An Analysis of Market Capitalization

| ✓ Paper Type: Free Assignment | ✓ Study Level: University / Undergraduate |

| ✓ Wordcount: 1738 words | ✓ Published: 12 Aug 2019 |

In this report we will focus on two companies, one company with market capitalization less than 30 pounds and one company with a market capitalization over 30 pounds millions. To facilitate this research we will spill it down in stages. Additionally, most of the information that will be used and most of the data will be available from the London Stock Exchange, which will analyse it for the better understanding. First, we will see what market capitalization is and what is for each company separately. Then we will see some general information about these companies, such as their head office headquarters and when they were admitted to be listed on the London Stock Exchange. In addition, we will see what the exchange market size is and what is for each company separately. After that, will be a review and analyse how well each organization’s stock has performed in the past year and in the last five years according to London Stock Exchange. At the end we will give a brief overview of each organization in terms of its operations, key markets and prospects. The companies we compare are Experian Public Limited Company (PLC) and Vodafone Group PLC.

In order to continue our research, we need to fully understand what market capitalization is and what it means. Market capitalization or stock market capitalization is the market value of the shares of a listed company, equal to the number of its shares, on their current stock market value. The capital market is one of the most important institutions for the development of a country’s economy, since its operation enables companies to raise funds for the implementation of their investment plans through the issuance of securities and for investors to make available the companies, through the purchase of their issued securities, part of their savings funds to achieve capital and dividend yields. The main ‘’player’’ in this market is the stock exchange. The mission of each stock exchange is to act as a lever for the development of the national economy (Dias, A., 2013). Still, we need to understand the importance of the Exchange Market Size or the Normal Market Size (NMS). On the London Stock Exchange, normal market size (NMS) for each security is calculated quarterly and is based on 2.5 per cent of the security’s average daily turnover in the preceding year. Market makers are often prepared to quote firm prices for volumes larger than the NMS but must quote prices for volumes of at least NMS.

Knowing the importance of market capitalization, we can see what happens to each of the companies. As mentioned, this will be done with the help of the London Stock Exchange.London Stock Exchange is a stock exchange based in England, in the city of London. As of April 2018, London Stock Exchange had a market capitalisation of US$4.59 trillion. It was founded in 1571, making it one of the oldest exchanges in the world. Its current premises are situated in Paternoster Square close to St Paul’s Cathedral in the city of London. It is part of London Stock Exchange Group (LSEG). London Stock Exchange is one of the world’s oldest stock exchanges and can trace its history back more than 300 years.

TheExperian PLC is a consumer credit reporting agency. Experian PLC offers credit and marketing services. The Company manages large databases that enable credit granting and monitoring, and help minimize fraud and credit risk, offers specialist analytical solutions for credit scoring, risk management, and processing applications, processes checks and credit cards, and offers consumers credit reports and scores. Experian collects and aggregates information on over one billion people and businesses including 235 million individual US consumers and more than 25 million US businesses. The registered address of the Experian PLC in in Newenham House, Northern Cross, Malahide Road, in Dublin, 17, in the Ireland. Also, the company operates in 37 countries with headquarters in the United Kingdom, the United States, and Brazil. The company employs approximately 17,000 people and reported revenue for 2018 of US dollar 4.6 billion. According to London Stock Exchange has a market capitalization value of 17,051.95 pounds millions. Also, has an Exchange Market Size value of 1.000 units. The Experian PLC has been admitted to London Stock Exchange on 11th of October of 2006.

Once, we saw a general view of the Experian PLC our research will continue with the performance view of the company in the last year and in the last five years according to London Stock Exchange.

Figure 1. The performance of the company Experian As at 14-Nov-2018 23:06:13

Figure 1. The performance of the company Experian As at 14-Nov-2018 23:06:13

As it can be seen from the diagram the Experian PLC company has a generally upwards trend during the last year. The year started with a somewhat slow growth in the months of January and February, with a few ups and downs in March and April. Later, from May , the company shows growth at a greater rate until October-November when it can be seen that there is a small drop which becomes again growth from the start of December. Specifically, Experian PLC had 1,550.000 units in November, 2017, and in the span of a year reached 2,000.000 units in October of 2018 and 1,872.38 units in November of that year.

Figure 1. The performance of the company Experian As at 14-Nov-2018 23:06:13

Figure 1. The performance of the company Experian As at 14-Nov-2018 23:06:13

If we analyze the diagram in the span of the last 5 years the company has still a generally upwards trend in rates. More precisely, it started at 1,201.00 units in 2014. There were a few phases of fluctuations until 2015 as it can be seen from the diagram but with an overall growth. Then we can see from the diagram that 2016 started with a quick growth. In particular, the company was at 1,500.00 in July of 2016. The company started with a slight growth in 2017 as well but ended with a loss. The year of 2018, which is the last one, was highly productive for Experian PLC as it climbed from 1,500.00 units to almost 2,000.00 while we can also see that later, meaning the current months, the company is at 1,800.00 units.

In general, the conclusion for the Explorian PLC through this research is the fact that it is a company with a constant increase in market capitalization, in the number of people it employs, but also and the increase rate in the market as it is shown by the London Stock Exchange.

The Vodafone Group plc is a British multinational telecommunications conglomerate, with headquarters in London. The company’s consumer products include mobile services, such as call, text, and data; broadband; television offerings and voice; mobile money services through M-pesa; Giga TV, an advanced digital service; and converged communication solutions, such as GigaKombi, Vodafone One Net Enterprise, Vodafone One, and Vodafone Meet Anywhere. It also offers Internet of Things connections to communicate securely with network; and cloud and security services for public and private cloud, as well as cloud based applications and products for securing networks and devices. In addition, the company offers carrier services, such as international voice, IP transit, and messaging. Further, it provides renting of mobile virtual network services. It predominantly operates services in the regions of Asia, Africa, Europe, and Oceania. Vodafone owns and operates networks in 25 countries, and has partner networks in 47 further countries. Its Vodafone Global Enterprise division provides telecommunications and IT services to corporate clients in 150 countries. Among mobile operator groups globally, Vodafone ranked 4th (behind China Mobile, Bharti Airtel and Vodafone Idea) in the number of mobile customers (313 million) as of 2018. The registered address of the Vodafone Group PLC is in Vodafone House, The Connection, in Newbury, RG14 2FN in the United Kingdom. The company employs approximately 111,556 (2018) people and reported revenue for 2018 of 46.571 euro billions. According to London Stock Exchange has a market capitalization value of 41,571.58 pounds millions. Also, has an Exchange Market Size value of 10.000 units. The Vodafone Group PLC has been admitted to London Stock Exchange on 26th of October of 1988.

Once, we saw a general view of the Vodafone Group PLC our research will continue with the performance view of the company in the last year and in the last five years according to London Stock Exchange.

Figure 1. The performance of the Vodafone Group PLC for the last year As at 14-Nov-2018 18:34:23

Figure 1. The performance of the Vodafone Group PLC for the last year As at 14-Nov-2018 18:34:23

Οπως παρατηρειτουμε στο διαγραμμα μπορουμε να διακρινουμε πως η εταιρια Vodafone Group PLC παρουσιαζει γενικα καθοδικη κινηση στον τελευταιο χρονο, δηλαδη, μεσα στο 2018. Ξεκινησε το Νοεμβρη του 2017 με περιπου στις 220.00 μοναδες και μετα απο μια σχετικα μικρη αυξηση στον γεναρη του 2018 της ταξης των 20.00 μοναδων παρουσιαζει μια καθωδικη πτωση. Πιο συγκεκριμενα, το Φλεβαρη του 2018 η Vodafone Group PLC βρισκεται στις 200.00 μοναδες ενω, τον απριλη εφτασε κατω απο το οριο των 200.00 μοναδων και ειδικοτερα στις 192.00 μοναδες. Υστερα, απο μια μικρη αυξηση κατα τον μηνα μαιο του 2018 που εβαλε την εταιρια πανω απο το οριο των 200.00 μοναδων η Vodafone Group PLC παρουσιαζει μια μεγαλη πτωση για τα δεδομενα του χρονου αυτου που την οδηγουν τον αυγουστο του 2018 στις 180.00 μοναδες περιπου και τον Νοεμβρη κατω απο τις 140.00 μοναδες. Γενικα, το διαγραμμα μας δειχει πως η εταιρια ειχε μια αρνητικη ταση στη διαρκεια του τελευταιου ημερολογιακου ετους.

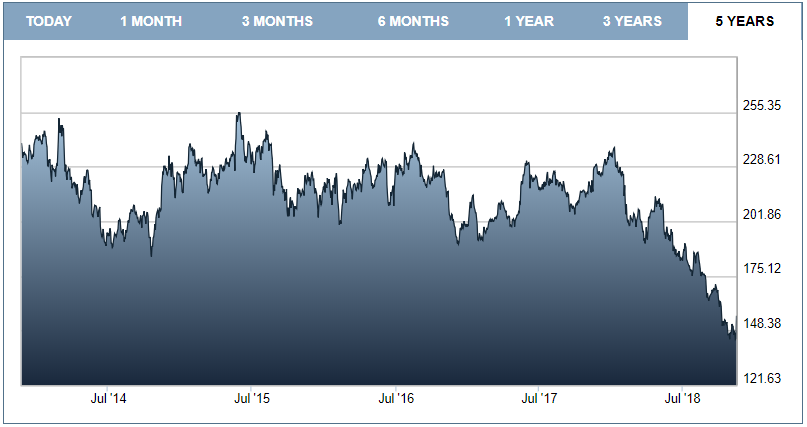

Figure 2. The performance of the Vodafone Group PLC for the last 5 years As at 14-Nov-2018 18:34:23

Figure 2. The performance of the Vodafone Group PLC for the last 5 years As at 14-Nov-2018 18:34:23

Οπως παρατηρειτουμε στο διαγραμμα μπορουμε να διακρινουμε πως η εταιρια Vodafone Group PLC παρουσιαζει γενικα καθοδικη κινηση στο βαθος της τελευταιας πενταετιας με την μεγαλυτερη πτωση να ειναι στο τελευταιο ετος, δηλαδη, στο ετος του 2018. Πιο συγκεκριμενα, η εταιρια ξεκινησε το ημερολογιακο ετος του 2014 και τον μηνα νοεμβρη του ιδιου ετους στις 230.00 μοναδες περιπου. Μετα απο μερικα σκαμπενεβασματα καταφερε να παει στις 250.00 μοναδες περιπου. Σ εκεινο το σημειο παρατηρειται μια πτωση μεσα στο ιδιο ετος της ταξης των 60.00 μοναδων περιπου. Στη συνεχεια, η Vodafone Group PLC ξεκινησε την χρονια του 2015 με θετικη πορεια. Ειδικοτερα, τον Γεναρη του 2015 καταφερε να βρισκεται στις 220.00 μοναδες και μετα απο καποια μικρα σκαμπενεβασματα τον ιουνη του 2015 καταφερε να ξεπερασει το οριο των 250.00 μοναδων. Απο κει και περα η Vodafone Group PLC παρουσιαζει πολλα σκεμπεναβασματα μεχρι το τελος 2016, με τα σημαντικοτερα να ναι τον Νοεμβρη του 2015 που περασε κατω απο τις 200.00 μοναδες και τον αυγουστο του 2016 που επανηλθε πανω απο τις 230.00 μοναδες. Αν και στις αρχες του ετους 2017 η εταιρια δεν ξεκινησε πολυ καλα (Φλεβαρης 2017, 190.00 μοναδες) καταφερε να ανταπεξελθει στις αγορες και να φτασει τον Ιουλη του 2017 στις 230.00 μοναδες και στις αρχες του ετους 2018 στις 235.00 μοναδες περιπου. Οπως προειπαμε απο κει και περα αρχιζει μια συνεχης καθοδικη πτωση για την Vodafone Group PLC με τον μαιη του 2018 να βρισκει την εταιρια στις 190.00 μοναδες περιπου και τον νοεμβρη του 2018 να βρισκει την εταιρια με κατι λιγοτερο απο 150.00 μοναδες.

The Vodafone Group PLC is undoubtedly one of the largest telecommunications companies in the world, but it is certainly a very large company with a market capitalization of 41,571.58 pounds millions. The fact which it is shown by this research for this company, which employs over 100,000 people worldwide, is that in general it shows a downward pressure on the markets with often little insights into the economic indicators.

References

Dias, A. (2013). Market capitalization and Value-at-Risk. Journal of Banking & Finance, 37(12), pp.5248-5260.

Ewing, B. and Thompson, M. (2016). The role of reserves and production in the market capitalization of oil and gas companies. Energy Policy, 98, pp.576-581.

Ng, M., Song, S., Piuzzi, N., Ng, K., Gwam, C., Mont, M. and Muschler, G. (2017). Stem cell industry update: 2012 to 2016 reveals accelerated investment, but market capitalization and earnings lag. Cytotherapy, 19(10), pp.1131-1139.

Toraman, C. and Başarir, Ç. (2014). The Long Run Relationship Between Stock Market Capitalization Rate and Interest Rate: Co-integration Approach. Procedia – Social and Behavioral Sciences, 143, pp.1070-1073.

Bloomberg.com. (2018). Bloomberg – [online] Available at: https://www.bloomberg.com/quote/EXPN:LN [Accessed 18 Nov. 2018].

Bloomberg.com. (2018). Bloomberg – [online] Available at: https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=324490 [Accessed 18 Nov. 2018].

Experian plc. (2018). About Us. [online] Available at: https://www.experianplc.com/about-us/ [Accessed 18 Nov. 2018].

Londonstockexchange.com. (2018). EXPERIAN share price (EXPN) – London Stock Exchange. [online] Available at: https://www.londonstockexchange.com/exchange/prices-and-markets/stocks/summary/company-summary/GB00B19NLV48JEGBXSET1.html [Accessed 18 Nov. 2018].

Londonstockexchange.com. (2018). Home – London Stock Exchange. [online] Available at: https://www.londonstockexchange.com/home/homepage.htm [Accessed 18 Nov. 2018].

Londonstockexchange.com. (2018). VODAFONE GRP. share price (VOD) – London Stock Exchange. [online] Available at: https://www.londonstockexchange.com/exchange/prices-and-markets/stocks/summary/company-summary/GB00BH4HKS39GBGBXSET1.html [Accessed 18 Nov. 2018].

Seth, S. (2018). Market Capitalization Defined. [online] Investopedia. Available at: https://www.investopedia.com/investing/market-capitalization-defined/ [Accessed 18 Nov. 2018].

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this assignment and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal