Benefits of Fair Tax Bill

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 2923 words | ✅ Published: 09 Oct 2017 |

Introduction

Fair Tax is a proposal to reform the federal tax code of the United States. It would replace all federal income tax (including the alternative minimum tax, corporate income tax and capital gain taxes), payroll taxes (including social security and Medicare taxes) with a single broad national consumption tax. It is not imposed on second hand goods and services.

Exports and intermediate business would not be taxed, nor would savings, investment and educational expenses, as they would be considered an investment rather than final consumption.

Personal services such as health care, legal services, financial services and auto repairs would be subject to the fair tax. In comparison to the current tax system, taxes income prior to purchasing such personal services. State sales tax generally exempts certain goods and services in an effort to reduce the tax burden on low-income families. The Fair Tax would use a monthly rebate system, instead of common state exclusion.

Fair Tax is progressive on consumption but would also be regressive on income at higher income levels (as consumption falls as a percentage of income).

It has positive effects on savings and investment and eases tax compliance that results in increased economic growth, it also provides incentives for international business to locate in the US by increasing US competitiveness in international trade.

The legislation would remove the Internal Revenue Service (IRS – 1913) after three years and establish an Excise Tax Bureau and a Sales Tax Bureau in the Department of Treasury.

There is a prebate is designed to ensure that no American pays federal tax on his spending up to poverty level. Prebate is based on the family size, regardless of their income. It is advance paid monthly with inflation adjusted to the household individuals.

At higher levels the prebate has less impact on households and a household’s effective tax rate approaches 23% of their total spending. A person spending at poverty level would have an effective tax rate of 0%, whereas someone spending at four times the poverty level would have an effective tax rate of 17.2%.

A critique, Beacon Hill Institute, estimated the overall prebate cost to be $489 billion (assuming 100% participation), but supporters say that an estimated amount of $945 billion dollars is deducted on income tax through different ways of tax evasions.

The fair tax rate is 23% for the first tear. The percentage is based on the total amount paid including tax ($23 out of every $100 spent in total). This would be equivalent to the 30% of $70 total spent. The rate would be automatically adjusted annually based on the federal receipts of the previous year with the prebate taken into consideration.

Supporters contend that the plan would effectively tax wealth, increase purchasing power, decrease tax burden by broadening the tax base.

They also expect to increase cost transparency for funding the federal government and it has positive effects on the civil liberties, environment and advantages with taxing illegal activities and illegal immigrants.

According to the opponents, Fair Tax is a burden on the middle class and fewer burdens compared to the high-income earners.

The current tax system is implicit but fair tax is explicit.

A poll in 2009 by Rasmussen reports found that 43% of Americans would support a national sales tax replacement and 38% opposed to this idea. The sales tax was viewed as fairer by 52% of Republicans, 44% of Democrats and 49% of the unaffiliated. President Obama does not support the Fair Tax Act arguing for more progressive changes to the income and payroll tax.

Differences between the federal income tax and the Fair Tax Act

The Fair Tax Act under the enactment 113th congress: H.R. 25 has 75 co-supports and the senate partner bill, S.122 has 8(as of 25/6/2014), which replaces the current Federal Income Tax and payroll taxes. It has been proposed to beat the issues that are constantly confronted by the administration and the populace of US by the current tax framework.

The Fair Tax Act arrangement is single rate national deals charge, which is required on the last retail utilization; where business inputs are not taxed and not the training educational cost is exhausted. While, there are individual taxes and corporate taxes, payroll tax, capital gains, estate gifts and Alternate Minimum Tax (AMT) under the current tax framework.

The option of tax replacement does not exist in the current framework yet under the Fair Tax Act, all salary and payroll taxes are supplanted alongside domain endowments, capital increases, independent work and AMT.

Fair Tax Act proposes to tax wage just once when it is used not at all like the current framework where salary is exhausted various times. Fair Tax has the broadest tax base and most minimal tax rate which does not impose poor at different levels or twofold taxes the wage. The revenue neutral rate is expected to be 23%, which is just about the same as the current tax framework, 24.7%. The evaluated net tax base of fair tax in 2010 was $9511t and $8000t of the current framework.

The sixteenth amendment is obliged to force the Income Tax while Fair Tax Act advances nullification of sixteenth amendment. The IRS has 10,000+ representatives and has the monetary allowance of $12.1b; however the Fair Tax act expects to annul it. The organization would be carried out by states and small tax bureau in treasury department.

The issue of wide tax gap is apparent in the current income tax framework through tax avoidance, as there is tax gap of $450b at present. The Fair Tax act dismisses tax avoidance through more noteworthy transparency. The tax rates are decreased and its effortlessness guarantees that Fair tax is enforced at lower cost.

The current framework’s aggregate yearly compliance cost surpasses $431b. The Fair Tax act predicts this compliance cost to fall by 90%. Presently, every individual documents his income tax form, which includes filling of different structures prompting wastage of time. Organizations making retail sales will record sales tax return for around 15-20m individuals.

Under the Fair Tax act, the legislature would be guaranteeing that the nation’s exports are not taxed as the exports are, no doubt devoured in an alternate nation. In the meantime, under the current framework, a good is taxed twice, once at the time of export and again by the importing locale. The domestic production is constantly hampered because of the slant of current tax framework towards favoring of imports.

As the current tax code obliges exposure of their private lives to the legislature with the end goal of recordkeeping, individual reviews, and so on. Some individuals of US feel presented to the hands of government. While some individuals help this thought, yet there are natives who restrict it and support the thought of Fair tax act which does not “straightforwardly” tax the people and their security is kept up.

The one real contrast the current framework has from the proposed Fair Tax act is the impact on non-filers of income tax and unlawful migrants. Because of tax avoidance as around 18% of the citizens have dodged tax and dropped out of the framework. The income tax framework is not ready to gather cash payments and other undocumented transactions from unlawful workers and have no method for catching the taxes on utilization of illegal products or stop the creation of black money. The Fair tax act recommends that taxes will be levied on retail utilization; consequently tax will be gathered from each person, who has a legitimate SSN staying in the nation and diminishing the incentives for the super rich to change over their money into black money. Unlawful migrants who don’t have a legitimate SSN won’t get any prebate, along these lines compounding their circumstance in the event that they don’t get enlisted themselves as resident of U.S.

The component of flexibility of payment of tax can be plainly seen in Fair tax act. The income and payroll taxes due on an individual are deducted at the time when individuals get their paychecks, yet people can decided to pay tax when they choose to expend merchandise past the poverty level.

The U.S economist, administrators and social activists accept that the current government tax is pulling down the economy by features of the framework, for example, supporting imports instead of supporting home grown items prompting unemployment in the economy. Additionally, the framework concentrates on specific interest groups and does not take entire economy in a strong and together way and must be replaced in spite of the fact that changes are done consistently. In the meantime, the same economist, officials, social activists, etc does accept that once the Fair tax act is ordered the tax base will be expanded. As indicated by them, 45 states have utilized sales tax for over 60 years. The tax can be gathered in conjunction with state sales tax.

Benefits of the Fair Tax Bill Proposed

Financial Effects

Taxation rate Visibility: Under the elected pay assess, the national government concentrates its incomes by forcing different duties on people and organizations. The current framework holds 73,954 pages of unpredictability making it hard to comprehend for the individuals. The expense is separated in diverse roads and not obvious to the individuals. Reasonable duty act serves to gauge the expense of agreeability by the administration.

Impact on Tax Compliance Costs: Every year give or take $500 to $600 billion is used in the consistence cost. The reasonable expense act will lessen these agreeability and expenses by 90% and contribute a bigger extent of that cash towards beneficial consumptions. The expense of agreeability would be incorporated with the duty by permitting the business and the State to keep 1/4 of 1% of expenses gathered.

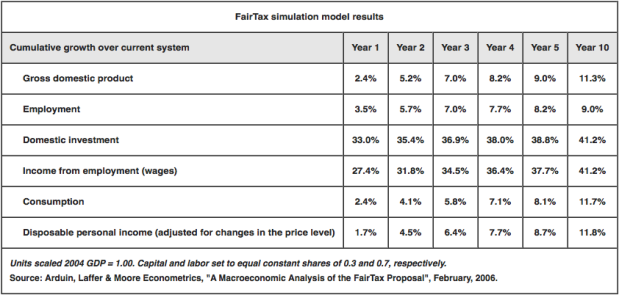

Spur economic growth: Through an exploration done by ‘National Bureau of Economic Research’ and ‘Americans for Fair Taxation’, it was observed that U.s.a’s GDP would develop by more or less 10.5% in the year after the execution of reasonable duty. Likewise, the true speculation could develop by 76% at starting levels and stay steady at 15% over the present level at last stages. Though, capital stock, work supply, yield and genuine compensation rate would increment by 42%, 4%, 12%, 8% individually.

Impact on International Business: the local duty structure is kept in attention by the MNCs before putting resources into that specific nation. A lower corporate expense and easier assessment structure alongside a decent exchange valuing strategy draws in higher corporate ventures to goad financial development. U.S.a’s corporate joined statutory pay charge, when contrasted and other OECD nations, is the most elevated and the reasonable assessment act would evacuate the corporate wage charge.

transition Effects

Pay Tax industry: As the reasonable duty act helps in lessening the consistence cost, it is assessed that amid the move period, national government would cut roughly $8 billion from IRS plan and lessen elected charge organization by 73%. The easier charge methodology would demonstrate its impact through ascent in unemployment in the salary charge office, charge attorneys, charge consistence staff in medium and expansive organizations furthermore in the product organizations which make charge arrangement programming. The 10.5% development anticipated by the reasonable duty analysts can help in exchange of the talented specialists of the IRS’s unemployed workers.

Time Arbitrage: In the period before the reasonable assessment is executed, there can be a solid motivator for the people to purchase merchandise without the deals expense, utilizing credits. At the point when the reasonable duty becomes effective, the credit can be paid off utilizing the untaxed payroll. Then again, the reasonable duty incorporates a 23% transitional stock assessment credit on the expense of the stock to be connected in the month that it is sold. The transitional stock assessment credit will altogether diminish the progressions to the net cost in the wake of exchanging to the reasonable duty. This impact will permit the single person to pay off their current obligation speedier.

Other Indirect Effects

Home Mortgage Interest Deduction: Up to the fundamental investment rate dictated by the Federal Reserve, reasonable duty won’t have any impact on the home loan premium. The moving from pay duty to reasonable assessment would assuredly prompt fall of around 25% in the investment rate.

State & Local Government Debt: The typical pay charge framework gives very much a couple of preferences to the state and the neighborhood metropolitan bonds. Particularly the investment paid on such securities is exempted from government assessment. This rebate permits the state and nearby governments to issue obligation at low yields, which will lessen their advantage costs. By supplanting the pay charge with reasonable expense, it will bring about the disposal of the government assessment points of interest of holding state and nearby bonds, as all the ventures would get to be free.

Dispersion of Tax Burden: The effect of reasonable duty follow up on taxation rate is a questionable point. According to the supporters, it would expand true salary, build duty base and decrease taxation rate and will be dynamic in nature. While, the restriction’s contention says that it is backward in nature and taxation rate on the high pay class would lessen. As indicated by the supporters, Fair Tax Act gives prebate that will make dynamic impact. A family may gain $25,000 and use 100% on utilization and an alternate family may win $100,000 and use 80% and spare the rest. Economist William G. Hurricane says that rate of pay exhausted is backward. In any case, when introduced with an expected viable assessment rate, the low-salary family above would pay a duty rate of 0% on the 100% of utilization and the higher wage family would pay an expense rate of 15% on the 80% of utilization. The compelling duty rate is dynamic on utilization. Utilizing a bigger time period, the other 20% would be expended and saddled eventually.

Loopholes of the Fair Tax Bill Proposed

Punishing the lower and working classes: The idea that people fitting in with the lower white collar class gathering will bear the load of expense for the nation is genuine. The Federal Income Tax is dynamic in nature. The individuals having a place with ‘just over the neediness level’ and center pay class will have less extension for reserve funds, though individuals having a place with higher wage gathering have more reserve funds in extent to the lower salary bunch. The reasonable expense appraisals or desires will just stand genuine if the people use 100% of their wage on assessable uses. Consequently specialists say that as indicated by this arrange the rich will be less influenced and those with less cash will wind up paying a higher rate of their wage as duty.

Expanding Potential for Tax Evasion: Such a high deals expense rate would without a doubt lead numerous to avoid the assessment, perhaps through exchange and buying products in different nations.

Diminishing Overall Spending: Under this proposal, the most ideal approach to bring down your taxation rate will be to use less. Excessively small using is bad for any entrepreneur economy. Truth be told, while numerous current assessment impetuses are particularly made to drive buyer using, the extensive deals expense could demoralize customers from using openly, in this way harming the economy.

Disposing of Tax Deductions and Credits: Numerous individuals get noteworthy profit from normal individual expense conclusions, for example, the home loan premium deduction, the tyke and ward forethought credit, training credits and reasonings, and the earned salary assessment credit – also the capacity to deduct hospital expenses and costs and understudy advance premium. The expense of home proprietorship, then, could fundamentally climb for mortgage holders who right now order and have huge investment installments. Leasing would get to be much additionally engaging, and an effectively weak land business sector could be crushed.

Making State Income a Bigger Burden. Though federal income tax would go away, state income tax would remain, and of course it would no longer be deductible against federal taxes. The effect would be a great burden on residents of high income tax states like California. Moreover, unless you live in a sales tax free state, like Oregon or New Hampshire, you could pay your state’s sales tax on top of the Fair Taxandon top of your state’s income tax. For a family living in Los Angeles making $100,000, this would be well over 40%.

Depending Too Much on Spending: Incomprehensibly, this assessment is subject to using, however in the meantime disheartens it. Additionally, since numerous well off people effectively put all alone and in different organizations, they may be further propelled to do so. Those moves could profit the economy general, yet since these exercises would be non-assessable, the national load movements to the lower financial classes.

Expanding Costs for Immigrants: The prebate check framework exclude non-subjects, essentially raising the average cost for basic items, particularly for lower-wage migrants, lasting living arrangement (“green”) cardholders, and visa holders. It could likewise prevent exceedingly instructed outside laborers with incredible vocations, for example, specialists, architects, and innovation area laborers.

Conclusion

All systems, for a matter of fact, have pros and cons. But after the research we observed that the following positive points came out which prove that the fair tax is actually a boon for the US economy and clearly stand above its cons.

- Positive impact on savings and investment (not taxed)

- Ease of tax compliance

- Increased economic growth

- Incentives for international business to locate in the US

- Increased US’s international competitiveness (border tax adjustment in global trade)

- Increased cost transparency for funding the federal government

- Positive effects on civil liberties and environment

- Advantages with taxing illegal activities and illegal immigrants

Hence if the fair tax system is implemented in the US economy, it will be a huge success and will result in the prosperity of the economy.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal