Accounting Chapter on Corporate Structure and Shareholder Rights

| ✓ Paper Type: Free Coursework | ✓ Study Level: University / Undergraduate |

| ✓ Wordcount: 7350 words | ✓ Published: 20 Apr 2021 |

Overview

Chapter Description

This is the first chapter on corporations in this course. Upon completion of this chapter students will be able to discuss the corporate structure and summarise the rights of shareholders in the corporation. The application of the tax laws and required tax forms will then be explained. Selection of an accounting period and use of various accounting methods will be discussed and summarised. Finally, the tax treatment of capital contributions to the corporation by shareholders and non-shareholders will be explained.

Learning Objectives

- Discuss the corporate structure.

- Summarise the rights and liabilities of shareholders.

- Explain the tax laws as they apply to corporations.

- Discuss selection of an accounting period.

- Summarise various accounting methods which may be used and their applicability to various situations.

- Explain the tax treatment of capital contributions from shareholders and non-shareholders.

Key Terms

- Accounting Period

- Articles of Incorporation

- Basis

- Board of Directors

- Capital stock

- Dividends

- Fiduciary

- Shareholder

Objective #1: Corporate Structure

This chapter will cover the general tax laws for domestic corporations. The legal issues involved in forming a corporation, such as the duties and rights of directors and stockholders, are explained. Issues specific to the Form 1120, U.S. Corporation Income Tax Return or the Form 1120S, U.S. Income Tax Return for an S Corporation will be discussed in subsequent chapters.

A corporation is an entity that is separate and distinct from its owners. Legally, a corporation is considered to be a person formed for the purpose of carrying on a business. As a separate entity, the corporation can sue or be sued. Unlike a partnership the corporation retains liability for damages or debts. This liability is normally limited to the assets of the corporation and does not pass down to the owners as in a partnership. As a result, the owners (stockholders) are protected from personal claims. The rules used to determine whether an entity should be taxed as a corporation changed in 1996. A business formed before 1997 and taxed as a corporation continued to be taxed as a corporation after the new rules took effect.

Corporate Operations

The purpose and authority of a corporation are derived from state corporate statutes, and bylaws. Most state corporate statutes require a set of corporate bylaws for each corporation. This document is prepared during the formation of the corporation and are occasionally modified as the corporation develops to maturity. This document is the blueprint for internal operations of the corporation. Modifications may be proposed by the Board of Directors but must be approved by the stockholders.

Each set of corporate bylaws will be customized to the particular corporation for which it was prepared in order to reflect that corporation’s situation. The bylaws will be a blueprint for operation of a corporation. Powers and rights of various parties (stockholders, officers, and directors) will be included along with the process of nominating and electing those who will be in charge. Dispute resolution and place and time of meetings of officers and the board of directors will also be included, as well as any provisions which are considered necessary. The bylaws work together with the Articles of Incorporation (see next paragraph) to constitute the legal framework of the company.

Articles of Incorporation

State corporate statutes usually state that the corporation may engage in all legitimate business activities. The Corporate Charter or Articles of Incorporation will normally be filed with the applicable state or regulatory agency for the state in which the corporation chooses to incorporate. This document will usually be drafted broadly and grants the corporation express powers such as the ability to borrow money, buy real estate, and conduct a specific business. If a corporation acts outside of the boundaries of its stated purpose it is said to be acting “ultra vires” (beyond its powers).

It also has the implied powers necessary to carry out the things it is expressly authorised to perform. The corporation has the implied authority to make bylaws to implement its Articles and conduct the affairs of the corporation. The express authority to make bylaws resides with the stockholders unless the corporate statute or charter delegates this authority to the board of directors. Bylaws cannot conflict with the Articles or corporate statute.

The initial board of directors is elected by the incorporators. The bylaws of the corporation contain the authority for setting up the board and will detail the size of the board. In addition, the responsibilities, powers, and duties of the board will be detailed in the bylaws. Successor directors are elected by the shareholders at the expiration of the terms of the initial board members. Directors are elected to a specified term of service specified in the bylaws. It is common practice for the terms of board members to be staggered in order to maintain the stability of the board. For example, Director A’s term ends in year 2, B’s term ends in year 3, and C’s term ends in year 4. Each board will normally have “inside” directors and “outside” directors.”

Inside Directors

Inside directors are also officers or managers of the corporation. As a result, they will have a certain special knowledge of the inner workings of the company, its financial position, and its competitive position. Outside directors are not otherwise employed by the corporation. These directors will often be president of some company in another industry. Outside directors are often thought to be more objective and are often thought of as a check on potential excesses of inside directors.

Although outside directors may not be as knowledgeable of specific issues relating to the company, they bring an outside perspective and may be more objective than the inside directors. Such independence may allow an outside director to be useful in resolving disputes between shareholders and the board or between inside directors.

The board of directors is the ultimate authority in the management of the corporation and is responsible for the management functions of the corporation. The directors establish company policies and elect and supervise the corporate officers. The officers are authorised by the board to act as agents for the corporation. The board defines the duties and responsibilities of each officer.

Single Director

A single director does not have the authority to act for the board. Board actions must be collectively authorised at a meeting at which a quorum (majority) of the board members is present. A required quorum is defined in the corporate documents and will constitute the minimum number of members that may be present in order to conduct any business.

The document may establish the same quorum for all board actions or require a simple majority for some actions and possibly a 2/3 majority for others. The board may decide to delegate some of its management functions to an executive committee. Executive committees often include the president, vice president and treasurer of the corporation.

Dividends

Dividends must be declared by the board of directors. This is a distribution to a class of shareholders from the company, usually from earnings, and is normally in cash. The board’s decision to declare a dividend cannot be questioned unless the stockholders can establish an abuse of discretion by the board. Board members are not compensated unless authorised in the corporate articles, bylaws or by a vote of the stockholders. The board is not authorised to make fundamental changes to the corporation.

Changes to the purpose of the corporation or creating new classes of stock must not be made by the board of directors. The authority to make such changes is vested in the shareholders.

Liability of Directors

The board of directors is responsible to the shareholders of the corporation. A board of directors has certain responsibilities and, if a breach of any duty to the corporation could result in personal liability.

Board members are required to exercise:

Duty of care

Directors must act as a reasonably prudent man would act when managing his own affairs. Directors are not responsible for mere judgment errors or failure to act prudently unless there is clear evidence of negligence.

Duty of loyalty

Directors owe a fiduciary duty to the corporation. This means that a director should always be acting in the best interests of the corporation. Directors may be held liable to the corporation in some situations such as:

Corporate opportunity

A director may not take advantage of an opportunity that is discovered in his capacity as a director. Such an opportunity rightfully belongs to the corporation.

Dealings with the corporation

Directors must conduct any dealings with the corporation in the open and in good faith. A transaction that required the vote of a board member who could personally benefit from the action may be voided by the corporation. Example: John is one of five directors. The board signed a rental contract with John. The contract may be voided by the corporation. Failure to disclose all material facts in such a transaction would be cause for nullification of the contract as well.

Statutory liability

Directors may be personally liable for authorizing the following acts:

Loans to stockholders

In short, loans to stockholders are generally prohibited by corporate statute.

Unlawful dividends

Payment of dividends when the corporation does not have a profit or surplus.

Acquisition of treasury stock

This occurs if you’re in violation of the corporate statute. Acquiring treasury stock can’t impair capital of corporation. Must be acquired with surplus funds.

Corporate waste

This generally involves preferential transfers of assets.

Duties of Officers

Officers may bind the corporation by individual acts within the scope of his/her authority. For example, the treasurer would have the apparent authority to borrow funds for the corporation. The express authority of each officer should be stated in the corporate bylaws.

Officers are entitled to compensation. If the salary is not stated in corporate documents the law implies that an officer may receive reasonable compensation for his services. Each officer has a fiduciary duty to the corporation. The corporate actions of each officer are covered under the laws of agency which gives them the authority to act in place of the corporation.

Capital Stock

Capital stock in a corporation represents an ownership stake in the business. It can consist of common shares and/or preferred shares (see below). If the corporation is publicly-held, then it has a large number of shares held by the general public which are freely traded on a stock exchange or a somewhat less supervised over-the-counter market. A privately held company is one which does not offer or trade its stock to the general public. An ownership stake in a privately held company can only be obtained through a private trade or exchange with an existing shareholder since the company’s stock is not publicly traded.

Capital is the total amount of the par value of stock with a stated par value and the cash received or to be received for no par shares outstanding. Any amounts received over the par value are recorded as capital surplus or additional paid-in capital.

Authorised stock is the maximum amount of stock the corporation is authorised to issue by the corporate charter. The amount of authorised shares may be increased later if authorised by the shareholders. This is often done if a company has additional capital needs at some point after its formation. Issued stock is the portion of authorised shares of stock for which certificates have been issued by the corporation.

Outstanding stock is issued stock being held by shareholders. Treasury stock is authorised, issued but not outstanding stock. This stock was reacquired by the corporation. Treasury stock is not entitled to dividends and may not be voted by the corporation. The corporation can resell Treasury stock.

Classes of Stock

- Common Stock—common stockholders are entitled to one vote per share of stock owned (unless the stock is designated as nonvoting stock). Common stockholders are entitled to dividends when they have been declared by the board.

- Preferred Stock—preferred stockholders generally have the same voting rights as common stockholders (unless the charter provides otherwise). Preferred stock is always granted some advantage over other classes of stock.

Further Stock Breakdown

- Cumulative preferred stock means that if the corporation has not paid a fixed dividend to these stockholders it will accumulate until it is paid. Common stockholders are not entitled to a dividend payment until all the accumulated dividends have been paid to preferred shareholders.

- Non-cumulative preferred—dividend obligations do not accrue if not paid.

- Participating preferred—preferred stockholders receive a fixed dividend and participate with common shareholders in dividends in excess of the fixed amount.

- Convertible—convertible preferred shares may be exchanged for shares of common stock.

- Redeemable—these shares may be called by the corporation for a fixed price.

Stock subscriptions are contracts to purchase a certain number of shares of capital stock. They are considered an offer to purchase and may be withdrawn at any time prior to acceptance by the corporation. The acceptance officially occurs when the corporation comes into existence and approves subscriptions.

Review Question 1:John, Jill, and several others are considering forming a business entity. They have been considering forming a corporation. They have been doing considerable research on the characteristics of corporate entities. Which of the following statements is correct?

ANSWER

|

Review Question 2:Jim knows that every corporation has a legal framework. Which of the following constitutes the legal framework of a corporation?

ANSWER |

Review Question 3The board of directors of a corporation is set up initially by the incorporators under the authority in the corporate bylaws. Which of the following statements is correct concerning the board of directors?ANSWERS |

Review Question 4A corporate board of directors has certain responsibilities, powers, and duties. Which of the following is not a function of a board of directors?ANSWERS |

Review Question 5:Corporate officers have certain duties and responsibilities. Which of the following is not a required function of corporate officers? |

Review Question 6Sam wishes to obtain an ownership stake in FUZZ corporation. FUZZ is a publicly-held corporation. What must Sam do to obtain his desired ownership stake? |

Objective #2: Rights and Liabilities of Shareholders

Ownership of the Corporation

As indicated previously, the corporation’s capital stock represents an ownership stake in the business. The determination of ownership and the shareholder’s basis in the shares of stock owned will be covered later in this section. The individual, group, or entity that owns at least one share of company stock is called a shareholder (synonymous with stockholder).

The shares of stock that the shareholders own are evidence of ownership of the corporation. As owners of the corporation, the shareholders will share in profits or losses of the company. In addition, as owners, shareholders generally have certain rights and possibly certain potential liabilities.

Stockholder Rights

- Stockholders have the right to receive stock certificates. This will be the stockholder’s evidence of ownership in the corporation. This evidence of ownership will entitle the shareholder to rights which are related to the ownership of stock.

- Stockholders have a reasonable right to transfer their stock. Corporations may impose reasonable restrictions on the stock transfer as listed in the articles, charter or contract. The Uniform Commercial Code states that an innocent purchaser cannot be bound by restrictions unless they are conspicuously stated on the certificates. A restriction that prohibits the transfer of stock without giving the Corporation the opportunity to buy the stock at book value would be considered a reasonable restriction. Certain Federal and state securities laws will apply to the transfer of stock in a corporation.

- Stockholders have the right to vote. Shareholders have the right to have and participate in shareholder meetings (these are held in accordance with the by-laws of the corporation). A quorum is the number of votes which must be present in order to validate the meeting and make decisions binding. The number of votes present at a shareholder meeting will include proxies which have been appointed by shareholders to vote their shares.

Some notes about voting rights

- Shareholders are bound by the votes of the majority of shareholders. Some corporate acts require a simple majority of shareholders however; fundamental changes such as mergers, changes in corporate purpose, or sale of the company often require a ⅔ or ¾ majority vote of shareholders.

- In situations which involve fundamental changes, dissenting stockholders often have the right to force the corporation to acquire their stock at its fair market value. This is possible because the fundamental change puts the stockholder in a different position than when they purchased their stock.

- Some US states allow cumulative voting which gives the minority shareholders a larger voice in management. Each shareholder is allowed to multiply their number of shares by the number of directors to be elected. For instance, a shareholder holding 10 shares in a company electing 5 directors would be entitled to 50 votes. He may choose to cast all of the votes for one director or divide his votes as he pleases.

Other Stockholders Rights

- Stockholders have the right to dividends if the board of directors declares a dividend. There is no inherent right to dividends until the dividends are declared by the board of directors. Upon declaration by the board of directors, the dividend becomes a legal obligation to shareholders. In some cases, a stockholder may force a corporation to pay a dividend by obtaining a court order. The stockholder must be able to establish that the corporation has enough cash, sufficient surplus for corporate needs and that the failure to declare a dividend is a “clear abuse of discretion” by the directors.

- Stockholders have pre-emptive rights. Unless the articles or charter states otherwise shareholders have the right to subscribe to all newly authorised shares of stock in order to maintain their proportionate equity interest in the corporation. This gives the stockholder the right of first refusal for shares of newly authorised stock. If the shareholder does not purchase enough shares to maintain their proportionate interest in the company, then they will have their ownership diluted.

Inspecting the Books, Lawsuits and Dissolution

- Stockholders have the right to inspect the books, records and stock lists of the corporation. However, they are not generally entitled to financial statements. Most corporations issue annual reports to stockholders.

- A stockholder has the right to sue in his own right to prevent corporate actions which are “ultra vires” (done without obtaining the necessary legal authority as required by the articles of incorporation or corporate by-laws), fraudulent or detrimental to the corporation. If successful, the stockholder would obtain a court injunction or order to stop the unwanted action. A stockholder also has a derivative right to sue in the name of and in behalf of the corporation for damages caused to the corporation by the officers, directors, or others. Before exercising his derivative right to sue, the stockholder must make a demand for the directors or officers to sue unless he can show that the demand would be useless.

- Stockholders have rights on dissolution—they are entitled to a pro-rata share of assets after payment of creditors and payment to owners of debt securities. This right is subject to any preferences in classes of stock. After all claims senior to those of common shareholders have been paid, the remaining assets will be received by the common shareholders. Common shareholders are last in order of preference when assets are distributed upon dissolution of the corporation.

Liabilities of Stockholders

Stockholders are not generally liable for corporate obligations, although this has its qualifications. Shareholder liability is much less common in large public corporations than in smaller, closely held corporations. They can be held liable for unlawful dividends (dividends paid that impair the capital of the corporation). In very rare instances, shareholders can be held liable for corporate debts.

This is commonly referred to as “piercing the corporate veil” and generally happens when multiple corporations are set up to insulate one part of the business from the activities of another part. Courts may treat the corporations as one for liability purposes. In order to establish that the corporations are separate and distinct the court will ask:

- Do they have separate and distinct Boards of Directors, officers and employees? Do they hold separate meetings?

- Are the business transactions commingled or separate?

- Is each corporation adequately financed or do they finance one another? This is extremely important!!

- Are they held out to the public as separate and distinct enterprises?

If the courts decide the corporations are not separate they may attach the assets to pay the creditors.

Individual shareholders are not permitted to use the corporate veil to protect themselves from acts of fraud or other illegal acts. Shareholders in closely held corporations are vulnerable to having the “corporate veil lifted,” but it is difficult to establish the existence of fraud or illegal actions.

Determining Ownership of Stock

The following rules apply in order to determine whether an individual directly or indirectly owns any of the outstanding stock of the corporation.

- Stock owned, whether the ownership be directly or indirectly, by or for a corporation, partnership, estate or trust will be treated as being owned proportionately by or for the entity’s shareholders, partners or beneficiaries.

- An individual is treated as owning stock if it is owned, directly or indirectly, by or for the individual’s family. In this case family includes only brothers and sisters, half-brothers and half-sisters, a spouse, ancestors and lineal descendants.

- Any individual owning (other than by applying rule 2) any stock in a corporation is treated as owning the stock owned directly or indirectly by that individual’s partner.

- To apply rule (1), (2) or (3), stock constructively owned by a person under rule (1) is actually owned by that person. But stock constructively owned by an individual under rule (2) or (3) is not treated as if it is actually owned by that individual for purposes of applying either rule (2) or (3) to make another person the constructive owner of that stock.

The IRS can reallocate gross income, deductions, credits or allowances between two or more organisations, trades or businesses owned or controlled directly, or indirectly, by the same interests. The service can make this reallocation based on the premise that it is necessary to clearly show income or prevent tax evasion.

Any disallowance of losses which results from the sale of exchange of property between related persons does not apply to liquidating distributions.

Shareholder’s Basis in Stock

A shareholder’s basis in stock is originally established by the purchase price of the stock multiplied by the number of shares purchased. If the shareholder paid any commissions at purchase, that should be added in. The resulting total cost of the purchase will be the basis. The original value of each share of stock is established during the incorporation process. This applies to all stock corporations whether they are organised as a “C” corporation or an “S” corporation. See the following example.

___________________________________________________________________________

Example

The ABC Corporation (a C corporation) has authorised the sale of 1000 shares of stock at a par or stated value of $50.00 per share. John purchased 100 shares at par value. John’s basis in the stock is $5,000.00. The corporation balance sheet would indicate $5,000.00 in the capital stock account as a result of this purchase. John’s basis in these shares of stock will not change. However, the fair market value of the stock may change over time.

If the stock does not have a par or stated value John’s basis would still be the cash paid for the stock and the corporation would record the total amount of the purchase in the capital stock account.

Review Question 7As a stockholder in EZBucks Corporation, Doris knows that she has certain stockholder rights. Which of the following is not an inherent stockholder right?

ANSWER

|

Review Question 8Jane owns stock in Lewser Corporation, a closely-held company. Jane thought that there never could be any shareholder liability. Which of the following may result in shareholder liability for corporate obligations?

ANSWER

|

Objective #3: Tax Laws for Corporations

The federal tax laws for businesses formed after 1996 classify the following types of entities as corporations:

- Businesses that are organised and defined as a corporation under state or federal laws.

- Businesses considered to be joint stock companies or joint stock associations as formed under the applicable state law.

- Insurance companies.

- Banks insured by the FDIC (Federal Deposit Insurance Corporation).

- Business entities which are wholly owned by a state or local government.

- A business specifically required to be taxed as a corporation by the Internal Revenue Code (for example, certain publicly traded partnerships).

- Certain foreign entities.

- Any other business that elects to be classified as a corporation by filing Form 8832, Entity Classification Election. For instance, a limited liability company (LLC) may choose to be taxed as a corporation by filing Form 8832. This is sometimes referred to as the “check the box” rule. Some states have specific rules that classify entities for tax purposes and may not recognise an entity as a corporation under the “check the box” rules.

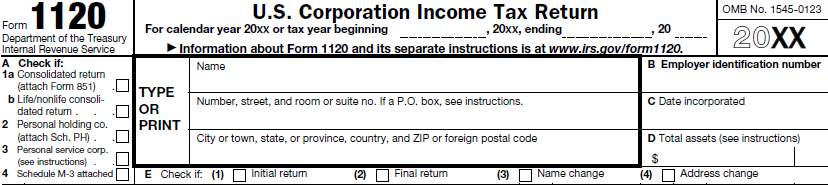

Corporations must file an income tax return whether or not they have taxable income for the year and even if they are in bankruptcy. Domestic corporations are required to file Form 1120 unless they are required to file a different, specialized form. (Specialized forms are discussed later.) A corporation that is engaged in farming is required to file Form 1120 unless it is a subchapter T cooperative.  [1]

[1]

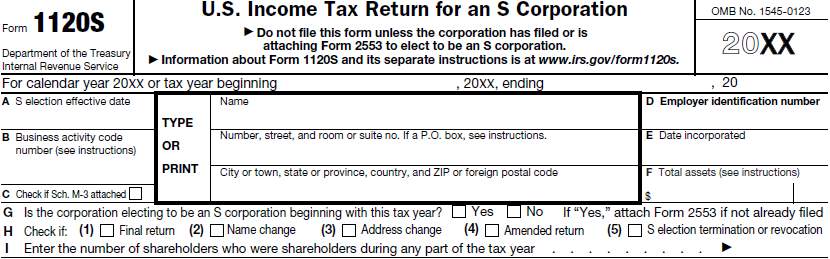

A corporation which has made an election to be treated as a subchapter S corporation and has had the election approved by IRS is required to file Form 1120S.  [2]

[2]

Electronic Filing

Electronic filing of corporate returns is generally available for Form 1120 including related schedules and attachments, and the extension to file, Form 7004. Corporations may file employment tax Foms 940 and 941 electronically, as well. The corporations may authorise electronic funds withdrawals for payment of any taxes due. Information returns such as Forms 1099 may also be filed electronically.

The electronic filing option does not apply to the following returns:

- Returns with precomputed penalties and interest.

- Also, returns with reasonable cause for failing to timely file.

- Returns with reasonable cause for failing to timely pay taxes due.

- Returns with requests to have overpayments applied to different accounts.

Corporations with total assets of $10 million or more that file at least 250 returns each year are required to file Form 1120 electronically unless they request a waiver. These rules are contained in the Regulations section 301.6011-5.

Special Returns for Organisations

The chart on the next page summarises various forms used by organisations that file special returns. In each case, the organisation will file its applicable special return instead of filing Form 1120. These organisation types and forms will not be discussed in this chapter. The chart is included to make students aware of these other entities and tax forms.

Organisation Type | Form |

| Exempt organisation with unrelated trade or business income | 990-T |

| Religious organisation exempt under section 501 (d) | 1065 |

| Entity formed as a LLC under state law treated as a partnership for federal tax purposes | 1065 |

| Subchapter T cooperation association (including a farmer’s cooperative) | 1120-C |

| Entity electing to be treated as a real estate mortgage investment conduit (REMIC) under section 860D | 1066 |

| Interest charge domestic international sales corporation (section 992) | 1120-IC-DISC |

| Foreign corporation (other life and casualty insurance company filing

Form 1120-L or Form 1120-PC) | 1120-F |

| Foreign sales corporation (section 922) | 1120-FSC |

| Condominium management, residential real estate management or time

share association that elects to be treated as a homeowner’s association under section 528 | 1120-H |

| Life insurance company (section 801) | 1120-L |

| Fund set up to pay for nuclear decommissioning costs (section 468A) | 1120-ND |

| Property and casualty insurance company (section 831) | 1120-PC |

| Political organisation (section 527) | 1120-POL |

| Real estate investment trust (section 856) | 1120-REIT |

| Regulated investment company (section 851) | 1120-RIC |

| Settlement fund (section 468B) | 1120-SF |

Personal Service Corporations

In essence, personal service corporations are corporations that meet all of the following requirements:

- Its principal activity during the “testing period” is performing personal services. The prior tax year will generally be the testing period unless the current year is the corporation’s first year. The testing period begins on the first day of its tax year and ends on the earlier of:

- The last day of its tax year, or

- The last day of the calendar year in which its tax year begins.

- Its employee-owners substantially perform the services in the test period. This requirement is met if more than 20% of the corporation’s compensation cost for its personal service activities during the test period is for personal services performed by employee-owners.

- Its employee-owners own more than 10% of the fair market value of the corporation’s outstanding stock on the last day of the testing period.

Personal services are activities performed in the fields of accounting, actuarial science, architecture, consulting, engineering, health, veterinary services, law and the performing arts.

A person is considered an employee-owner of a personal service corporation if both of the following are true:

- He is an employee of the corporation or performs personal services for, or on behalf of, the corporation (even if he or she is an independent contractor for other purposes) on any day of the testing period.

- He owns any stock in the corporation at any time during the testing period.

Personal Holding Companies

Personal holding companies must file Schedule PH with Form 1120 to calculate the PHC tax. A corporation is generally considered a personal holding company if it meets both of the following tests:

- PHC income test. For the tax year, at least 60% of the corporation’s adjusted ordinary gross income was PHC income. Corporations must complete the following worksheet to determine the PHC test. The worksheet is from Schedule PH instructions.[3]

- Stock Ownership Requirement. At any time during the last half of the tax year, five or fewer individuals owned, whether directly or indirectly, in excess of 50% in value of the corporation’s outstanding stock.

The following organisations are considered individuals when applying this requirement.

- A qualified pension, profit-sharing or stock bonus plan.

- A 501(c) trust that provides for the payment of supplemental unemployment compensation in certain circumstances.

- A private foundation (in accordance with the description in section 509 (a)).

- A portion of a trust which is permanently set aside or will be used exclusively for the purposes described in section 642(c).

The following are exceptions which are specifically exempted from treatment as personal holding companies even if they meet the two tests listed above.

- Tax exempt corporations

- Banks, domestic building and loan associations, certain lending or finance companies

- Life insurance and surety companies

- Small business investment companies operating under the Small Business Investment Act of 1958

- Corporations under the jurisdiction of a court in a title 11 or similar case

- Foreign corporations

Closely Held Corporations

A corporation is closely held if all of the following situations apply:

- If it is not a personal service corporation

- If at any time during the last half of the tax year more than 50% of the value of the outstanding stock is held directly or indirectly by five or fewer individuals. Certain trusts and private foundations are considered individuals for purposes of this rule.

Since a closely held corporation has such a small number of shareholders, the company’s stock will not normally be publicly traded. This makes it difficult to determine the value of such a company’s stock since a small number of persons own stock and there is no established market for the shares. In the U.S., more than 90% of all businesses are closely held and the majority are family businesses.

Direct ownership rules

The following rules are used to determine if more than 50% in value of the stock is owned directly or indirectly by five or fewer individuals.

- Stock owned, directly or indirectly, by or for a corporation, partnership, estate or trust will be considered to be owned proportionately by its shareholders, partners or beneficiaries.

- An individual is considered to own the stock owned, directly or indirectly, by or for his or her family. For this situation family includes, brothers and sisters (including half-brothers and half-sisters), a spouse, ancestors and lineal descendants.

- If a person owns an option to buy stock, he is considered to own that stock.

- When applying rule (1) or (2) stock considered owned by a person under rule (1) or (3) is treated as actually owned by that person. Stock considered to be owned by an individual under rule (2) is not treated as owned by the individual again for rule (2) to consider another the owner of that stock.

- Stock that may be considered owned by an individual under either rule (2) or (3) is considered owned by the individual under rule (3).

The at-risk rules will limit a taxpayer’s losses resulting from most activities to the amount which the taxpayer has at risk in the activity. These rules will apply to certain closely held corporations (other than S corporations). An amount at-risk generally equals:

- The money and adjusted basis of any property contributed by the taxpayer to the activity, and

- Any money which has been borrowed for the activity.

Consolidated Returns

A consolidated tax return is one that includes a parent corporation and a group of smaller corporations (subsidiaries). A corporation with subsidiary corporations may choose to file a consolidated return or to file its own return. In that case, each subsidiary would also file a separate return. The parent may choose to file a consolidated return for simplification and to obtain tax benefits not available if the parent and its subsidiaries filed separate returns.

An affiliated group of corporations is a group which is connected through stock ownership. This group may file a consolidated tax return rather than filing separate Forms 1120. An affiliated group can consist of one corporation (the parent corporation) that owns at least 80% of the voting power and at least 80% of the fair market value of the stock of at least one other corporation included in the affiliated group. The requirement for ownership of at least 80% of the voting power of one of the other corporations in the group means that nonvoting and nonconvertible stock is not included in the stock ownership requirement. This affiliated group can consist of additional corporations as long as the parent and a subsidiary corporation meets these two ownership tests with respect to the additional corporations.

Consolidated returns offer certain tax advantages such as:

- The ability to offset current losses with profits from an affiliated corporation in the current tax year rather than having to carry the losses back to a prior period.

- One corporation’s excess charitable contributions can be deducted against another corporation’s income.

- Complete (100%) exclusion from income of dividends paid by one corporation to the other.

- Corporation can postpone the time at which income from intercompany transfers is taxed.

Disadvantages include:

- The income of all corporations is combined for purposes of applying the corporate tax rates. Only one corporation in the group gets the benefit of the lowest tax bracket.

- The accumulated earnings credit is allocated among the entire group.

- Intercompany transactions can lead to deferral of losses and bookkeeping complications.

The first year a consolidated return is filed each one of the subsidiary corporations must file Form 1122, Authorization and Consent of Subsidiary Corporation to be Included in a Consolidated Income Tax Return, with the corporate parent. The parent corporation must attach the Form(s) 1122 to its Form 1120 for the first tax year each subsidiary consents to be included in the corporate return.[4]

The parent corporation is required to file Form 851, Affiliations Schedule each year for itself and also for the other corporations in the affiliated group. This form provides information regarding tax credits and payments, voting stock, business activities, and changes in stock holdings for each affiliated corporation in the group. The parent must also attach schedules showing the gross income and deductions, taxable income, reconciliation of retained earnings and reconciliation of taxable income to book income for each subsidiary. These schedules must be attached to its Form 1120. [5]

Due Date and Signatures

Corporate tax forms must generally be filed by the 15th day of the 3rd month after the end of the corporation’s tax year. New corporations filing a short period return should file not later than the 15th day of the third month after the end of the short period. A dissolved corporation must file its final Form 1120 by the 15th day of the third month after the date of dissolution.

A corporation may obtain an automatic six-month extension by filing Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, by the regular due date of the return. If the due date falls on a Saturday, Sunday or legal holiday, the corporation may file on the next business day. Filing Form 7004 does not extend the time period for tax payments. A corporation, like an individual, is required to pay any expected tax liability when the Form 7004 is filed. As long as Form 7004 is filled out correctly and is filed by the due date of the return to which it applies, IRS will grant it automatically with no notification. The corporation will only receive a notification from IRS if the extension is disallowed or is terminated. IRS reserves the right to terminate the extension at any time.

Form 7004 will only apply to the specific return identified in Part II of the form. It is not a blanket extension. A separate Form 7004 must be filed for each return for which an extension is desired. [6]

Private Delivery Services

Corporations may use certain private delivery services approved by the Internal Revenue Service to meet the “timely mailed is timely filed/paid” rule for tax returns and payments. The authorised private delivery services are listed in the instructions for the appropriate tax return. These services can provide written proof of the mailing date of the return/payment. The use of unauthorised private delivery services will not constitute “timely mailing/timely filing or timely payment.”

Corporate tax returns must be signed and dated by the president, vice president, treasurer, assistant treasurer or any other corporate officer authorised to sign for the corporation. If an employee of the corporation prepares the return the paid preparer section should not be completed. The paid preparer section should only be completed if the corporation pays a non-employee to prepare the return.

If a return is being filed on behalf of the corporation by a trustee, receiver, or assignee the fiduciary must sign the return instead of the corporate officers. If a corporate return is filed by a receiver or trustee in bankruptcy on behalf of the corporation a copy of the court order assigning the authority to sign the return to the receiver or trustee must be attached.

Form 1138

Although the filing of Form 7004 does not extend the time to pay any taxes due, a corporation that expects a net operating loss (NOL) in the current tax year can file Form 1138, Extension of Time for Payment of Taxes by a Corporation Expecting a Net Operating Loss Carryback, to extend the time period to pay the tax for the immediately preceding tax year.

- [1] Form 1120

- [2] Form 1120S

- [3] Instructions for Schedule PH (Form 1120), page 4

- [4] Form 1122

- [5] Form 851

- [6] Form 7004

References

- Devereux, M., Maffini, G., & Xing, J., 2018. Corporate tax incentives and capital structure: New evidence from UK firm-level tax returns. Journal of Banking and Finance, 88, pp. 250-266. https://doi.org/10.1016/J.JBANKFIN.2017.12.004.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this coursework and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal