SMEs Effects on Singapore’s Economy

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 1760 words | ✅ Published: 13 Oct 2017 |

- Daron Chua Kiat Yi

1. Introduction

In his reply to NMP Teo Siong Seng, Minister of State for Trade and Industry Teo Ser Luck said: “SMEs are an important part of Singapore’s economy as they make up 99 percent of our companies, employ 70 percent of our workforce and contribute 50 percent of our GDP.”

Small and Medium Enterprise known as SME is a commonly used term. As stated by Law, (2014, no pagination):

Although the term is widely used, there is no standard definition of an SME based on net worth, turnover, profits, or number of employees.

For Singapore, a change of definition to SMEs was done recently (W.E.F, 1 April 2011). New parameters for SMEs are not to have an annual sales exceeding S$100 million OR over 200 workers. This ensures SMEs will have a greater ease of accessibility to government incentives (Spring Singapore, 2011).

This paper aims to cover economic contributions, constraints faced by SMEs as well as steps taken to strengthen SMEs to ensure its sustainable contributions to Singapore economy.

2. Economical Contributions of SMEs

2.1 Employment

SMEs in Singapore contributes to 70% of our workforce, hiring 7 out of 10 Singaporeans (Teo, 2014). As astonishing as the number may seem, it is actually not surprising to see SMEs in the job creation process. Jobs tend to range from manufacturing to retail to even hotel lines. Evidence has also shown that young firms tend to generate more jobs than their share of employment (OECD, No date). The key mechanism in SMEs in developing countries is to generate “decent” jobs. SMEs will absorb people whom are unemployed or is currently working in low productivity sectors (Palma and Gabriel, 2005).

2.2 Growth

SMEs sector also plays an important part in generating growth within industries. Many of the SMEs are survivalist in nature while some have dynamic potential. Some companies began in the microenterprise scale and grew. In this case, it is where microenterprise wind up into SMEs as the survival of the fittest. However this process would be harder to come by if government policies do not support such activities. The health of SMEs will also determine the supply of large firms in the future. It is a growing process where SMEs may end up as large firms. Futhermore, large firms with a SME background would more likely collaborate with other SMEs contributing to additional benefit to the economic efficiency. (Palma and Gabriel, 2005).

2.3 Wealth

SMEs are innovators and contributors to a country’s economic growth (through higher total factor productivity – TFP).A economy with a higher proportion of SMEs is more likely to be able to adjust smoothly to shocks or business cycles (TechINASIA, 2007). Since up to 99% of Singapore companies are made up of SMEs, Singapore would be more likely to survive a financial crisis if one is to happen.

3. Economical Constrains of SMEs

SMEs regardless in any nation will face economical constrains. Constrains to be discussed are financial, labor, supply and policy.

3.1 Financial Constrains

SMEs are being restricted strongly in accessing finance. A study by Scott (2006, p.1), “…previous research indicates constraints in accessing finance for females, ethnic minorities and the less well educated.” This gives insight on how entrepreneurs are being denied because of their characteristics.

In a recent event of global financial crisis, there is a reduction in growth and demand. Falling in demand means declining profits or lower revenues which can lead to losses without reduction in expenses. With banks continuing with the deleveraging process, SMEs tend to be more vulnerable than larger companies as SMEs have high dependence on bank financing. Financial constrains of SMEs are worsen with the lack of internal funding (OECD,2014).

3.2 Labor Constrains

SMEs may face manpower issues. In Singapore, this is caused by population shortage. According to SMBWorld Asia Editors (2014), “Nearly half of the respondents cited difficulty in hiring staff (49 per cent)”. The limitation of importation of foreign workers causes SMEs to be unable to find skilled workers at affordable wages. The government also expects two out of three Singaporeans to hold PMET job by 2030. This further reduces the ability for businesses to find manpower for a low paying/skilled job. (Wong,2013).

3.3 Supply Constrains

Having a problem in the Supply chain is another constrain faced by SMEs. A supply chain is defined by fulfilling a customer’s request (direct or indirect). A supply chain consists of not only the manufacturers and suppliers, but also transporters, warehouse, retailers and customers (Chopra et al., 2004).

Knowing that failure to communicate with any of the chain will result in huge losses. One example would be the Japan disaster on March 2011. Many businesses had placed all their orders on a best supplier at the lowest price. The disaster had resulted in delays in production, shortages and caused a spike in product prices. (Fisher, 2011).

3.4 Policy Constrains

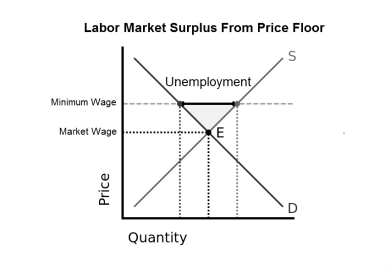

Changes in government policy may place additional burdens on SMEs. Such policies may be imposing tax or introducing a price floor. An example of a price floor given by Parkin (2014, p.131), “when a price floor is applied to a labor market, it is called a minimum wage.”

Fig 2.4.1 Illustration of problems imposed by minimal wage

Minimal wage creates inefficiency use of resources. It cause disturbance to the market system and a deadweight loss. The intervention by government forces SMEs to have a reduction in quantity of workers they wish to hire. SMEs would have to do a trade-off between profits and hiring more workers to get the job done.

This also applies to tax imposed by the government. Like minimal wage, tax creates deadweight loss. The shift in market equilibrium will result in lesser goods sold hence generating less profits. SMEs may also have to absorb some of the tax imposed, further reducing profit earnings (Parkin, 2014).

4. Steps taken to strengthen SMEs in Singapore

Singapore takes constant steps to strengthen SMEs. Factors are:

4.1 Manpower

To curb with shortage of manpower faced in Singapore, the government provides more support in capability upgrading and innovation. A new SME talent program has been adopted to attract young talents from ITE and polytechnics to work upon graduation (MTI, 2013). To better sustain SMEs, the government can provide better health benefits. Healthcare benefits not only maintain a healthy workforce but also to give a positive impact to attract and retain employees (Singapore Business Federation(SBF), 2013).

4.2 Productivity

To increase productivity, SMEs in Singapore are adopting productivity measures. First, companies can make use of technology (Internet, Social Media, etc) or send their workers for training. As stated by Chua, (2014):

Amongst this, 53% have enrolled their workers in skills training courses, whilst 42% have either acquired automation equipment or are utilising infocomm technology in their business.

Secondly, the Singapore government has provided SMEs with assistance schemes. Such schemes also help business to undergo improvements in productivity and innovation. An example of such scheme is the Productivity and Innovation Credit (PIC). PIC aims to help businesses defray rising operating cost with a 400% tax reduction (IRAS, 2014).

Thirdly, Singapore’s SMEs productivity can be improved by allowing SMEs to have better access to public research institutes. With an upgrade in technology, SMEs can look forward to other tangible benefits such as time and manpower when co-developing new ideas with the research institutes (SBF,2013)

Lastly, SMEs can seek collaboration with public-private partnerships for productivity improvements. The Singapore Government works with industries such as Trade Association and Chambers to identify sector wide issues as a whole. As such solution providers and users will be teamed up to come up with solutions to improve productivity, something that would be undoable previously due to lack of resources. (MTI,2013)

4.3 Financing

With more banks moving towards being Basel III compliant, higher risk SMEs are unable to get loans due to higher capital requirements. At times like this, SMEs can turn to other sources of finance, such as crowd funding and trade receivables exchange. Both alternate sources of finance are on an online platform(SBF,2013). Crowd funding is done by individuals pool in their money such as kickstarter.com to fund personal projects. In the case of Singapore, crowd funding is at its minimal level for SMEs as crowdfunding is a fairly new concept. (Koh, 2013)

The Government recognises that SMEs are an important part of the economy. To help such businesses grow, SMEs enjoy benefits such as a partial tax exemption scheme which lowers taxable profits of these companies. While the partial tax exemption scheme is available to all companies, the exemption thresholds are designed to target specifically at SMEs. (Ministry of Finance, 2014)

5. Conclusion

In conclusion, unlike huge companies like MNCs, SMEs face much difficulties despite receiving much government benefits. In order to survive, SMEs must engage in improvements with usage of technology and training. Most SMEs are reluctant to spend in other to save cost, however they must look at the bigger picture.

One future prospect is with the adaptation of internet technology. The use of technology in Singapore is still fairly new. With a new wave of savvy-tech young entrepreneurs, young entrepreneurs can make of social networking via facebook, etc to connect their businesses. Young entrepreneurs can also make use of kickstarter (crowdfunding) to finance their projects. In time to come, young entrepreneurs may be able to integrate internet technology into Singapore’s SMEs culture.

Other examples of future prospects include promoting woman-owned business and adopting globalization.

References

http://www.irwingrayson.com/dloads/isbe06financeBarriers.pdf

http://www.oecd.org/cfe/smes/financing-smes-scoreboard-2014.htm

http://www.asme.org.sg/index.php/news/new/smes-face-challenge-of-slower-growth-in-workforce

http://smallbusiness.chron.com/constraints-placed-business-economy-33982.html

http://www.sbaer.uca.edu/publications/supply_chain_management/pdf/01.pdf

http://hbswk.hbs.edu/item/6684.html

parkin text book

http://www.rocketbomber.com/images/483.png

http://english.sccci.org.sg/index.cfm?GPID=2262

http://www.iras.gov.sg/irasHome/PICbonus.aspx#about_pic_bonus

http://www.spring.gov.sg/AboutUs/AR/Documents/FV_AR12_13/web/flipviewerxpress.html

http://www.businesstimes.com.sg/top-stories/crowdfunding-in-spore-catching-on-fast

http://app.mof.gov.sg/corporate_income_tax.aspx

http://www.itdweb.org/smeconference/documents/plenary/PI Berry ENG.pdf

http://www.oecd.org/industry/smes/2090740.pdf

https://www.techinasia.com/significance-of-singapore-smes-to-the-economy/

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal