, which results in acceptance, and mitigation. Whereby, failed internal processes and or systems from human factors or external events, resulting in risk are analysed.

Risks can be managed using the four step risk management process model:

- Establish context

- Assess Risks

- Risk identification

- Risk analysis

- Risk evaluation

- Treat Risks

- Monitor and review Risks

Fig 1: Risk Management Process Links (Wikipedia – Operational Risk Management Dec 2016)

The benefits of the ORM Model are that it reduces of operational loss, lowers compliance or auditing costs, it can detect unlawful activities early on, and lastly it can reduce exposure to future risks.

This project investment is financially justified as it has a positive net present value. However risks may arise if the Argentinian Government changes its laws, and regulations, as normal operations for the currency and investments are interfered with. Another risk issue is if the viewpoint or perspective of the parent changes over time.

Financial risk is measured in terms of the variance or standard deviation of a variable such as return percentages or change rates. In foreign exchange, the relevant factor would be the change rate of the spot exchange rate between currencies. A higher standard deviation means a greater currency risk.

Financial risk management techniques called value at risk (VaR) are generally used by Managers, as it examines the distribution of returns for changes in exchange rates to establish the outcomes with the worst returns

The amount that could be lost on an investment over time is therefore determined and given probabilities for when changes in exchange rates occur, which helps Managers.

The VaR method assumes that the distribution of exchange rate movement is normal. If the distribution of exchange rate movements is not normal, then estimating the maximum expected loss is subject to error.

Zircon can buy Insurance to protect itself against risks. Which means the insurer will be able to evaluate the risks efficiently due to repeated exposure to it. It may also provide inspection and safety measures, benefiting both the company and the Insurer. However this will become part of the operating expenses for Zircon, resulting in reduced earnings for the company.

Zircon’s Manage after analysing and evaluating all financial and operational exposures and using relevant methods, can then establish whether the project would be feasible. They can already gather from the cash flow that there is no loss, so the overall project earnings would be beneficial and have a positive outcome for the company.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal