Supply Chain Management of Aerospace

| ✓ Paper Type: Free Assignment | ✓ Study Level: University / Undergraduate |

| ✓ Wordcount: 2334 words | ✓ Published: 12 Aug 2019 |

Supply chain is a crucial part of any business involved in sales of some kind. Aircraft manufacturing is no different to that. Without supply chain a business is simply unable to operate. Airbus and Boeing are the leading aircraft manufacturers in the aviation along with Boeing. Industry demand has led aircraft orders to increase and so both Airbus and Boeing plans to increase production. The question is if the supplier can keep up.

In this paper I will analyse the supply chain of aerospace that affect both manufactures and how the increase in demand of airlines has affected the supply chain. I will do so by highlighting the key suppliers and how their reactions effect the entire supply chain. It will also focus on the importance of the SCM in a business for efficient daily operations.

Fuel cost in every industry has seen a rise, especially in aviation. The increase in passengers in passenger travel has demanded more fuel efficient aircrafts. This has resulted in airlines changing -their future strategies towards manufacturing and design. In Europe Ryanair uses the most recent and fuel efficient aircrafts on the market, B737-800. Their strategy is to keep aircrafts for a maximum of 5 years before selling them on and ordering replacement, more advanced and efficient models directly from Boeing, the manufacturer. Ryanair’s whole model is based off this as well as their forward thinking in 2001. Many airlines across the world from North America to Europe to Asia are seeking more efficient models and seeking to buy them straight off the manufacturers. The two largest manufacturers of the world, Boeing and Airbus, will have to adapt their supply change to fulfil on all orders received from customer airlines and others.

Boeing

Boeing was the leader in when it came to long range travel. With the 747 out of date they wanted to reinvent the definition of travel. At this time, they introduced the B787 ‘Dreamliner’. This aircraft aimed to provide a new meaning of value. The new release of the B787 changed the way image of long range travel but also the future of how they were built.

Value Chain Network

Airbus has a globally established a value chain analysis in the aviation industry that requires completing the needs of customers. They have managed to excel at this in all their years. The production network is a combination of several factors:

- Manufacturers

- Suppliers

- Retailers

- Transport

- And more

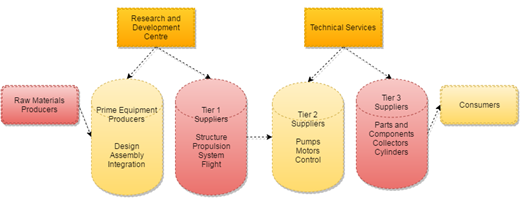

There are many supplier categories involved in the production the aircraft.

The first business involved in this are the original equipment manufacturers. These companies are in the final stage of the network before they get delivered to the customer. This process involves designing, developing and assembling of the aircraft. OEM’s are responsible for the delivery of the aircraft and so must also do all checks and testing. The largest OEM’s are Airbus and Boeing which are the OEM’s I will be using as examples throughout the essay.

Secondly come the tier 1 suppliers. This supplier is responsible to directly supply to the OEM. They are risk sharing partners of the OEMs. First tier suppliers are also responsible for assembly of engines, avionics, toilets, cabin interior, etc. An examples of such are Rolls Royce for the engines.

Tier 2 suppliers provides complex product required by tier 1 supplier. They are often produced in-house or they could have used multiple other providers to produce these components.

Tier 3 supplier are mostly small companies that indirectly provide parts for OEM and are much more specialised and have complex process to be created.

Figure 1.1

This type of supply chain is also known as vertical collaboration (Coyle et al. 2013 , p116-117). Other than the immediate supplier there are others, such as institutes of academia, government institutes and researcher etc. that all have a direct with OEMs. Between aircrafts manufactures, OEMs, they might have slightly different supply chain but they mostly have the same concept.

Technical Services are also External

Above in figure 1.1 it shows how the value chain for the A350XWB development programme. The industry is continuously looking for better aircrafts and so the pressure on OEMs increases as they have developed more aircraft programs. These programmes become much stricter and cost can run up massively. A strategy they have started using is outsourcing.

Airbus has been trying to cope with the demand by outsourcing. Not only have they been trying to outsource their production but also the design of components. This area is a key player in the supply chain management of the business. This is well explained through the analysis of Boeing v Airbus in outsourcing.

- Outsourcing

Manufacturers have always outsourced non critical parts and airbus is no stranger to that. Airbus has always been in direct competition with Boeing. Whoever makes the first move, the second will follow. Outsourcing has been one of those things. Boeing decided to outsource 90% of it 787 Dreamliner project. This was a 40% increase from what they were previously outsourcing. Airbus decided that for their next project to increase to 50% which was a 20% increase from previous projects. Boeing might have helped Airbus unintentionally. With 90% of its project outsourced, they proved that by attempting to reduce their financial risk through outsourcing it increased the risk of project failure and risk management (Nakamoto, 2008)

As Boeing took the initial step to outsource, Airbus could only watch as their production system was unable to respond with the value in dollar decreasing. Inevitably, Airbus was eager to follow this strategy. Although if they were to follow they would have to adopt a better strategy and be able to justify it for the long run. If anything there is a lesson to be learned from Boeing that there is a limit to outsourcing to suppliers. Due to the nature of the industry, outsourcing in such complex and sophisticated projects could have a detrimental impact on the company’s reputation. Airbus had promised the market cost saving though outsourcing (Nakamoto, 2008).

Airbus decided to look into outsourcing as a way to save cost for its parent group. They have a number of questions to asks themselves before agreeing to it. The first is, is it strategic in the long run? Most companies’ relationship is based on experience and trust. Once they decide to switch suppliers and it backfires they won’t be able to return resulting in a huge loss to in quality, cost, delivery time and much more.

As airbus is a major company, outsourcing will result in the loss of jobs within their internal employees. Therefor OEMs will usually follow a supplier selection process. Such process consists of the following:

- Identification – Simply listing all potential suppliers. As they are a leading company within the industry they would have access any database required e.g. Thomas Register of American Manufacturers.

- Shortlisting– Gathering all required information on selected suppliers. The questions asked in this stage are usually around price, dependability, experience, recommendations etc. (Infoentrepreneurs, 2016)

- Selection – This stage you would ask for quotations. These suppliers are able to handle the order they receive.

- Scorecards – Used to monitor quality and performance.

(John J. Coyle, 2013)

In this instance Airbus decided to go ahead with it as the potential benefits were greater then not going ahead with it. They chose to way it against expansion in new markets such as China, Russia and India. These are the same areas that Airbus decided to outsource to.

(Sodh, 2012)

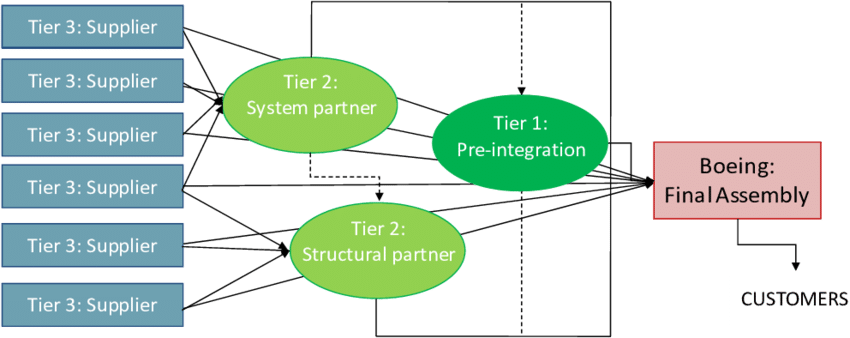

Example Boeing’s Supply Chain

By using Boeing, we will properly identify their supply chain network. Boeing supply chain practises have can be categorised in three sections or topics.

- Just in time orders. Boeing have decided that they will produce aircrafts on order. New products have the tendency to take a bit more time than usual. As a result, the lead time is any from a year to 20 months. In their 787 Dreamline programme they had agreed to start selling in late December and received their first order in early 2004. Due to the programme their first order would be arriving at about four to five years’ time. As Boeing operate from the US they have 3 assembly line and one manufacturing line. Other parts are outsources as explained previously. With Boeing only taking aircrafts on order it encourages their 2nd and 3rd tiers to operate as efficiently as possible with first tier supplier. One way of accomplishing such is by practically working next to each other. Maybe not in the same town but perhaps still in the same town.

- Customer – Boeing receives many order and they would almost never be private. Nearly all of these would be split between airlines and leasing companies. Leasing companies will easily order just as much as a major airline. SMBC and Avalon are in the top five leasing companies in the world so you can imagine how many they would order. This is also in relation with their network as they will operate for customers. Not all airlines will purchase straight form the OEM but many will. As you can imagine aircraft are expensive. So the smaller airlines would go for either second hand or through leasing. Ryanair for example buy all aircraft new but will in time sell which they have done.

- Suppliers come in three different ways with Boeing: engines, avionics and aerostructures.

Current Challenges faced in Aerospace

Both Airbus and Boeing had development programmes for their latest generation of aircraft. These are the A350XWB and the B787 Dreamliner. Both Boeing and Airbus had an estimated figure to deliver 1600 aircrafts. However, the both OEM have come to a halt due to their suppliers. As both have a fair amount of sourcing within their company it is very much possible that they will receive a delay. One of the cases that has caused them a delay is from a first tier supplier. Their engine manufacturers have identified a fault in the engines they have deliver to the OEM. This has caused a massive standstill in production as well as the OEMs had to stock ‘inventory’. As both airlines are received more orders then they have assembly lines it is unusual for them to hold stock. (Skift, 2018)

Airlines are no strangers to delays. For obvious reason they would not delay on purpose but when did have a delay it was for different reasons. Most of these delays they would have had was on the design or attempting different techniques during assembly. Now, however, with the industry booming it has challenged the suppliers. When they outsource and receive more orders the challenge for suppliers is on. Suppliers might have had the resources to cope with demand at the time when received the contract and could have handled some more but I believe both the OEM and supplier were not prepared for this type of demand. (Forbes, 2018)

Rolls Royce, Pratt & Whitney and CFM International are struggling with engine issues. For Boeing it has not affected them too much but Airbus has. Airbus had to store 100 A320NEOs on the tarmac in Hamburg and Toulouse. (Skift, 2018)

Not only is there material constraints there is also personnel. Both OEMs have estimated to deliver 5 more aircrafts per month compared to last year. It is evident here that the supply chain with both have serious issues that need to be clarified before the 2019 as then they were looking to increase the production rate even more.

Despite the introduction of innovation in aircraft through lower fuel, software, material and engines, some companies have made it more complex in production. Even with the innovation it has caused more problems up the production chain.

Through the analysis conducted there are certain areas that could be improved. The following are points that OEMs need to review

- Demand management; OEMs need to maintain a balance that is fair to both customers and the Supplier. It is understandable that the market is growing and demand for new aircraft increasing but there is a limit at which both supplier and OEM cannot take more order. The forecasting method should be applied here so as they would be able to have some degree what to except and let all relevant parties know in advance.Demand management is exactly there to prevent such things from happening. The manufacturers have some type of power as they are able to say how many would be for sale, or when, or how many. As the manufacturer it is their job to forecast this (John J. Coyle, 2013)

- CRM –Customer Relationship management. The goal of this is to position customers in a way that will improve the profitability of the company while enhancing customer relationship.

Conclusion

OEMs depending on their development programmes are able to adapt their supply chain. In most cases these only differ slight and only in certain areas. Supply chain management is a crucial part for manufacturing. It can either make or break you. With a proper supply chain management in place a business is able to do very well. It still always possible to slip up in some areas but then again in most cases there is time to correct it. As we have seen in the cases outlined Boeing made an error with outsourcing at some stage but was able to correct in time without costing too much.

Bibliography

Forbes, 2018. Demand Tests Supply Chain At Airbus and Boeing, With Tariff Impact Uncertain. [Online]

Available at: https://www.forbes.com/sites/marisagarcia/2018/08/13/demand-tests-supply-chain-at-airbus-and-boeing-with-tariff-impact-uncertain/

[Accessed 12 December 2018].

Infoentrepreneurs, 2016. Supplier selection process. [Online]

Available at: https://www.infoentrepreneurs.org/en/guides/supplier-selection-process/

[Accessed 06 December 2018].

John J. Coyle, C. J. L. J. R. A. N. B. J. G., 2013. Managing Supply chain – A logistics Approach . In: J. Sabentino, ed. Managing Supply chain – A logistics Approach . Pennsylvania: s.n., p. 692.

Nakamoto, P. B. a. M., 2008. Boeing’s subcontracting problems do Airbus a favour. [Online]

Available at: https://www.ft.com/content/a3ec38bc-0fbe-11dd-8871-0000779fd2ac

[Accessed 9 December 2018].

Skift, 2018. Boeing Gains an Edge as Airbus Struggles with Engine Issues. [Online]

Available at: https://skift.com/2018/04/28/boeing-gains-an-edge-as-airbus-struggles-with-engine-issues/

[Accessed 10 December 2018].

Sodh, M. S., 2012. Application: Mitigating New Product. January, p. 20.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this assignment and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal