Applicability of Contemporary Microeconomics in Addressing Real Life Practical Issues

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 2937 words | ✅ Published: 08 Feb 2020 |

1.0 Introduction

Microeconomics is a social science that studies how individuals and firms “make themselves as well off as possible in a world of scarcity” (Perloff 2010, p. 25). As one of the main objectives of contemporary microeconomics is to explain real-life issues, contemporary microeconomic theories are often used by individuals, governments and firms to assist with important decisions. Consumers use microeconomics to help them make spending decisions which maximise their utility. Firms use microeconomics to make informative decisions with regards to consumer behaviours, productivity, supply and demand and costs and revenue. Microeconomics is also important for governments, who use microeconomic policies to improve the microeconomics of markets by determining taxes and wage levels. This essay is going to illustrate how contemporary microeconomics can be applied when addressing real-life practical issues, focusing on the content covered in previous lectures.

2.1 Prisoner’s Dilemma and Nash Equilibrium

Game theory is the study of “conflict and cooperation” (Turocy et al 2001) and involves studying how the decisions of players in a certain situation affect the decisions of the other players. The Prisoner’s dilemma is a situation in game theory that illustrates why two individuals may choose to act in their self-interest and not cooperate, even if it appears that it is in their best interests to cooperate. Nash equilibrium is a “stable state in which no player can gain advantage through a unilateral change of strategy” (Chang 2015). Prisoner’s dilemma and Nash equilibrium are concepts studied within game theory that, when applied to real-life issues, the applications are endless.

A topical example of the prisoner’s dilemma is Brexit – the two “prisoners” in this case being the UK and the EU. The UK’s decision to defect and leave the EU in an attempt to exploit its own self-interest and reap the advantages of the EU’s single market without the costs, leads to the EU also “defecting”. This could result in detrimental impacts for not only the EU but also the rest of the world, for example, it could instigate possible trade wars. Both “prisoners” act in their self-interests, disregarding the risk of impacting a much larger community. Murray (2016) suggests that both sides should remember the prisoner’s dilemma and the negative impacts that could be brought about, and therefore should “go for the optimal resolution by cooperating”. Murray (2016) states that to cooperate, the UK and the EU should be willing to negotiate a free trade deal. Another real-life application of the prisoner’s dilemma is the problem of greenhouse gas emissions and climate change. The best individual outcome for a country would be to defect (continue to pollute), while other countries cooperate and stop polluting. To break the prisoner’s dilemma, it is often necessary for authoritative bodies to step in, for example, in 2008 the UK government implemented the world’s first legally binding target – the 2008 Climate Change Act. The aim of this act is to reduce the UK’s CO2 emissions by 80% by the year 2050 (Gov.uk 2015).

In 2008, Satoshi Nakamoto invented blockchain to act as the transaction ledger of bitcoin. (Antonopoulos 2017) states that “bitcoin is a collection of concepts and technologies that form the basis of a digital money ecosystem”. Bitcoin blockchain was designed so that it is continuously in a state of self-reinforcing Nash equilibrium (Curran 2018). The concept of Nash equilibrium is crucial in Bitcoin, because it is important that the entire protocol is in a continued state of Nash equilibrium, so it discourages bitcoin miners from attempting to cheat the system, and in fact, is why blockchain is “cheat-free” (Blockgeeks 2017).

2.2 Blockchain

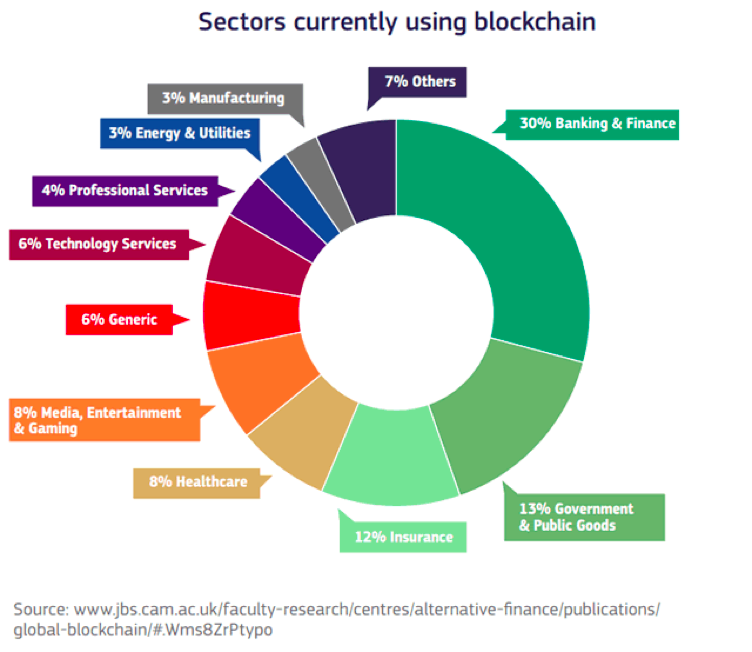

Blockchain is “an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value” (Tapscott 2016). In addition to being the technology behind the cryptocurrency Bitcoin, there are countless real-life applications of blockchain. According to Figure 1, the banking and finance sector are embracing blockchain technology the most out of all the sectors, with the insurance industry, government and public goods sector, healthcare and media all being sectors that are also using blockchain.

Blockchain technology has the potential to revolutionize the banking industry due to the many advantages that it offers – the main two being reducing costs and reducing the time it takes to make international transfers (Pratap 2018). Transferring money internationally can take a long time, as well as entail risks, however, using blockchain technology makes international transfers quick and eradicates risk. Another benefit of blockchain for the banking industry is in the creation of a client identification system. This is particularly important in banking because banks have to perform Know Your Customer, and therefore the transparency of blockchain means that financial institutions can gain “swift and secure access to up-to-date customer data”, allowing customers to be identified on a single occasion (Maguire 2018).

Blockchain technology has the potential to revolutionize the banking industry due to the many advantages that it offers – the main two being reducing costs and reducing the time it takes to make international transfers (Pratap 2018). Transferring money internationally can take a long time, as well as entail risks, however, using blockchain technology makes international transfers quick and eradicates risk. Another benefit of blockchain for the banking industry is in the creation of a client identification system. This is particularly important in banking because banks have to perform Know Your Customer, and therefore the transparency of blockchain means that financial institutions can gain “swift and secure access to up-to-date customer data”, allowing customers to be identified on a single occasion (Maguire 2018).

Figure 1

Another application of blockchain technology is smart contracts. Smart contracts are “self-executing agreements where the terms between buyers and sellers are directly written into the code itself” (Choros 2018). They are decentralised, unchangeable, very difficult to hack and guarantee that neither sides to an agreement are scammed, and therefore have opened up a world of new applications intended to solve many real-life practical issues. In real estate agreements, for example, using smart contracts eliminates the need for estate agents, lenders and inspectors as the contracts can be verified and enforced automatically, and therefore do not require human interaction (Barrington 2016). Smart contracts can also be useful for employment contracts. By entering into a smart contract, employees would be able to know exactly what their employer expects of them, which would help improve relationships between employers and employees (Cox 2018). Cox (2018) suggests that smart contracts could also be used to facilitate wage payments. Another example of how smart contracts are proving useful is for the insurance industry. A big challenge that the industry faces is fraud. Smart contracts can help insurance companies limit the impact of fraud because both the insurer and customer can lock into an agreement without the use of mediators (Choros 2018).

Another interesting real-life application of blockchain is in dermatology. Due to dermatology’s visual nature, digital imaging is now used by all dermatologists for “documenting diseases, following patient progression and assessing treatment efficacy” (Tung et all 2018). Therefore, the secure data storage and distribution of these digital medical images that blockchain offers is proving very useful for the industry. Tung et al (2018) suggest that blockchain could potentially lead to improved diagnosis of diseases because allowing “machine learning algorithms” access to medical images on a secure blockchain network optimises computer‐assisted analysis.

2.2 Bids/auctions

Auctions play an important role in microeconomics as they are one of the ways in which financial assets and commodities are allocated amongst individuals and firms. There are four primary types of auctions: English auctions, Dutch auctions, first-price auctions and second-price auctions. Since auctions are viewed as games, the use of game theory and the concept of Nash equilibrium can be used to determine prices in auctions, enabling firms and authoritative bodies to design auctions that get the most out of bidders. An example of where an authoritative body treated an auction as a game to get the most out of the auction was in 2000, when the British government designed an auction that sold off its next-generation mobile phone licences, leaving Gordon Brown with £22.47bn (The Economist 2000).

A real-life application of a generalised second-price auction is in search engine advertising such as Google, which is driven by an auction market. In such an auction, advertisers choose keywords that are related to their product, and then place a bid for their chosen words. The ads are then ranked by bids and the highest bidder wins the auction which means they gets their advertisement placed on a certain page of Google. The highest bidder pays the price of the second highest bidder (Cornell University 2012). Another real-life example of an auction system is Facebook. According to Lua (2017), advertising on Facebook is one of the “most powerful advertising systems available to digital marketers”. Facebook uses aVickrey-Clarke-Groves (VCG) auction system, which differs from most auctions because the winner is the ad that creates the most value, as opposed to the ad with the highest bid.

Another example of how auctions can be applicable to real-life situations is that firms use auctions for their initial public offerings (IPO). Dutch auctions can also be used in an IPO to determine the optimum price for stocks (Corporate Finance Institution c.a 2018). In a Dutch auction, a firm reveals the amount of shares it wishes to sell. Investors then reveal how many shares they wish to buy and state a price. Once a “minimum clearing price” is determined, investors who bid that minimum price are given shares (Weinberg 2004). In 2004, Google used Dutch auctioning for their IPO. According to Corporate Finance Institution, Google relied on this type of auction to “minimize under-pricing and to earn a fairer price on its IPO.” Whether Google’s IPO approach was successful or not is a controversial subject. Some argue that it was successful because Google went public at $85 a share, which then increased by 30% in just two days. However, many market analysts criticised the Dutch auction process, being afraid that investors would collectively submit a low bid and cause Google to open at an unfavourably low price. Another use of Dutch auctions is by government agencies for the public offering of treasury bills and bonds.

2.3 Risk and uncertainty

A large field of study within microeconomics is the concept of risk and uncertainty. Although risk and uncertainty are often used interchangeably, it’s important to distinguish between the two. American economist Frank Knight published his book Risk, Uncertainty and Profit (1921) to reinforce the important distinction between the two terms. According to Knight (1921), a known risk is “easily converted into an effective certainty,” while “true uncertainty is not susceptible to measurement”. Knight’s distinction between risk and uncertainty can be used to help analyse the behaviour of firms and investors. Expected utility theory is also a particularly useful microeconomic tool used for analysing real-life situations where individuals must make a decision under uncertainty, for example, in financial markets and in the insurance industry. While discussing expected utility theory, it’s important to consider the work of Kahneman and Tversky (1979), who developed an alternative critique to expected utility theory where, “unlike expected utility theory, where the carriers of utility are final levels of wealth, under prospect theory the carriers of utility are gains and losses relative to some reference point” (al-Nowaihi et al 2006, p.2).

Financial decision-making is not a straightforward process as it involves comparing assets against payoffs from which are subject to risk and uncertainty, and therefore whilst making decisions about financial investments, firms have to take into consideration all possible outcomes. American economist Harry Markowitz developed the theory of portfolio choice – a theory for households’ and firms’ allocation of financial assets under uncertainty. His theory analyses how risk can be reduced by examining how wealth can be optimally invested in assets which differ in regard to their expected risk and return. Markovitz’s theory is based on the idea that risk-averse investors can construct portfolios to optimise expected return based on a given level of market risk, emphasising that risk is an essential part of higher reward. Hedge funds.

Understanding risk is the foundation of the insurance industry. The idea of risk aversion and its implications for insurance demand is important as it tells us the terms under which people are willing to buy insurance. In order for an insurance market to exist, people need to be risk averse and willing to pay risk premiums. When an insurer’s expenses are relatively low in relation to the expected losses from covering a particular risk, people are more likely to buy insurance and the premium is more likely to be economically feasible. If someone is risk averse, they are willing to pay something for insurance to keep what they have rather than take the chance of having a loss.

2.4 Stable Marriage Problem

The stable marriage problem is another theory within contemporary microeconomics which is highly applicable to real-life practical issues. The stable marriage problem involves matching n women to n men, taking into account the personal preferences of everyone involved, so that all sets of marriages are “stable” (Kyle Luong, 2016). Gale and Shapley (1962) developed an algorithm that means that no matter people’s preferences, a stable allocation will always exist. This algorithm can now be applied to many different industries to solve real-world situations, the most common application being in assigning medical graduates to hospitals.

In the 1980’s, economist Alvin Roth became interested in using microeconomic theories to improve real-world systems, in particular matching algorithms (Medium 2016). Roth decided to work with the National Residency Match Program, a non-profit organisation which assigns medical students to hospitals because at the time, the program were struggling as doctors and hospitals were often unsatisfied with their assignments. Roth used Gale and Shapley’s work to reform the program, meaning that matches began to be a lot more stable. It was only in the early 2000s that people realised that the matching theory can be used to pair kidney transplantations (Kim de Bakker, 2016). Roth devised an exchange system to help mismatched donor-recipient pairs find others in the same situation, and eventually, through complex chains of exchange, all participants had the promise of finding a suitable match.

3.0 Conclusion

It is clear that contemporary microeconomic theories can be very applicable to everyday life. Individuals, firms and authoritative bodies all use microeconomic theories such as those spoken about in this essay in order

The overarching topic of this essay is game theory, which is a huge part of microeconomics and has great practical importance and relevance. It is important in analysing our everyday behaviour because all human interactions such as in economics, law and politics can all be modelled as a game and analysed through game theory.

When thinking about the importance of contemporary microeconomics and its applicability to real life practical issues, it’s important to remember that models, structures and theories used in economics are based on assumptions, and therefore we cannot rely on the theories alone. Critiques of models do exist e.g. the pitfalls of smart contracts so important to understand this before making decisions.

Create a basis of understanding problems (draw light on problems) – by understanding that people are risk averse, people will be willing to pay to avoid the risk

4.0 References

- al-Nowaihi, A. and Dhamiy, S., 2006. Why Do People Pay Taxes? Prospect Theory Versus Expected Utility Theory. August 2006 1-31. In Press. Available from: https://www2.le.ac.uk/departments/business/people/academic/sdhami/dr-sanjit-dhami-research-papers/why-do-people-pay-taxes-prospect-theory-versus-expected-utility-theory [Accessed 1 November 2018].

- Antonopoulos, A.M., 2017. Mastering Bitcoin. Second edition. USA: O’Reilly Media Inc.

- Barrington, T., 2016. Will Blockchain Smart Contracts Revolutionize Real Estate Transactions? [online]. CA: Propmodo Inc. Available from: https://propmodo.com/will-blockchain-smart-contracts-revolutionize-real-estate-transactions/ [Accessed 5 November 2018].

- Blockgeeks, 2017. What is Cryptocurrency Game Theory: A Basic introduction [online]. Available from: https://blockgeeks.com/guides/cryptocurrency-game-theory/ [Accessed 3 November 2018].

- Chang, K., 2015. Explaining a Cornerstone of Game Theory: John Nash’s Equilibrium. The New York Times [online], 24 May 2018. Available from: https://www.nytimes.com/2015/05/25/science/explaining-a-cornerstone-of-game-theory-john-nashs-equilibrium.html [Accessed 26 November 2018].

- Choros, J., 2018. 5 Real-Life Applications of Smart Contracts [online]. Available from: https://news.coinsquare.com/blockchain/5-real-life-applications-of-smart-contracts/ [Accessed 5 November 2018].

- Cornell University, 2012. Google AdWords Auction – A Second Price Sealed-Bid Auction [online]. New York. Available from: https://blogs.cornell.edu/info2040/2012/10/27/google-adwords-auction-a-second-price-sealed-bid-auction/ [Accessed 20 November].

- Corporate Finance Institution, c.a. 2018. Dutch Auction [online]. Available from: https://corporatefinanceinstitute.com/resources/knowledge/finance/dutch-auction/ [Accessed 1 November 2018].

- Cox, L., 2018. 5 Applications of Smart Contracts [online]. UK. Available from: https://disruptionhub.com/smart-contract-uses/ [Accessed 1 December 2018].

- Curran, B., 2018. What is Game Theory? And how does it relate to Cryptocurrency? [online]. UK. Available from: https://blockonomi.com/game-theory/ [Accessed 20 November 2018].

- De Bakker, K., 2016. Matching theory and the allocation of kidney transplants. 14 June 2016. In Press. Available from:

- Gov.uk, c.a. 2010. 2010 to 2015 Government Policy: Greenhouse Gas Emissions [online]. UK. Available from: https://www.gov.uk/government/publications/2010-to-2015-government-policy-greenhouse-gas-emissions/2010-to-2015-government-policy-greenhouse-gas-emissions [Accessed 20 November 2018].

- https://dspace.library.uu.nl/bitstream/handle/1874/335883/Matching%20Theory.pdf?sequence=1&isAllowed=y [Accessed 10 December 2018]

- Knight, F.,1921. Risk, Uncertainty and Profit. Boston and New York: Houghton Mifflin Company.

- Lua, A., 2017. How Does Facebook Ads Bidding Work (and How Much Do Ads Cost) [online]. Available from: https://medium.com/social-media-tips/how-does-facebook-ads-bidding-work-and-how-much-do-ads-cost-e8dab524d7b0 [Accessed 16 November 2018]

- Luong, K., 2016. Matching theory: kidney allocation. [online]. Canada: University of Western Ontario.

- Maguire, E., 2018. Blockchain KYC Utility [online]. US: KPMG. Available from: https://home.kpmg.com/xx/en/home/insights/2018/02/blockchain-kyc-utility-fs.html [Accessed 5 November 2018].

- Medium, 2016. How a matchmaking algorithm saved lives [online]. Available from: https://medium.com/@UofCalifornia/how-a-matchmaking-algorithm-saved-lives-2a65ac448698 [Accessed 1 November 2018].

- Murray, I., 2016. Brexit – The Prisoners’ Dilemma Of Britain And The EU. Value Walk [online], 30 June 2016. Available from: https://www.valuewalk.com/2016/06/brexit-prisoners-dilemma/ [Accessed 6 December 2018].

- Perloff, J.M., 2010. Microeconomics. Sixth edition. Boston: Pearson.

- Pratap, M., 2018. How is Blockchain Revolutionizing Banking and Financial Markets [online]. Available from: https://hackernoon.com/how-is-blockchain-revolutionizing-banking-and-financial-markets-9241df07c18b [Accessed 13 December 2018].

- Tapscott, D. and Tapscott, A., 2016. Blockchain Revolution: How the Technology Behind Bitcoin and Other Cryptocurrencies is Changing the World. New York: PenguinRandomHouse.

- The Economist, 2000. Brown’s Bonanza [online]. 4 May 2000. Available from: https://www.economist.com/britain/2000/05/04/browns-bonanza [Accessed 10 December 2018].

- Tung, J. K. and Nambudiri, V. E., 2018. Beyond Bitcoin: potential applications of blockchain technology in dermatology. The British Journal Of Dermatology,179 (4), 1013-1014.

- Turocy, T.L. and von Stengel, B., 2001. Game Theory [online]. London: CDAM Research Report Series.

- Weinberg, A., 2004. IPO Dutch Auctions Vs. Traditional Allocation. Forbes [online], 10 May 2004. Available from: https://www.forbes.com/2004/05/10/cx_aw_0510mondaymatchup.html#5e7de7342361 [Accessed 13 December].

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal