Influences on Russian Stock Market

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 2079 words | ✅ Published: 19 Oct 2017 |

Contents (Jump to)

The aim of this study is to find out the economic factors, that have an impact on the growth of the stock market of the Russian Federation, and to determine quantitative figures of their impact. In order to reveal the correlation between the Russian stock market and economic factors, the method of regression analysis will be applied. On the ground of the examined literature I suppose, that internal factors will influence the growth of the Russian stock market in a greater way. The tasks of the study are the following. Firstly, I will make a literature review describing the factors which influence the growth of the stock market. Secondly, I will set quantitative figures of the impact of economic factors on the growth of the stock market. Finally, I will make a conclusion about supposed research results.

Introduction.

The modern world economy presents extremely difficult complex interrelations. In conditions when goods, capital and information easily exchange among countries, any disturbance in the economy of one country can easily spread over its boundaries. A high level of globalization of the world economy not only increases the effectiveness of the production and gives the potential for the development, but also increases system risks. The Russian stock market is rather developed and can be a successful ground for investment of money into valuable securities. For a long period of time, the concerned market has remained a permanent source of profits for the majority of the players from Russia and other countries. Most valuable securities of Russian enterprises undoubtedly give their owners great opportunities for carrying various transactions with the only goal to earn profit.

Thus, in view of the fact that the role of the stock market as an instrument of inviting additional revenue grows, it is interesting to find out what factors have a great impact on the development of the stock market. It is even more important because of the nowadays unstable economic situation. Besides, the stock market heavily impacts the financial system, and this fact confirms the importance of this study.

Topics, being studied in this research, are widely covered in the modern financial literature, but in a greater degree on stock market of the foreign countries. In the course of the works, the range of English publication of 2010-2014.

The object of this study is the Russian stock market.

The subject of this study is investigated factors that influence the growth of the Russian stock market.

The aim of this graduation thesis is to find economic factors that influence the growth of the stock market of the Russian Federation, and to determine quantitative figures of their impact.

To achieve our goal, this paper considers the following tasks:

- Analyze literature devoted to the studies of the factors that influence the development of the stock market.

- Determine quantitative figures of the impact of economic factors on the growth of the stock market.

- Make a conclusion about supposed research results.

Literature Review.

Research about the correlation between various factors and the growth of the stock market is one of the most examined topics for many economists.

14 macroeconomic variables were distinguished in the article by Srivastava (2010), including the wholesale price index, industrial production index, money supply, net export, exchange rate of the Indian rupee against the dollar, discount rate of the ten year government liabilities, and gold and oil prices. In the end of the analysis the authors come to a conclusion, that most impact on the Indian stock market is caused by the level of industrial production, wholesale price index and discount rate. In general, the conclusion was made that in the developing countries with an extensive wholesale market in the long-run, internal factors will have a greater impact, and their stock markets are less subjected to the influence of the global crisis tendencies.

The same results were made by Al-Jafari & Salameh (2011), who examined the influence of macroeconomic factors on the stock markets of the developed and developing countries. As the main factors, the authors separated the economic activity, inflation, discount rate, money supply and exchange rate. The impact of these parameters was rated in the interval from 2002 till 2008 in 16 developed and 16 developing countries. As a result, it was revealed that macroeconomic parameters have a greater impact on the markets of the developed countries, when its correlation with the markets of the developing countries is much less marked.

Hsing & Hsieh (2011) did research of the quarter by macroeconomic data in the period from 2000 to 2010. As a method of the analysis, GARCH and ARCH models were used. They included real output, government debt, money supply, real discount rate, nominal exchange rate, expected inflation, interest rate level and profitability of stock index abroad, who the factors of the analysis. As a result, the following correlations were discovered: the growth of the stock index in Poland is encouraged by the growth of industrial production, reduction of the state debt against the GDP, the reduction of the real discount rate, devaluation of the currency, and a low level of the expected inflation. In the light of these interrelations the authors present a range of recommendations to the country authorities for the maintenance of the stock market. In particular, they recommended to contribute into economic growth, pursue a soft tax policy and support a low level of the discount rate and inflation.

Suvanujasiri & Boriboon (2010) analyzed 372 variables in the context of their influence on SET50 – the stock index of Thailand. With the help of the factor analysis, the variables were sorted out and grouped. As a result, they chose 10 basic factors which determined the dynamics of SET50 in the crisis period between 2006 and 2008, including the DJIA index profitability, oil prices and exchange rates. The obtained model gives an explanation to more than 80% of index dispersion, i.e. selected factors influencing its dynamics in a broad way.

The literature review marks several key macroeconomic factors, which influence the stock market. Firstly, many researchers decline that the dynamics of the stock market depends on the real economic sector and on the level of economic activity. The GDP, index of industrial production and index of economic activity are often used as a quantitative measurement of this factor. Secondly, the discount rate has a sufficient impact on the stock value, which is reflected in the model of discounting cash flows. The change in the discount rate causes the change in the current value of future revenues of the stocks, which leads to the change of its market price. In various research they use either rates on gilts (10 years) or short-term rates (3 months), according to the study purpose. Thirdly, the level of inflation has great importance, as it influences, record risk-free rate and thus discounts cash flows. High and unstable inflation presents risk for investors and decreases stock price. The literature analysis either the real level of inflation or a modeled expected inflation, i.e. more often the average level for the last year. Also in many studies the correlation between, the dynamics of the stock market and money supply in the economy is stated. Money growth rate is one of the characteristics of any monetary policy and influences the investors’ expectations. In empirical studies various interpretations of money quantity are used, from a narrow definition (M1) to the wide one (M3). Finally, one most important factor, which figures in almost all research is the exchange rate. It influences the country’s economy, first of all, through trade, as it causes relative appreciation or falling costs of export and import. The analysis uses both the real and nominal exchange rates against the U.S. dollar.

As a result, I chose some factors, which influence the growth of the stock market in different countries.

Methods.

Further research reveals the economic factors, that influence the growth of the stock market of the Russian federation, and to make its quantitative evaluation. For this research I used the data of the Moscow Stock Exchange, the World Bank for the period of time from January 2010 till January 2015, i.e. over 5 years.

In order to find a correlation between the Russian stock market and the economic factors, it is useful to apply the method of regression analysis in the econometric program STATA. The RTS index is the dependent variable. The independent variables are micro- and macroeconomic factors. In particular, the GDP, discount rate, exchange rate are macroeconomics factor. For the quantitative evaluation, the Industrial Production Index (IP), Interest Rate (IR), RUR/USD and RUR/EUR Exchange Rate (ExR) are use.

The fundamental measure for the performance of the economy is the level of gross domestic product, or the GDP. The GDP measures the total income in an economy earned domestically, including the income earned by foreign-owned factors of production. The GDP is important to the stock market as it serves a measure of the health of the economy. As a rational stock market investor, a rise in the level of the GDP (a positive growth rate) from one period to the next, would suggest that firms on the whole are performing positively. This aggregate performance of firms allows for more reinvesting which should ultimately lead to higher future earnings and stock prices. An increase in the GDP from one period to the next should also increase the level of the stock market because consumers in general have more purchasing power and would likely devote more income toward stock market investing, ceteris paribus. In this regard, the GDP acts as a proxy for purchasing power ability of investors.

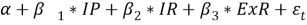

Thus, model RTS is of a form of multiple regression:

RTS =  (1)

(1)

where  ,

, ,

,  ,

, – regression coefficients.

– regression coefficients.

In order to define correlations between the variables, to decrease its number in the model and to make the model more compact, we used factor analysis to estimate data as a method of Principal Component Analysis. This method helps to unite related variables and to separate aggregative factors. Received factors will be orthogonal, i.e. independent on each other, which is very important in constructing regression models. With the help of Principal Component Analysis we singled out two aggregative factors: internal and external. Now we will analyze how each of the factors influences the dynamics of Russian share index.

Results Anticipated.

The goal of the research is to define economic factors, which influence the dynamic of the stock market, in particular the RTS index. The examined literature proves that internal factors will have great impact on Russian stock market. In that case the correlation of the Russian stock market, as a developing one, with the stock markets of the developed countries is less essential. It means that the influence of external factors will probably be insignificant.

In previous studies researchers had used some other variables in their study to define the relationship between economics factors and the dynamic of the stock market, but there is still a significant ground to work in this regard. Better results can be found which is a good ability for the future results, with the addition of some new variables.

Conclusion.

This paper investigates the effects of economic factors on the Russian stock market. The Russian stock market is cointergrated with micro- and macroeconomic variables. The Russian stock prices are positively related to industrial production, inflation and short-term interest rate, and negatively related to long-term interest rates and oil prices. The foreign exchange rate changes may affect stock prices in either direction. Devaluation of the Russian RUR against the US Dollar is positively (negatively) related to stock price changes.

The implication of the findings would be for both the government as well as for multinationals. It may affect decisions about monetary and fiscal policy.

Besides, not insignificant is the consideration of complex interrelation between stock markets of the different countries, in particular, how volatile economic situation in one country can influence the market or markets of the other country.

References.

Srivastava, A. (2010). Relevance of Macro Economic factors for the Indian Stock Market. Retrieved on, 8(1).

Al-Jafari, M. K., Salameh, R. M., & Habbash, M. R. (2011). Investigating the relationship between stock market returns and macroeconomic variables: evidence from developed and emerging markets. International research journal of finance and economics,79, pp. 6-30

Hsing, Y., & Hsieh, W. J. (2012). Impacts of macroeconomic variables on the stock market index in Poland: new evidence. Journal of Business Economics and Management, 13(2), 334-343.

Suvanujasiri, A., Boriboon, N., & Ahmadi, H. Z. (2010). The influence of economic factors on the performance of Thailand major stocks equity market by multi-factor model.Journal of International Finance & Economics,10(2).

1

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal