Macro-Economic Signs of a UK Recession

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 2418 words | ✅ Published: 19 Oct 2017 |

EXPLAIN THE MACRO-ECONOMIC SIGNS OF A RECESSION IN THE UK

Introduction

The UK has been through several recessions, the most recent was in the last two quarters of 2008 to the third quarter of 2009. (The Guardian, 2009) reported that the financial sectors were in tatters especially RBS who revealed that they made a loss of £28bn as a result the government was forced to step in with a bailout package. Interest rate was cut to 0.5%, unemployment spiralled to £2.2mil the highest since 1981. In 2009 GDP shrank by 1.9% during the quarter, the worst since 1979.

Without any doubts, unemployment and economic growth are the two most noteworthy macro economic indications of a recession in UK and elsewhere. For government to achieve full employment and sustainable growth there must be an effective economic policy which outlines clear objectives that would yield consistent results of success.

Having said that, some of the objectives set are potentially in conflict with each other, which means that, in attempting to achieve one objective, another one is ‘sacrificed’. For example, in attempting to accomplish full employment in theshort-term,price inflation may occur in the longer term.

What is macro economic?

(Anderton, 2008, p.147) refers to “macro economics is the study of the economy as a whole”. To elaborate on Anderton’s definition, it is a branch of economics which focus on the different aspects of the economy and how they are interrelated to each other for generation of wealth. The aspects include performance of the country, its behaviour and decision taken related to the economy of the country. The major indicators of macroeconomics are unemployment, inflation, economic growth, interest rate and balance of payment.

What is recession?

(BBC, 2013) refers to recession as thedecline of real national output over two consecutive quarters causing a contraction in the total volume of production in the economy.

Economic indications of a recession in the UK

To know how well an economy is performing against these objectives, economists employ a wide range of economicindicators. Economic indicators measure macro-economic variables that directly or indirectly enable economists to judge whether economic performance has improved or deteriorated. Tracking these indicators is especially valuable to policy makers, both in terms of assessing whether to intervene and whether the intervention has worked or not.

- Economic Growth

According to (Tutor2u.com, 2014), economic growth “is the long term expansion of a country’s productive potential”. This productive expansion is measured by Gross Domestic Product (GDP) which is the official calculation used to compute output in most economies including the UK. Why GDP is so important? It is an important indicator because it measures the success of an economy. The general concept of GDP is that, the higher the GDP the more successful a country will be in terms productivity. In the UK, the growth of GDP is carefully observed by institutions and companies. The Monetary Policy Committee (MPC) of the Bank of England (BOE) used GDP as a means to set and adjust interest rate accordingly.

In a bid to control rising price in a recession, MPC could increase interest rate however if the economy is experiencing sluggish growth, MPC would be expected to freeze, lower interest rate, or weakening the sterling pound by means of trading it on the stock exchange market in order stabilise the economy. The Treasury and the Chancellor use the GDP to set economic policy. In case of contraction, taxes would be lowered and government spending would increase as a result.

The Office of National Statistics (ONS) uses the GDP figure to identify and assess which part of the manufacturing and services industry grew or shrunk. The ONS gathers and compares trading data against historic trends in order to provide useful statistics. By identifying the sectors or industries that are lagging behind government can address the problems by introducing apprenticeship schemes.

If an economy is experiencing growth, it is an excellent opportunity for firms to take advantages by expanding and increase revenue. On the other, negative growth means firms will cut back on expenses resulting in loss of jobs. If growth rises significantly above or below the trend rate of 2.5%, the economy is experiencing excessive growth or low growth. If the rate becomes negative for at least 2 quarters in succession, the economy is in recession.

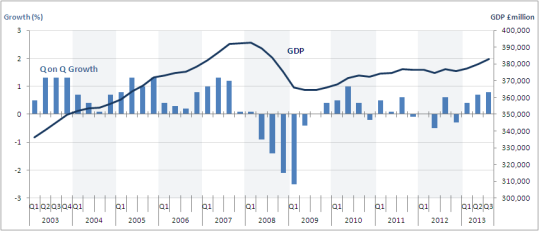

The graph below shows UK’s GDP trend from 2004-2013. The first quarter of 2008, GDP peaked at 2.8% which is just over £390mil and in the first and second quarter of 2009, GDP plummet to approximately 0.9% which is just under £370mil

Source: ONS

- Unemployment

Unemployment is viewed as loss of income for government and waste of resources. When people are unemployed it creates poverty which triggers additional problems example increase in thefts which government will have to deal with in the future. High employment is an economic indicator of good performance. Countries which are fast growing, example Japan, tends to have low level of unemployment. The logic behind this is that, because the economy is expanding more people are needed to produce goods and services.

Over the year, industries have moved from labour intensive to capital intensive. Technologies have replaced human workers. The ones that are made redundant are added to the list of growing unemployment which will possibly push the economy into recession. To avoid this government will have to create jobs to balance the impact. The rate of which jobs are created is linked to the level of employment therefore job creation is considered an economic performance.

The effect of unemployment on businesses is that if people are not earning an income they are unlikely to spend which means businesses would see a fall in demand of goods and services therefore loss of revenue and profits, reduction in wages, and not taking on new staff.

High level of employment means government will have to increase spending on social welfare example JSA and housing benefits. Firms may have to reduce output due to fall in demand which could lead high restructuring cost.

International Labour Organisation (ILO) definition defines unemployment as those without a job but who are seeking work at current wage rates (ILO, 2014). The UK however uses two methods to calculate the rate of unemployment. The Labour Force Survey (LFS) and Claimant Count. The LFS was designed by the ILO and the UK government uses it to generate unemployment statistics while the claimant count statistics is based on the numbers claiming benefits for being unemployed. It is generally recognised that the Claimant Count under-estimates actual unemployment levels.

The UK has not got a set figure as part of their employment objectives policy. The current objective is to achieve full employment as possible.

The chart below highlights the huge difference between the LBS and Claimant Count for period of 1970-2012.

Explain the ways in which the UK government could act to alleviate the worse effects of the recessions in the UK. Illustrate your answer using graphs and diagrams.

Fiscal policy is widely used for a variety of economic reasons. One of the reasons is to pull the economy out of recession by bringing about real change in level supply and demand. This is important because the main cause of a recession is unsustainable consumption. The usage of fiscal policy means the government would have to exceed their spending budget in attempt to stimulate the economy, reduce employment and eventually aggregate demand will increase. It is very important to highlight that fiscal and monetary policies are short term measures and will only solve the problem temporary. They are not immune from uncertainties.

Government spending on infrastructures can kick start the recovery process. The Construction of roads, hospitals, school, etc will provide employment which will increase government’s revenue. Direct and indirect taxation is another way the government can boost the economy. By reducing income tax on employees’ wages, consumers will have more disposable income consequently it encourages them to spend therefore consumption will increase. If corporation tax is slashed, firms can reinvest by means of expansion and recruitment.

Indirect tax which is VAT on goods on services, often times the government used this as means to encourage and discourage consumers from spending example, presently the VAT on tobacco products and alcohol is extremely high because those products have contributed to secondary problems which is very costly to the government. The NHS for example cannot cope with the amount of drink and drugs related problems.

The graph below shows the relationship between price level, aggregate supply (AS) and aggregate demand (AD). When government applies fiscal policy to resuscitate the economy from recession, movements along the AS curve occurs.

For example if government reduces income tax and corporation tax, employees would have real income therefore they will spend more and consumption would increase from AD1 to AD2. As for firms, they can reinvest by means of technology and expansion which would boost efficiency and create more employment which would increase the equilibrium real output from Q1 to Q2 whilst price level rose to P1 to P2.

Getting it right is essential. If government propped up the economy too fast by means of over spending, from AD2 to AD3, this will cause inflation and price would increase from P2 to P3

Monetary policy is used to control the flow of money supply in economy and it is responsibility of the Monetary Policy Committee (MPC) of Bank of England (BOE). Their main role of the committee is to maintain a relatively low interest rate. During a recession, the MPC is expected to take the following measures to jump the economy. Those measures would be to allow more money to circulate, restrict the flow of money to prevent price increase and control spending imports if there is a trade deficit.

An increase in interest rate would discourage investors and businesses from borrowing. In a recession, interest rate would be lowered to attract investors and businesses. When the BOE reduces interest rate, other banks will follow suit and also relax their lending conditions as a result, repayment on mortgages will be lowered therefore, it is most likely that the housing market will see a sharp increase in supply of houses due to the demand of lower mortgages. Investors and businesses will have easy access to affordable loan which can be used for expansion, retaining and hiring staff. However, consumers would save less because the interest earned will be unattractive

A fall in interest rate would reduce the price level of goods and services thus making them more affordable against competitors on the internal market thus causing a drop in trade deficit.

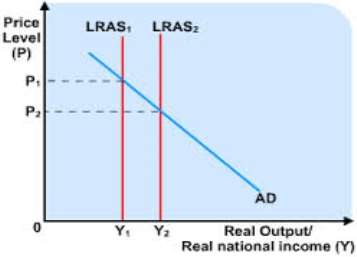

From the diagram below, if the MPC chooses to increase the interest rate, AD would reduce from Y1 to Y2. This would lead to a fall in the price level from P1 to P2. If it is lowered, the demand curve would shift to the right, resulting in RO and price level to rise. Over a period of time the market will go back to its original equilibrium point i.e. stabilise.

Supply side policy

(Hall et al., 2008. pp752-753) refers to supply side policy as long term macro economic plans which are aimed to deliver continuous growth. These policies would include legislation to remove any impediments that prevent the market from functioning. In a recession, an efficient supply slide policy would act as existing vehicle that would speedily assist in the recovery process.

In 1970s, (BBC, 2004), the Trade Unions were seen as a pillar of obstruction towards economic development. They organised and encourage endless industrial strikes that crippled the industry. To curb the power of the Union, Mrs Thatcher introduced new laws which limited the Union’s power. In the end it led to privatisation which allowed competition therefore, goods and services became cheaper.

Supply side policies focus on future economic gains by concentrating on improving the infrastructure to create a friendly business environment that would attract overseas investors and business to relocate to the UK. In the last few years, overseas manufactures such as Nissan, relocated to Sunderland, an investment worth millions of pound and created thousands of jobs (The Telegraph, 2012). The policy further aim to improve human capital development by means of continuous training in the education system, tax reforms to reduced income tax by replacing direct taxes with indirect taxes, financial measures that would increase competition amongst institutions in a bid to limit “red tape”, reforming of the welfare system by cutting benefits which would encourage people on benefits to seek employment.

Policing and transportation are another part of the supply slide policy. If all goes well with these future implementations, aggregate supply (AS) will increase continuously to form Long Run Aggregate Supply (LRAS) which will reduce the price level and increases real output.

The latest transportation infrastructure developments which relate to supply side policy are the High Speed Rail (HS2) and Heathrow Airport expansion. These developments are of vital importance. The expansion of both networks would see an increase in domestics and international investments, jobs creation, and balance of trade.

The most notable disadvantage of supply slide policy is that it is very costly to implement and it will take a long time to yield results.

The graph below illustrates the effects of applying an efficient supply slide policies. LRAS1 is shifted to the right which then becomes LRAS2. This movement along the AD curve increased real output from Y1 to Y2, resulted in lower price level from P1 to P2. This however may lead to a reduction in unemployment, higher imports, and lower exports.

Reference list

Anderton, A (2008).Economics, AQA. 5th. ed. Essex: Pearson Education.

Dave, Hall et al (2004).Business studies. 3rd. ed. Essex: Pearson education.

BBC (2014).UK unemployment falls to five-year low of 2.2m[online]. Available from: http://www.bbc.co.uk/news/business-27046681. [Accessed 30/04/2014].

Tutor2u (No date).What is recession?[online]. Available from: http://tutor2u.net/economics/content/topics/macroeconomy/recession.htm. [Accessed 30/04/2014].

BBC (08/07/2008).What is recession?[online]. Available from: http://news.bbc.co.uk/1/hi/business/

7495340.stm. [Accessed 01/04/2014]

BBC (15/04/2014).Economy tracker: Inflation[online]. Available from: http://www.bbc.co.uk/news/

10612209. [Accessed 15/04/2014].

BBC (2009).Enemies within: Thatcher and the unions[online]. Available from: http://news.bbc.co.uk/

-1/hi/3067563.stm. [Accessed 05/03/2004].

Office for National Statistics (2014).Consumer Price Inflation, March 2014[online]. Available from: http://www.ons.gov.uk/ons/rel/cpi/consumer-price-indices/march-2014/index.html. [Accessed 02/05/2014].

Tutor2u (No date).Economic Growth[online]. Available from: http://tutor2u.net/economics/revision-notes/as-macro-economic-growth.html>. [Accessed 02/05/2014].

The Guardian (2009).Timeline: UK recession[online]. Available from: <http://www.theguardian.com/

-business/2009/oct/23/uk-recession-timeline>. [Accessed 03/05/2014].

The Telegraph (2012).Nissan invests £250m and creates jobs at Sunderland plant[online]. Available from: <http://www.telegraph.co.uk/finance/newsbysector/transport/9754123/Nissan-invests-250m-and-creates-jobs-at-Sunderland-plant.html>. [Accessed 28/04/2004].

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal